Triva isn't available right now.

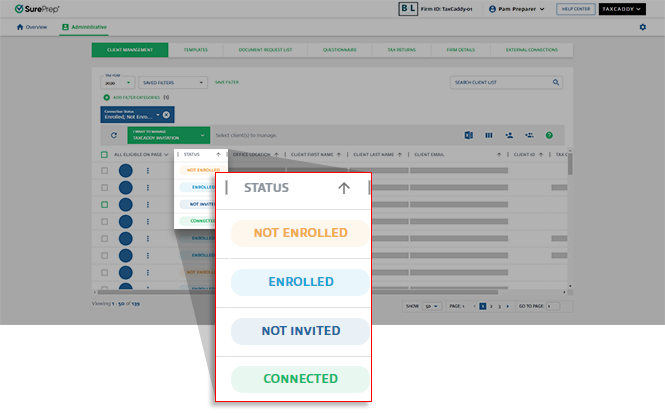

TaxCaddy Status | Log in method |

|---|---|

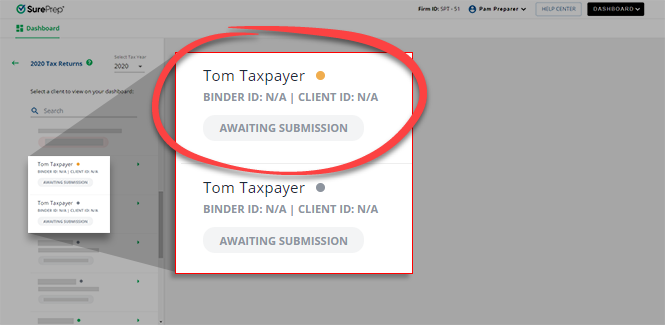

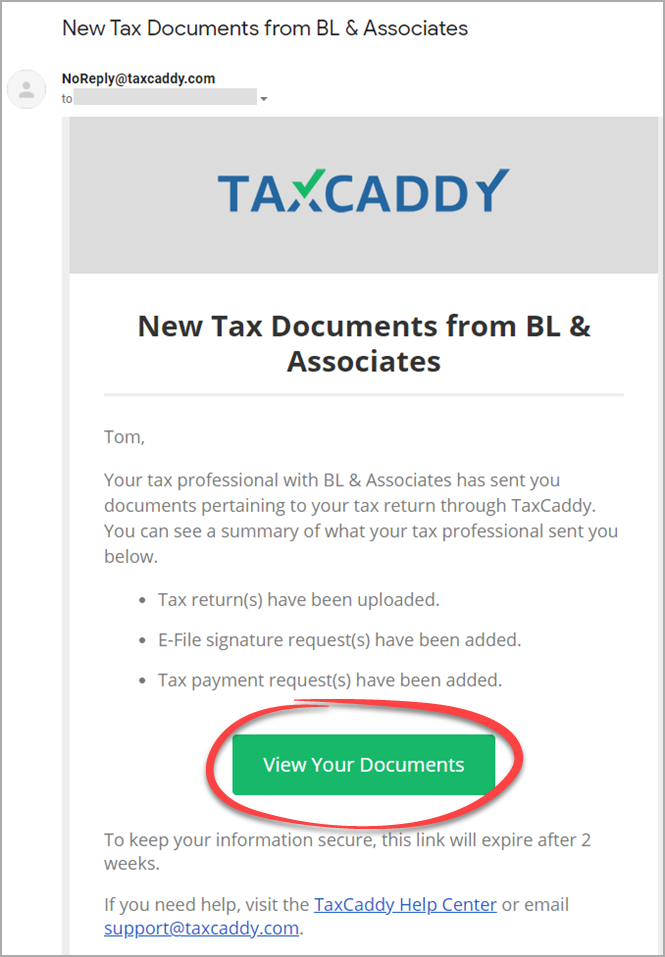

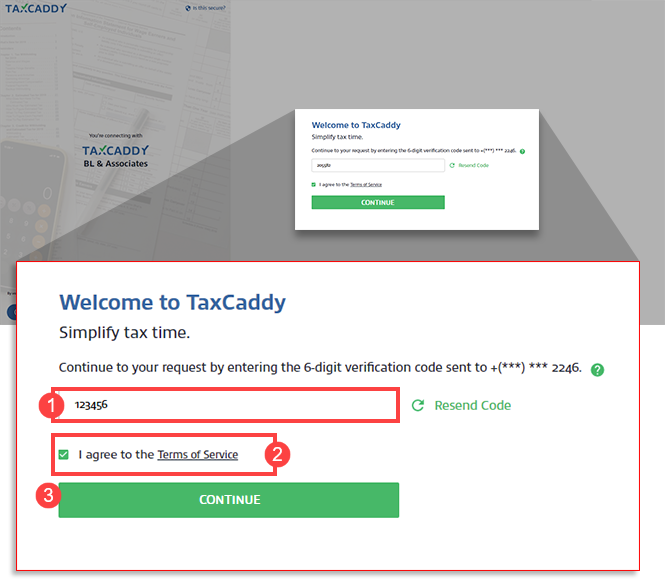

Not Invited Not Enrolled Enrolled without a password Connected using Dynamic Password | Dynamic Password Taxpayers without TaxCaddy login credentials can access their deliverables using a dynamic password (i.e. verification code) texted to their mobile phone via SMS. |

Connected Enrolled with a password | TaxCaddy.com login Client's TaxCaddy login credentials (i.e. email address and password). |

User type | Action |

|---|---|

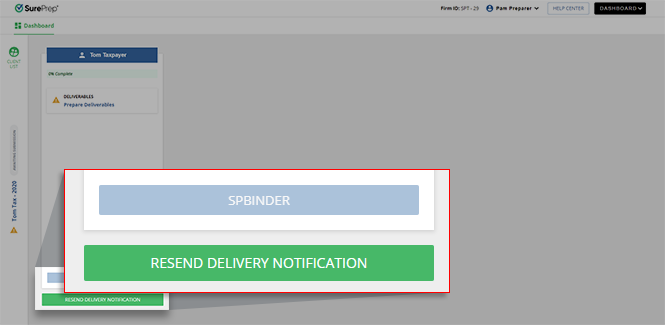

Tax Professionals | Tax professionals can use the RESEND DELIVERY NOTIFICATION feature in Reviewer Dashboard to send a new dynamic password email and link to the client. |

Clients (with access) | Client can log in then create a password to setup TaxCaddy login credentials for future logins. |

Clients (with an expired link) | Clients can setup a password using the Having trouble logging in? link on TaxCaddy log in page. After receiving the password reset email, clients can use their mobile phone number to setup a password. Clients can also reach out TaxCaddy taxpayer support for a new dynamic password link. |