The fiscal year 2024 has seen a significant increase in demand for legal services among Australian law firms, according to a new Thomson Reuters report

The Australian legal market in the 2024 financial year (FY 2024), which ended in June, has been marked by unprecedented dynamism and growth. Despite the challenges faced in FY 2023 — which saw a contraction in profit per equity partner (PPEP) for the first time since 2016 — the legal industry has rebounded in FY 2024 with remarkable vigor. This resurgence is characterized by a significant upswing in legal demand as well as a surge in scale to match.

To examine these developments more extensively, the Thomson Reuters Institute has published its 2024 Australia: State of the Legal Market Report, that provides critical insight into what forces are at play in the country’s legal market.

A market on the rise

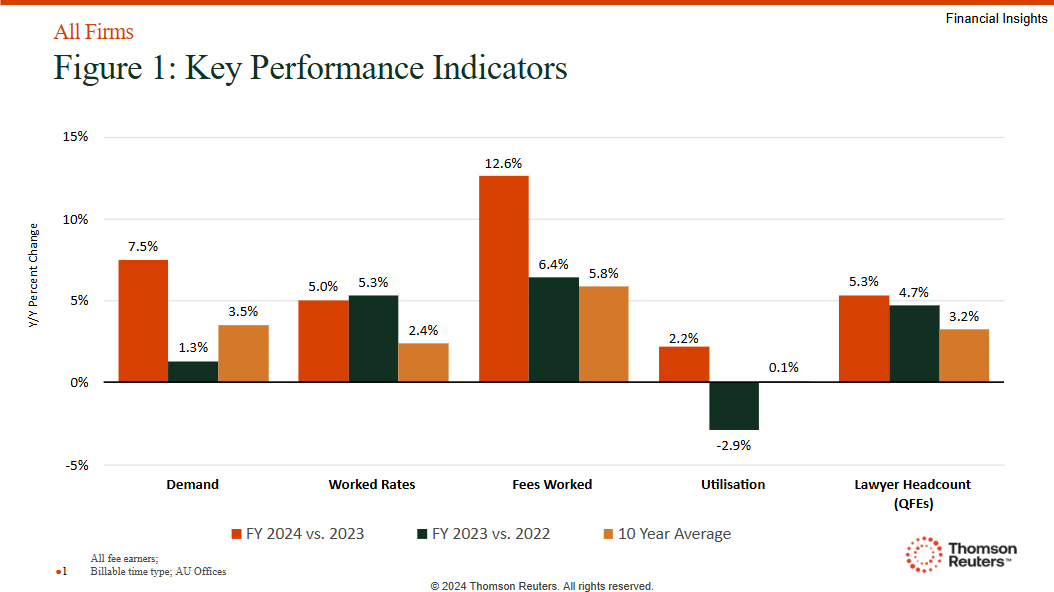

The fiscal year 2024 has seen a significant increase in the demand for legal services, exhibiting an average growth rate in the total hours worked by the average law firm of 7.5%, which notably exceeds the past decade’s average of 3.5%. This growth has been broad-based, encompassing both transactional and counter-cyclical practice groups. Transactional demand led the way with an 8.5% increase, while counter-cyclical demand grew by 6.8%. Every major practice area, including banking & finance, corporate general, construction, workplace relations, and dispute resolution, has experienced growth.

Geographically, this demand surge has been widespread, with regions like Melbourne and Perth growing at more than 9% year-over-year, and Brisbane experiencing a staggering 13.7% increase in demand. Sydney, the largest market by revenue, grew by 6.7%, outpacing its 10-year average growth rate. This robust demand has been driven by strong economic fundamentals, particularly in the mining industry, which is undergoing significant reorganization and expansion.

Technological investment and innovation

In response to this surging demand, Australian law firms have significantly increased their technological investments. The advent of generative artificial intelligence (GenAI) has disrupted traditional legal practices, prompting firms to invest heavily in technology. Investment in knowledge management, which includes GenAI, grew by 6.4% per qualified fee earner (QFE) in FY 2024. However, Australian firms are still trailing their counterparts in the United States in real technology group spending, growing their investment by 2.9% above inflation compared to 4.7% in the US.

Despite this, Australian law firms have managed to control their expenses better than in previous years. Overhead expenses grew by 8.8%, but this was largely due to increased headcount. Total expenses per QFE rose by 2.6%, while revenue per QFE increased by 5.4%, resulting in a 14.1% rise in profit per lawyer QFE.

While the market’s growth is promising, it also presents several challenges. The path to full equity partnership is becoming increasingly difficult, the report shows, with the average firm hardly increasing its equity partnership totals despite an 8.3% growth in overall headcount since FY 2022. This has led to a more competitive environment for new lawyers, who now face greater competition for fewer equity partnership opportunities.

The role of GenAI

The report also illustrated how GenAI continues to be a significant disruptor in the legal industry. While many Australian legal professionals recognize its potential, there is still a sense of hesitance. According to the Thomson Reuters Institute’s recent Generative AI in Professional Services Report, 85% of Australian legal professionals believe GenAI can be applied to legal work, but only 48% think it should be. This cautious approach is reflected in the slow adoption of GenAI tools by Australian law firms, with many firms opting to be fast followers rather than early adopters.

Despite this, the potential impact of GenAI on billing practices, law firm revenue, and legal staffing is widely acknowledged.

The 2024 Australia: State of the Legal Market Report highlights a pivotal moment for the legal industry. The country’s law firms are at a crossroads, balancing the thriving demand of today with the need for strategic adaptations to rapidly approaching technological shifts. By carefully managing firm culture, promotions, and technological investments, many Australian law firm leaders can navigate their firms through these challenges and seize the opportunities presented by this new era of legal practice.

You can download the full 2024 Australia: State of the Legal Market Report here.