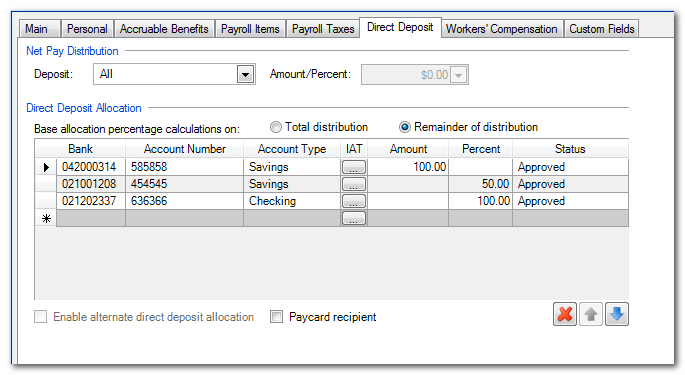

In this scenario,

Base allocation percentage calculations on

needs to be set to

Remainder of distribution

. This is because it's possible that more than 50% of the total distribution is left after the fixed $100 dollars is allocated. So, if the net pay was $1,000, then $900 remains after the $100 fixed amount. Because

Remainder of distribution

is marked, the application allocates $450 (half of what's left). If the

Total distribution

checkbox is marked, then $500 is allocated to the second savings account.