While

MOBILE NUMBER

and

SSN

are optional fields, we highly recommend you enter at least one of these fields to improve your client's TaxCaddy login experience. Clients that successfully log in by verifying the

MOBILE NUMBER

(via SMS) or

SSN

will instantly get access to all the requested items you sent them. If a mobile number is missing in

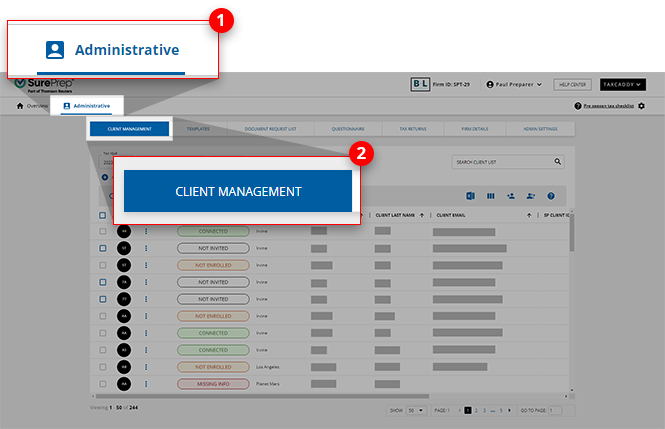

Client Management

, TaxCaddy will get the mobile number from the tax software when you use

Create Custom DRL

. Client's with missing mobile phone number or SSN will be able to log into TaxCaddy, however, your firm users will need to make sure their identity before you and your clients can see each other's documents, requests, and activities.