Legal

Recommended Products

-

CoCounsel

Move faster and accomplish more with a professional-grade, generative AI assistant that transforms the way you work. Thomson Reuters CoCounsel is with you every step of the way, backed by authoritative content and industry-leading expertise.

-

Westlaw

Conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology.

-

Practical Law

Accelerate how you find answers with powerful generative AI capabilities and the expertise of 650+ attorney editors. With Practical Law, access thousands of expertly maintained how-to guides, templates, checklists, and more across all major practice areas.

Tax & Accounting

-

Top products for corporations

-

Top products for accounting firms

Recommended Products

-

CoCounsel

Move faster and accomplish more with a professional-grade, generative AI assistant that transforms the way you work. Thomson Reuters CoCounsel is with you every step of the way, backed by authoritative content and industry-leading expertise.

-

UltraTax CS

Provides a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

-

1040SCAN

Automate work paper preparation and eliminate data entry

Trade & Supply

Recommended Products

-

Foreign Trade Zone Management

Software that keeps supply chain data in one central location. Optimize operations, connect with external partners, create reports and keep inventory accurate.

-

Indirect Tax

Automate sales and use tax, GST, and VAT compliance. Consolidate multiple country-specific spreadsheets into a single, customizable solution and improve tax filing and return accuracy.

Risk & Fraud

Recommended Products

-

CLEAR

Search volumes of data with intuitive navigation and simple filtering parameters. Prevent, detect, and investigate crime.

-

Fraud Detect

Identify patterns of potentially fraudulent behavior with actionable analytics and protect resources and program integrity.

-

ID Risk Analytics

Analyze data to detect, prevent, and mitigate fraud. Focus investigation resources on the highest risks and protect programs by reducing improper payments.

News & Media

Recommended Products

-

Reuters Connect

Around the globe, with unmatched speed and scale, Reuters Connect gives you the power to serve your audiences in a whole new way.

-

Reuters Plus - Content Studio

Reuters Plus, the commercial content studio at the heart of Reuters, builds campaign content that helps you to connect with your audiences in meaningful and hyper-targeted ways.

-

Reuters.com Platform

Reuters.com provides readers with a rich, immersive multimedia experience when accessing the latest fast-moving global news and in-depth reporting.

Books

Recommended Products

-

What's new in legal products

Shop our latest titles

-

Shop tax customer favorites

ProView Quickfinder favorite libraries

Developers

-

APIs by industry

-

Related sites

-

United States Support

-

International support

-

New releases

-

Join a TR community

-

Free trials & demos

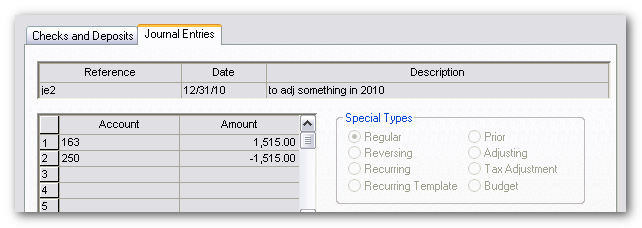

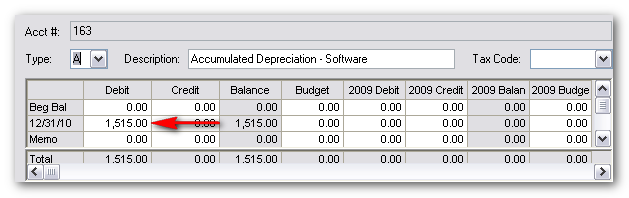

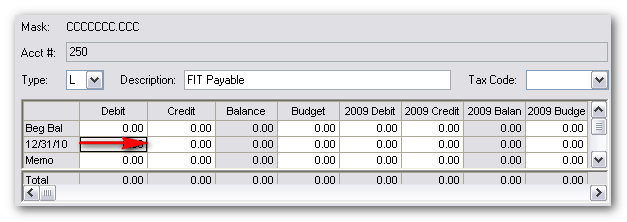

CSA conversion: balance adjustment entries

Example in Creative Solutions Accounting (CSA)

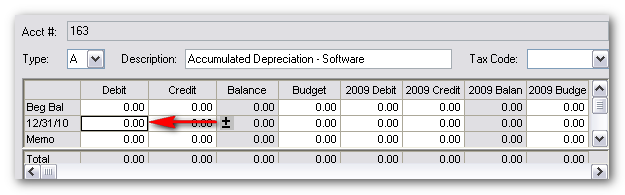

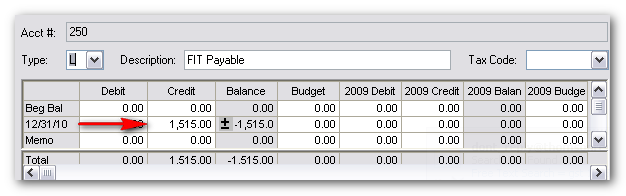

The opposite scenario

This article applies to:

- Product: Accounting CS, Workpapers CS