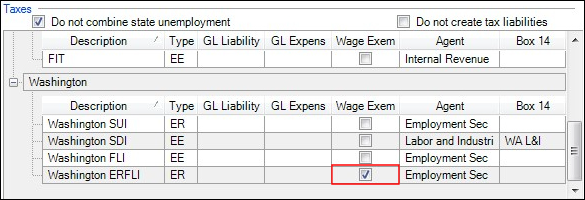

The Washington Long-Term Care Insurance (LTI), also known as Washington Cares, became effective July 1, 2023. This employee paid tax calculates at a tax rate of .58% for July 2023 and later dated checks associated with a Washington work location. There is no wage base for the Washington LTI tax.