The automotive industry is very symbolic in a lot of countries. In the United States, it’s been a symbol of freedom for decades. For Japan and Korea, it’s a symbol of their rise over the past 50 years into very advanced manufacturing economies. And now places like Mexico and India are on that same path.

Since the automotive industry is such a large employer and source of pride in many local economies, it’s no wonder that a lot of countries are building regulatory frameworks that incent manufacturing and in particular, export manufacturing. These and other potential regulatory changes are therefore particularly relevant to global auto industry players, and there’s a fair amount of speculation as to what the impact may be.

Free trade and global supply chains

Going forward, a lot of countries will be setting up and adjusting regulations to incent and create more of an infrastructure around automotive manufacturing in their countries. This will be a significant change, which will help shape the form of the global supply chains.

As an example, there has been a lot of talk about the North American Free Trade Agreement (NAFTA) from a North American perspective recently…whether it will survive, and if it will, what the future of NAFTA look like, and what its impact on the auto sector will be. This provides a very interesting case study in what is going on in the world of free trade and automotive in particular.

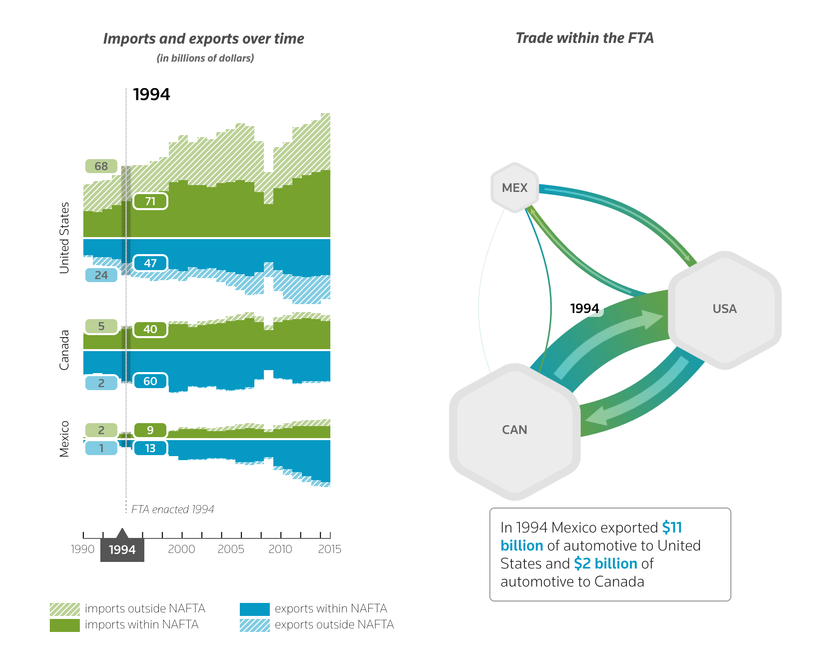

NAFTA automotive trade in 1994

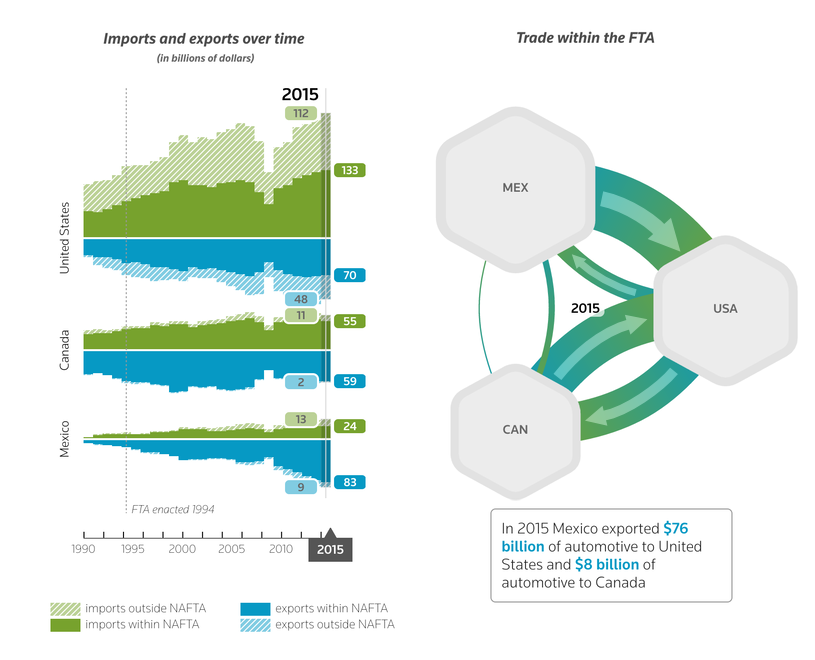

NAFTA automotive trade in 2015

Since 1994 Mexico has grown to become the number 2 supplier of vehicles to the U.S. market.

Source: Interactive data visualization published in Is free trade fair trade? Examining the true impact of NAFTA.

While no one knows for sure what we’ll see in terms of NAFTA changes, it seems likely that the regional value content requirements will increase. And there’s even talk of including domestic value content (i.e., U.S. value content) alongside regional value content as a means of measuring the origin of the goods produced. There is also discussion around changing the tracing rules, which essentially break down bills of materials into components and trace, in a deeper level of detail, the composition of those components.

The importance of this is that it will force companies to be much more stringent in the way they deal with free trade agreements.

At a macro level, it will force companies to rethink their supply chain structures and potentially move some of their supply base away from off-FTA countries like Japan and Korea in the case of NAFTA, into Mexico and even into the United States.

