Our new report on crypto-assets and their place in the global regulatory scheme shows a complex and changing landscape.

The incredible growth of crypto-assets and their intersection with the globally regulated financial system has produced complex regulatory and legal challenges, according to a new report, Cryptos on the rise 2022, from Thomson Reuters Regulatory Intelligence (TRRI), which examines some of the risks and benefits of this next iteration of digital transformation.

The report probes new areas of global regulatory emphasis such as central bank digital currencies (CBDCs), non-fungible tokens (NFTs), stablecoins, decentralized autonomous organizations (DAOs), crypto-advertising, and financial crime.

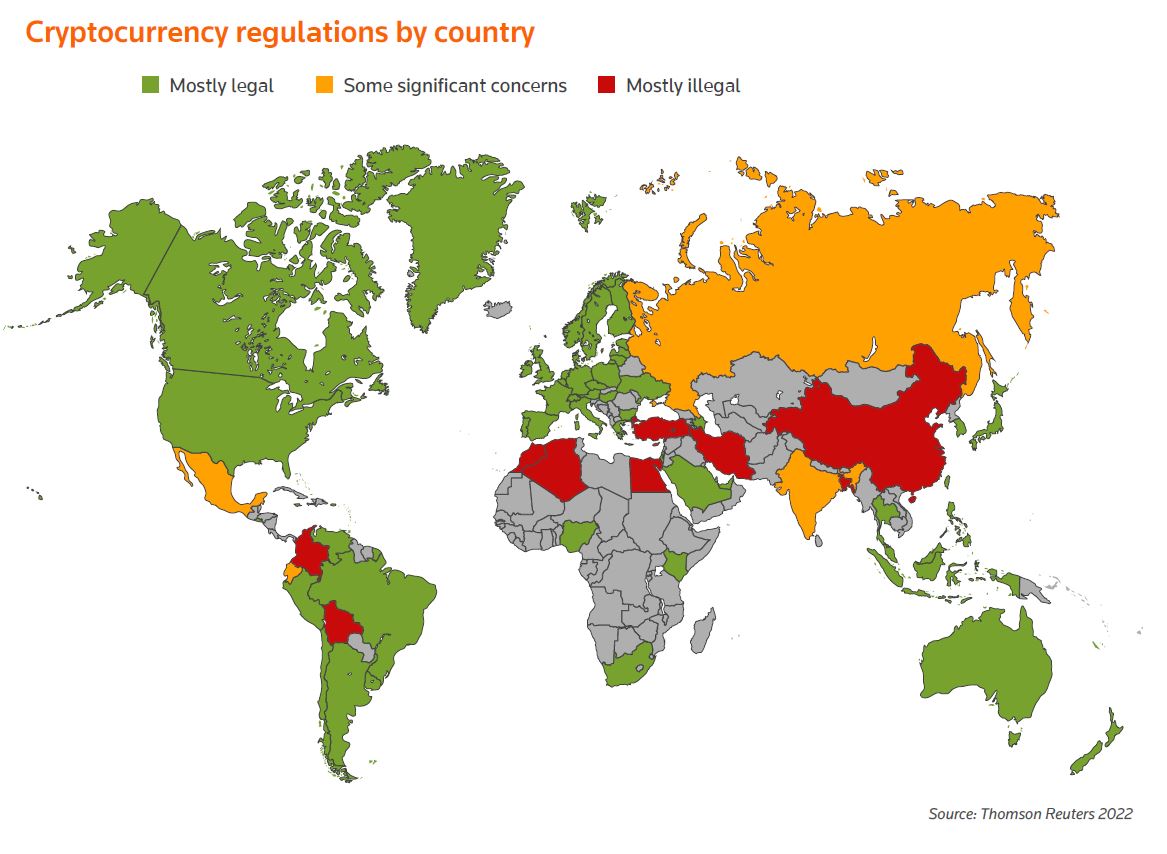

The report also contains an updated compendium and map, which offers a country-by-country overview of the rapidly developing regulatory and legal framework for cryptos. The compendium includes approximately 70 important countries, their regulatory approach or stance on cryptos, general tax status along with links to valuable information such as the pertinent regulatory bodies or enacted regulations.

You can see the full digital version of the Cryptos on the Rise 2022 report here

The tremendous growth of cryptos, now estimated to be near $3 trillion in total market capitalization, is also examined. Such growth in popularity and size means that crypto-assets are now presenting new risks, such as disruption of traditional financial services and growing concerns about potential threats to global financial stability. Other, less macro-risks include the need to protect vulnerable customers, market manipulation, fraud, anti-money-laundering concerns, and cybersecurity, all of which will also need to be addressed. The increasing regulatory challenges are exacerbated by the growing public awareness, acceptance and use of cryptos.

Indeed, this perceived threat to financial stability is being considered by supranational policymakers with the identification, monitoring, and management of risks continuing to concern and on occasion confound regulators and firms alike. The challenges include operational and financial integrity risks from crypto-asset exchanges and wallets, investor protection, and inadequate reserves and inaccurate disclosure for some stablecoins. Moreover, in emerging markets and developing economies, the advent of crypto can accelerate what the International Monetary Fund has called cryptoization — which occurs when these crypto-assets replace domestic currency and circumvent exchange restrictions and capital account management measures. In other words, creating a situation that could have a potentially profound impact on financial stability.

Although outright bans on cryptos around the globe are somewhat rare and are diminishing, some jurisdictions are emerging as staunch advocates. Many regions, however, fall somewhere in the middle as regulations are slow to keep pace with the immense popularity of cryptos — a risk, in and of itself.

In many countries, cryptos appear to be at a legal and regulatory tipping point, the report shows. Concerns about financial stability and vulnerable customers, together with the apparently persistent misperceptions about financial crime, are driving policymakers to consider significant action. Policymakers must, however, balance these considerations with the benefits which could be derived from the more widespread adoption of cryptos.

Some countries, meanwhile, are welcoming cryptos with seemingly few regulatory concerns. Cryptos’ borderless nature makes this even more challenging, as is evidenced by the near-overnight relocation of miners and crypto-firms out of China after that country clamped down on crypto activity. Most jurisdictions are reluctant to stifle innovation, but it would be politically unacceptable to deliberately risk either wholesale financial stability or widespread retail customer detriment.

The clear message from the report is that there is an urgent need for a coherent, comprehensive, and global approach to the regulation and oversight of cryptos. The need for policymaking pre-emption and cooperation is seen as increasingly urgent as crypto-assets — which for now only accounts for a small portion of overall financial system assets — continues to grow rapidly. Further, direct connections between crypto-assets and systemically important financial institutions and core financial markets are rapidly evolving, opening the door to the potential for regulatory gaps, market fragmentation, or arbitrage.

Without a coherent international approach to cryptos there is a danger that they will fail to achieve their potential, and the world will lose the considerable benefits they could bring.

The special report will be featured at several upcoming conferences as well as on the Compliance Clarified podcast which is available on Google, Apple, and Spotify.