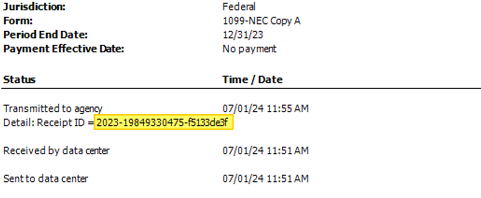

In the preview, go to the Header information section to get the

Submission ID

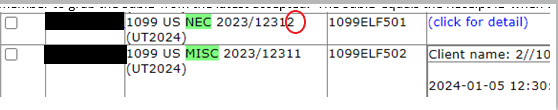

, then go to the Recipient Detail section to get the

Record ID

.

You can use the find icon (binoculars) or press ctrl + F on your keyboard to find a vendor or independent contractor by name.