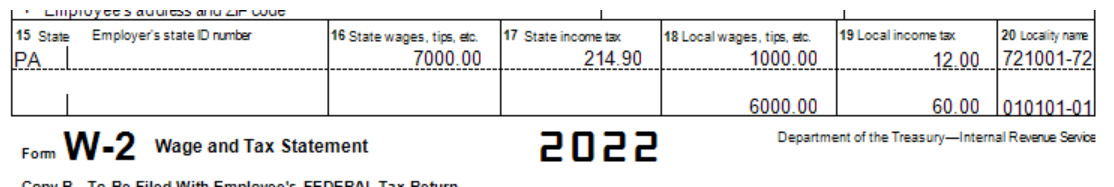

The six-digit PSD code of the work location that is assigned to the tax item by the state of Pennsylvania, followed by a dash (-) and the 2 digits entered in the W2 PSD Code field is used as the PSD code in Box 20.

For employees who work in multiple work locations, each location's unique 6-digit PSD code that is assigned to the tax item by the state of Pennsylvania, followed by a dash (-) and the 2 digits entered in the W2 PSD Code field is used as the PSD code in Box 20 on the line with the associated wage and tax amounts.