Thomson Reuters Regulatory Intelligence's new "Cost of Compliance Report 2020" examines how risk & compliance functions might face the challenges ahead

Without question, compliance functions for financial services firms around the world have matured in the decade since the financial crisis, with many firms enhancing their compliance capabilities to embrace the new range of disciplines and specialties required.

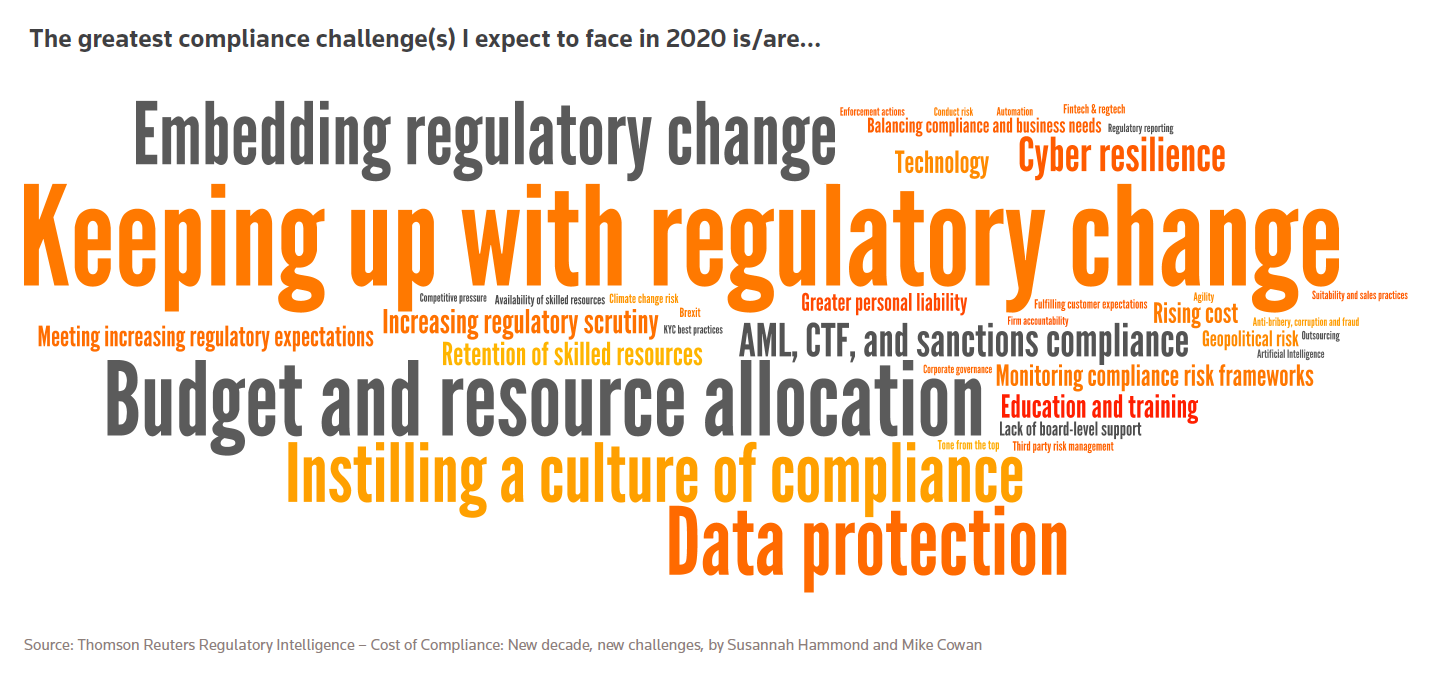

Yet today, the risk and compliance functions are at an inflection point that demonstrates the difficult balance between the need for investment in skills and resources and the tight budgets under which many compliance functions operate. This is set against a background — even before the impact of the COVID-19 pandemic is considered — of continued uncertainty about culture and conduct risk issues, regulatory reform, and the growing threat of personal liability.

The new Cost of Compliance Report 2020, published by Thomson Reuters Regulatory Intelligence (TRRI), examines this inflection point and offers insight as to how best firms’ risk and compliance functions might face the challenges ahead.

The 11th annual survey on the cost of compliance closed before the profound ramifications of COVID-19 became apparent. The survey gathered more than 750 responses from risk and compliance practitioners around the world, representing global systemically important financial institutions, banks, insurers, brokers, wealth managers, and payment services providers. While the report does consider the regulatory response to COVID-19, it could not take into account the specific views of respondents.

To update the report for the impact of the pandemic, TRRI has launched a follow-up snapshot survey of five free-text questions to enable participants to share their evolving concerns. (Click here to take the cost of compliance snapshot survey. The survey should take no longer than 5 minutes to complete and, as ever, all information will be treated in the strictest of confidence and results will be displayed anonymously.)

The results of the snapshot survey will form part of a special report on the COVID-19 cost of compliance which will be available to download in the third quarter of 2020.

Challenging operational atmosphere

Even as financial firm leaders are primarily focused on the myriad implications of COVID-19, the pre-existing challenges and issues considered in the latest Cost of Compliance Report will not have gone away. Indeed, many of those challenges have become more profound given the additional strain placed on the operational resilience of all financial services firms due to the pandemic.

Compliance officers themselves will be front and center to help their firms navigate the unprecedented chaos and disruption caused by the pandemic. In a new question posed for the second decade of the Cost of Compliance Report, participants were asked about the characteristics of the ideal compliance officer.

The aftermath of the 2008 financial crisis saw a focus on culture and conduct — the pandemic will test adherence to firms’ approach to culture and conduct risk just as it has been testing firms’ operational and prudential resilience plans. Those firms which previously took a simple tick-box approach to culture and conduct risk are likely to be vulnerable to risky behavior and the associated poor customer outcomes. And while even the strongest of firms will feel the impact of COVID-19, those that have built a firm-wide risk aware approach to culture and conduct risk will emerge ahead of those who simply paid lip service.

Overall, the results of the 2020 survey indicate an inflection point for financial services firms — and more worrisome, all the hallmarks of the cycle can be seen ready to begin again. Although it is too early to tell the how the virus will influence that inflection, already many financial firms are asking for that various regulatory initiatives be postpones so they can focus more on managing immediate crisis-related events.

Clearly, it would be potentially very unwise for firms to reduce the budget available for risk and compliance at this time. There will be competing priorities, of course; but in troubled times firms need a well-resourced, highly skilled compliance function more than ever. If at all possible, firms should consider additional investment in skills at all levels, operational resilience (especially involving IT infrastructure), and cementing their approach to culture and conduct risk throughout the firm.