This would cost a lot for automotive companies, as they would have to look for new suppliers in places where supply does not currently exist or try to help their supply chains become more efficient in areas where the local suppliers may not be as efficient as the suppliers they’ve been buying from.

Another big change over the next few years will come into force in Asia with or without the United States in it.

The Trans-Pacific Partnership (TPP) without USA might be another FTA in addition to Regional Comprehensive Economic Partnership (RCEP) that can shape the Asian supply chain structures. If RCEP becomes a major FTA, the automotive industry is structured in that region in a way that would open up entirely new ways of constructing your suppliers in a duty-free or relatively duty-free way that criss-crosses an entire continent.

Environmental regulations

Environmental regulation is another area where there’s been great speculation on the impact it may have on the automotive industry. For example, tight emission standards in large trading regions like the EU will force global automakers to develop technologies to comply with them even if their home regions are not as demanding, therefore advising global product development. Modern FTAs are also likely to include environmental standards as a part of their scope, tying free trade to meeting environmental standards – TPP would have been a step in this direction.

That said, I don’t think environmental regulations will have a huge impact on the industry, because the auto sector is already headed in an environmentally-friendly direction that is unlikely to reverse.

We know that consumers are pretty pleased with more fuel-efficient cars, both for the sake of their wallets and the environment. And there is a sufficient amount of concern around the environment that consumers will continue to demand more fuel-efficient and environmentally friendly cars going into the future.

According to a 2016 Consumer Reports survey, “The vast majority of American adults (84 percent) feel that automakers should continue to improve fuel economy for all vehicle types.”

With automakers playing a leading role in the sustainability revolution already underway, I believe that consumer demand will continue to push the industry toward cleaner cars more so than any regulation (or in the U.S. case, despite any potential softening of regulation). And that’s just something that car manufacturers are going to have to build into their plans.

Learn more

ONESOURCE Global Trade for FTA – Gain confidence and add visibility across your entire FTA process.

Thomson Reuters automotive solutions are here to guide you through uncertain times in managing risk and reducing cost in the supply chain.

Uncertainty and risk in the automotive industry – Download the report

Podcast: Building global trade compliance across your supply chain