Triva isn't available right now.

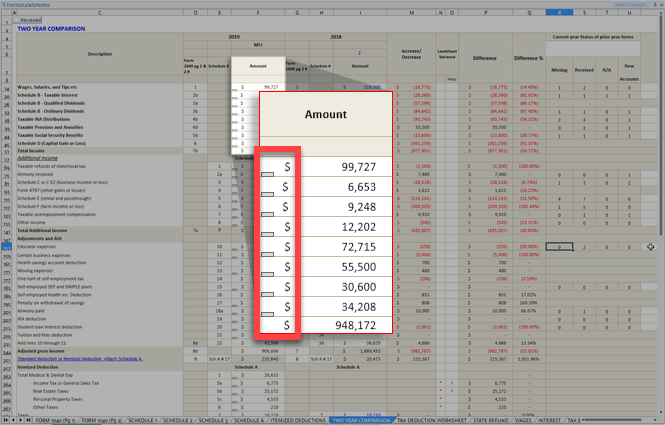

Column | Description |

|---|---|

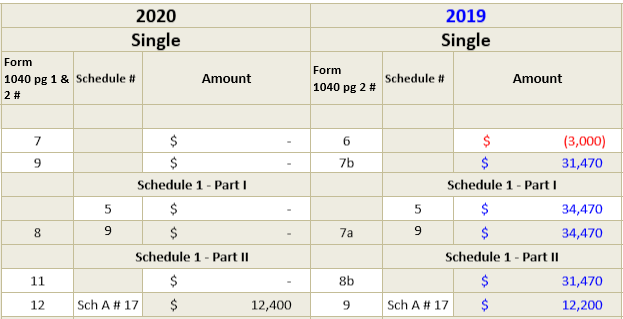

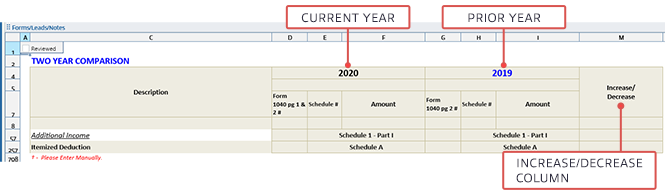

[Current Year] | Shows the current year's amounts and details. |

[Prior Year] | Shows the prior year's amounts and details. |

Difference | Shows the difference based on amount value. |

Difference % | Shows the difference based on percent. |

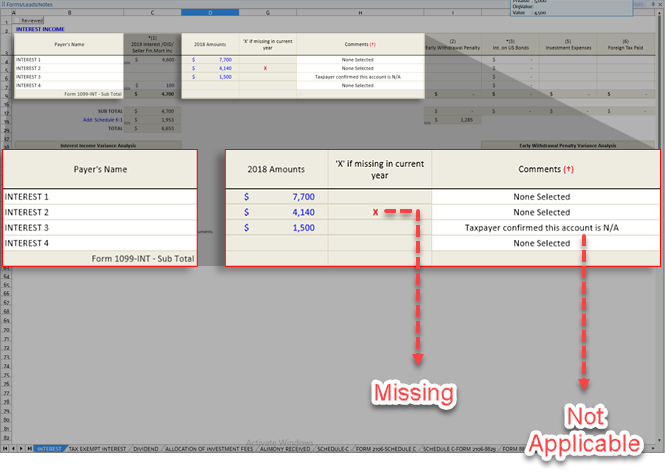

Missing | Shows the number of prior year accounts that are missing in the current year. |

Received | Shows the number of prior year accounts that are also received in the current year. |

N/A | Shows the number of prior year accounts missing in the current year. However, the client has verified that the accounts are not applicable this year. |

New Accounts | Shows the number of new accounts received this year for the first time. |

Comments | Lets you add a comment if necessary. Adding a comment helps preserve the entity for the reviewer irrespective of deleting it from the binder Input Forms or the tax software when you import TR. |

Column | Description |

|---|---|

[Current Year] | Shows the current year's amounts and details. note

Current (tax) year values don’t automatically populate for UltraTax CS and Lacerte. You have to manually enter the amounts in 1040 pages. |

[Prior Year] | Shows the prior year's amounts and details. |

Increase/Decrease | Shows the difference based on amount value. |

Column | Description |

|---|---|

[Prior Year] Amounts | Shows the amount earned or expended in the prior year for that account (CCH Axcess Tax and GoSystem Tax RS only). |

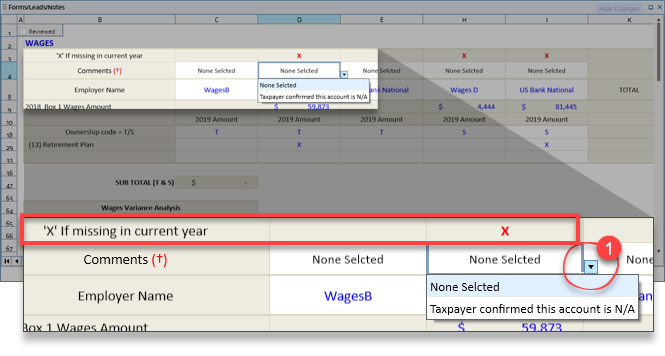

X if missing in the current year | Shows 'X' if the current year amounts are missed but the amount was present in the prior year |

Comments | If the client verifies that the account isn't applicable for the current year, then you can select the option Taxpayer confirmed this account is N/A . Once you select the comment from the dropdown menu the X select from the X if missing in current year column will be removed. |