Triva isn't available right now.

Requirement | Description |

|---|---|

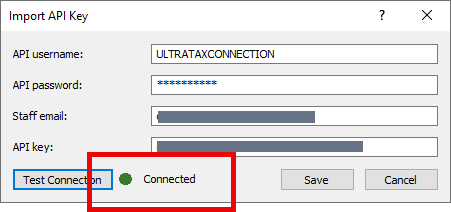

X | SurePrep Integration you'll need be complete and the Test Connection status should pass as Connected . |

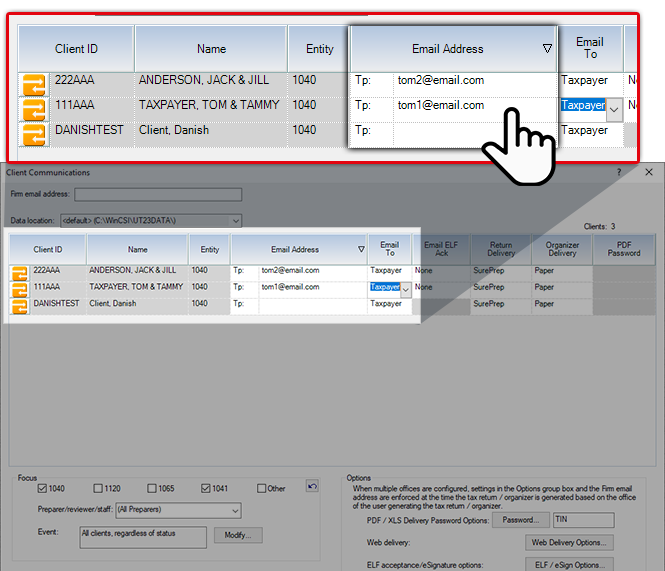

X | Client's email address and Tax Client ID should not exist in TaxCaddy. |

X | Available from UltraTax CS 2023 onwards. |

Error message | Description |

|---|---|

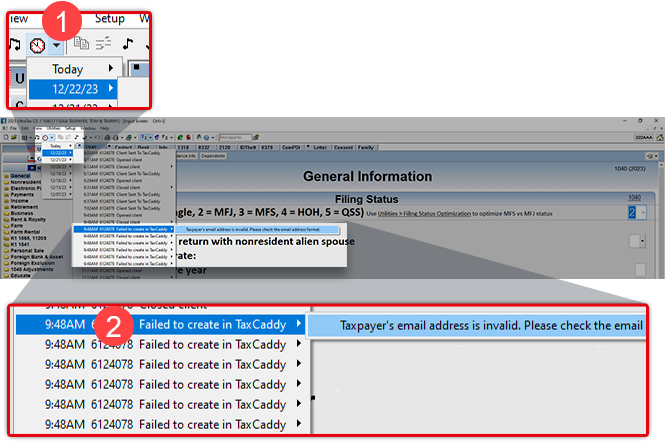

Taxpayer's email address is invalid. Check the email address format. | The email address entered in UltraTax may have been incorrectly entered. Check the email address in UltraTax CS and make sure the client doesn't already exist in TaxCaddy. |

A standard client already exists with this Tax Client ID. | You can't add the same client twice in TaxCaddy. Check TaxCaddy to make sure if the client already exists. |