In Thomson Reuters Regulatory Intelligence’s latest survey of compliance professionals, we see a role that is achieving greater responsibility within their firms while facing a myriad of practical operational challenges as well

In our current regulatory state, there is a much greater need for robust and accurate compliance functions within virtually every organization. With geopolitical unrest, economic instability, banking failures, sustainability challenges, crypto-assets and new technologies as the backdrop, many financial services firms need to be able to rely on an effective and efficient compliance function to steer them through the labyrinth of associated regulations.

As workloads are increasing, there is also a limit on the finite resources available to manage these growing compliance burdens. These concerns are compounded by a diverse and expanding range of subject areas with which compliance officers need to be familiar as well as an expectation of a greater volume of regulatory change. This larger picture is set against increased costs and difficulties in recruiting skilled compliance staff.

Overall, survey respondents outlined a sector that held greater responsibility but also contained practical operational challenges that threaten to undermine efforts to provide their firms with the level of compliance support required in today’s environment.

Thomson Reuters Regulatory Intelligence’s 14th annual survey of compliance leaders — distilled into the 2023 Cost of Compliance Report — was undertaken against this backdrop. The report explores the challenges that compliance officers face in 2023 and exposes the depth of issues that compliance leaders have encountered. The survey was taken of more than 350 practitioners, representing global systemically important banks (G-SIBs), other banks, insurers, asset and wealth managers, regulators, broker-dealers, and payment services providers mainly in the United States, the European Union, and the United Kingdom.

Overall, survey respondents outlined a sector that held greater responsibility but also contained practical operational challenges that threaten to undermine efforts to provide their firms with the level of compliance support required in today’s environment.

Some of the key findings of the annual report include:

-

-

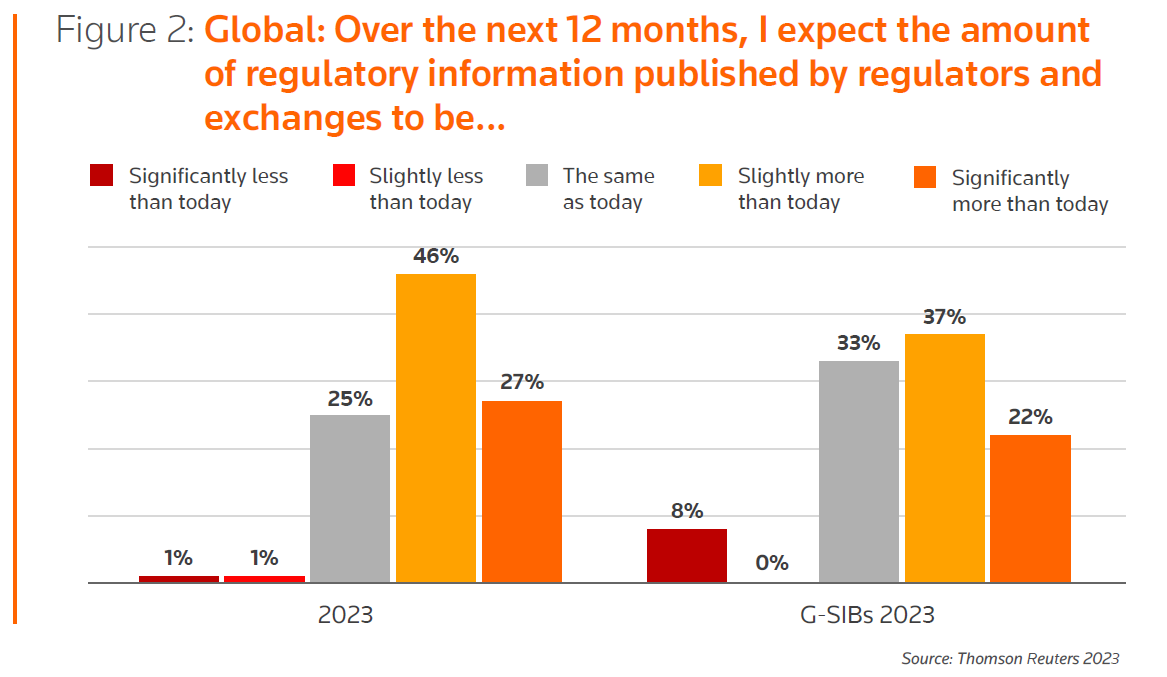

- The volume of regulatory change was expected to increase and was seen as a key compliance challenge for boards and compliance officers.

- Cost pressure and balancing competitive and compliance pressures were reported as key challenges, yet 45% of respondents did not monitor their cost of compliance with regulations across their organizations.

- One-third of respondents expected compliance teams to grow, and the cost of compliance staff was also expected to increase, while turnover of staff and budgets remain at 2022 levels. An increase in the number of firms using outsourced providers for their compliance functionality was also reported.

- Retaining skilled resources is seen as essential to deliver on a growing range of subjects with which the compliance function is involved. The recruitment of the appropriate talent comes at a cost, and the appeal of becoming a compliance officer has been reduced due to the potential for increased personal liability.

- Low staff morale is emerging as a key conduct risk for many financial services firms. This may lead to wider noncompliance issues due to staff error or manipulation. Couple this with the identification of cybersecurity as a prominent culture and conduct risk, and it becomes more important for firms to ensure internal security controls are robust.

- Firms operated an effective compliance culture despite the conduct and culture risks, with respondents predicting they will spend more time on culture and conduct issues in 2023.

-

The findings of this annual report are intended to help financial services firms with planning and resourcing while allowing them to benchmark their own approaches with those of the wider industry. The experiences of the G-SIBs are analyzed where these can provide a sense of the stance taken by the world’s largest financial services firms.

You can download a full copy of Thomson Reuters Regulatory Intelligence’s 2023 Cost of Compliance Report, here.