Triva isn't available right now.

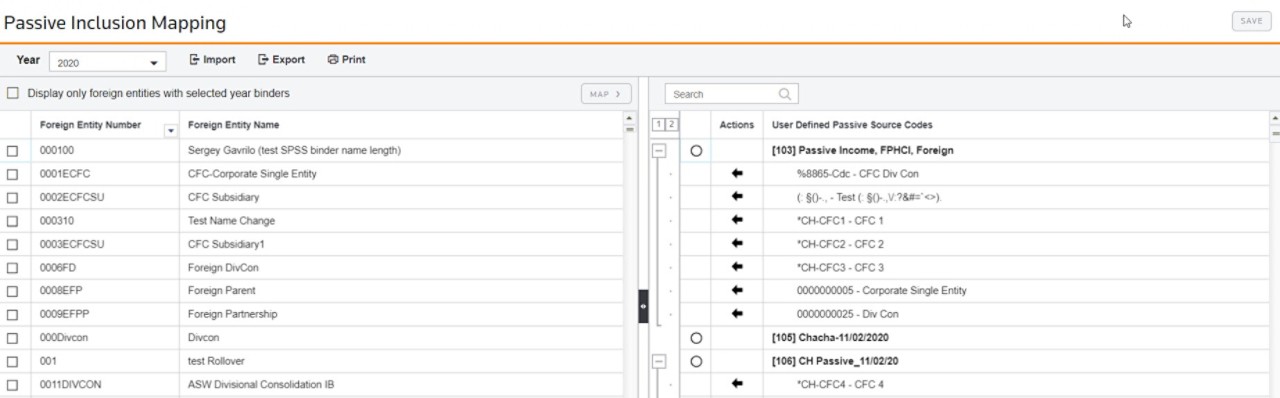

Company No. | Company Name | Source Code | Description |

|---|---|---|---|

FGNCFC101 | Foreign CFC 101 | ||

FGNCFC102 | Foreign CFC 102 | 10011 | Passive Income 1 |

FGNCFC103 | Foreign CFC 103 | ||

FGNCFC104 | Foreign CFC 104 | 10032 | Passive Income 3B |

FGNCFC105 | Foreign CFC 105 | 10032 | Passive Income 3B |

FGNCFC106 | Foreign CFC 106 | ||

HTFGN201 | Foreign Entity 201 |