Legal

Recommended Products

-

CoCounsel

Move faster and accomplish more with a professional-grade, generative AI assistant that transforms the way you work. Thomson Reuters CoCounsel is with you every step of the way, backed by authoritative content and industry-leading expertise.

-

Westlaw

Conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology.

-

Practical Law

Accelerate how you find answers with powerful generative AI capabilities and the expertise of 650+ attorney editors. With Practical Law, access thousands of expertly maintained how-to guides, templates, checklists, and more across all major practice areas.

Tax & Accounting

-

Top products for corporations

-

Top products for accounting firms

Recommended Products

-

CoCounsel Tax, Audit, Accounting

Move faster and accomplish more with a professional-grade, generative AI assistant that transforms the way you work. Thomson Reuters CoCounsel is with you every step of the way, backed by authoritative content and industry-leading expertise.

-

UltraTax CS

Provides a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

-

1040SCAN

Automate work paper preparation and eliminate data entry

Trade & Supply

Recommended Products

-

Foreign Trade Zone Management

Software that keeps supply chain data in one central location. Optimize operations, connect with external partners, create reports and keep inventory accurate.

-

Indirect Tax

Automate sales and use tax, GST, and VAT compliance. Consolidate multiple country-specific spreadsheets into a single, customizable solution and improve tax filing and return accuracy.

Risk & Fraud

Recommended Products

-

CLEAR

Search volumes of data with intuitive navigation and simple filtering parameters. Prevent, detect, and investigate crime.

-

Fraud Detect

Identify patterns of potentially fraudulent behavior with actionable analytics and protect resources and program integrity.

-

ID Risk Analytics

Analyze data to detect, prevent, and mitigate fraud. Focus investigation resources on the highest risks and protect programs by reducing improper payments.

News & Media

Recommended Products

-

Reuters Connect

Around the globe, with unmatched speed and scale, Reuters Connect gives you the power to serve your audiences in a whole new way.

-

Reuters Plus - Content Studio

Reuters Plus, the commercial content studio at the heart of Reuters, builds campaign content that helps you to connect with your audiences in meaningful and hyper-targeted ways.

-

Reuters.com Platform

Reuters.com provides readers with a rich, immersive multimedia experience when accessing the latest fast-moving global news and in-depth reporting.

Books

Recommended Products

-

What's new in legal products

Shop our latest titles

-

Shop tax customer favorites

ProView Quickfinder favorite libraries

Developers

-

APIs by industry

-

Related sites

-

United States Support

-

International support

-

New releases

-

Join a TR community

-

Free trials & demos

CoinTracker partnership with SurePrep

FAQ

CoinTracker SurePrep promotion

- You may purchase apremium tax planon behalf of any clients that haveup to 10Ktransactionsfor $199(Note that if your client purchases a premium tax plan on their own, they’ll only get up to 1 K transactions for $199)

- You may purchase apremium tax planon behalf of any clients that havemore than 10Ktransactions at a30% discount.

- Watch this quick tutorial to familiarize yourself with CoinTracker.

- Connect your client’s exchanges & wallets to CoinTracker.

- To add exchanges & wallets, visit the Add Wallets page. When you select the exchange or wallet from the Wallet Type dropdown, you'll see instructions on how to connect that particular exchange or wallet with CoinTracker. Depending on the exchange or wallet selected, you can import transactions through an API or by a CSV file.If the exchange or wallet isn’t appearing on the dropdown, this means CoinTracker doesn’t have a direct integration yet. You can still import your clients’ transaction history. We highly recommend importing all transactions, even from exchanges and wallets without direct integrations.

- If you are connecting exchanges or wallets on behalf of your clients, you will have to request API keys and CSV files from your clients.

- noteTo ensure the accuracy of tax reports, it's very important to connect all exchanges and wallets your client transacts in a given year.

- Review transactions.

- After connecting exchanges & wallets, it's best to double-check that everything looks as accurate as possible. CoinTracker will flag any transactions that need extra review and the reasoning. You can see transactions needing review for the tax year on the CoinTracker tax page.

- You can edit transactions manually or tag them by following these steps. For further help with calculating your capital gains, this help doc is a useful resource for general troubleshooting tips.

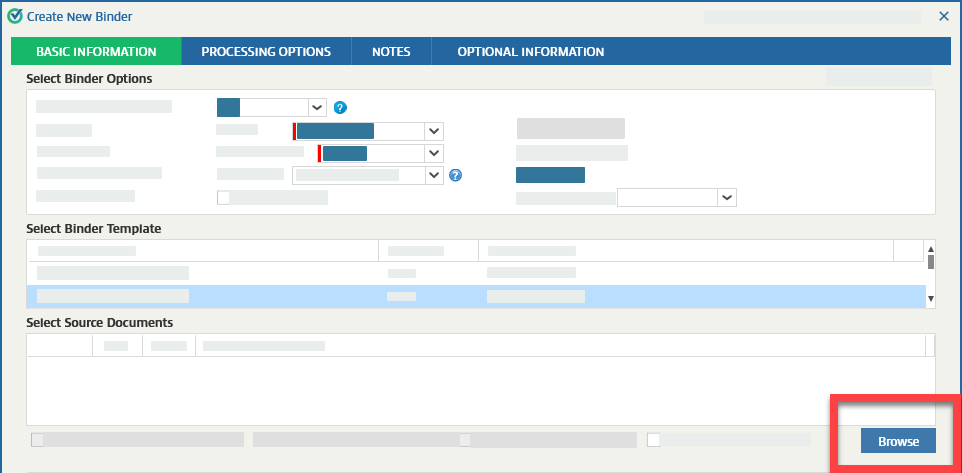

- Upload documents to a client’s TaxCaddy account or directly to the binder.

- You or your client can upload documents to a client's profile in TaxCaddy.

Upload documents to a client's binder from FileRoom or TaxCaddy.

Upload documents to a client's binder from FileRoom or TaxCaddy.

- You can visit CoinTracker’s online help center.

- Within your tax professional CoinTracker dashboard, you can contact the tax pro email support alias

This article applies to:

- Product: SurePrep