Triva isn't available right now.

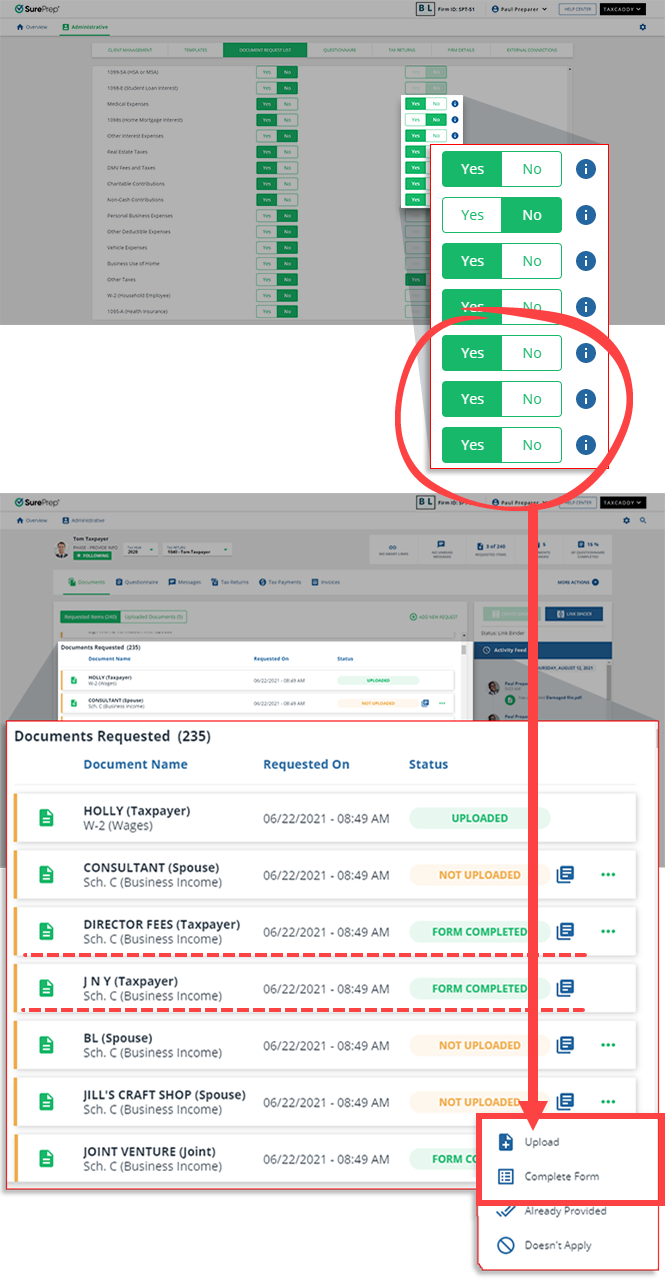

icon to learn more about the consolidated Itemized Deductions category.

icon to learn more about the consolidated Itemized Deductions category.

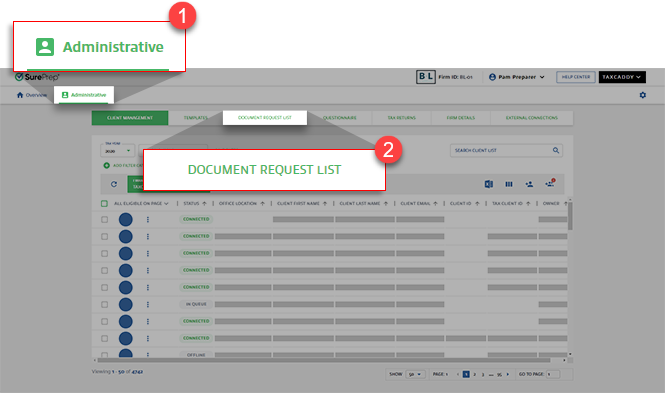

Categories | Supported tax application |

|---|---|

Schedule C | Yes |

Schedule E | Yes |

Schedule F | Yes |

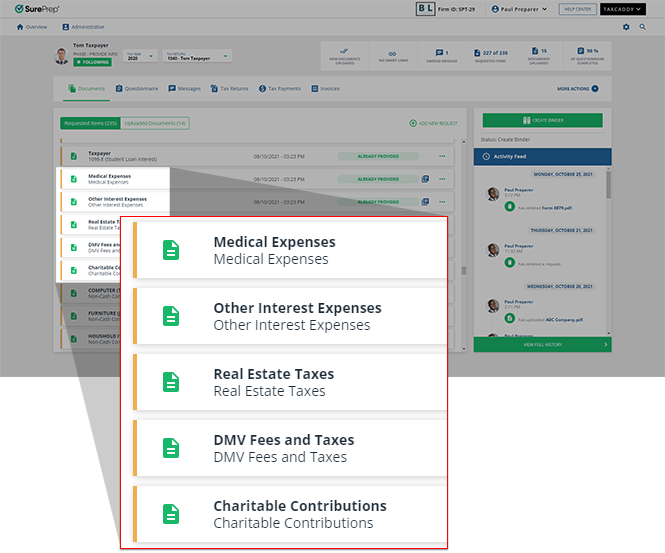

Charitable Contributions | Yes |

Non-Cash Contributions | Yes |

1098s (Home Mortgage Interest) (OFF by default) | Yes |

Other Interest Expenses | Yes |

Medical Expenses | Yes |

Real Estate Taxes | Yes |

DMV Fees and Taxes | Yes |

Other Taxes | Yes |

Foreign Bank and Financial Accounts (OFF by default) | CCH Axcess Tax |

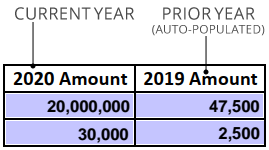

Tax application | Auto-populates |

|---|---|

GoSystem Tax RS CCH Axcess Tax | Current year and prior year data (except Foreign Bank Account). Current year = Identifier/description fields Prior year = amounts from last year |

Other tax application (for example, UltraTax, Lacerte) | Doesn’t auto-populate prior year data. |

icon will group each entity in that category into a single request as a consolidated itemized deduction (CCH Axcess Tax and GoSystem Tax RS).

icon will group each entity in that category into a single request as a consolidated itemized deduction (CCH Axcess Tax and GoSystem Tax RS).