While corporate law department leaders may anticipate an increase in their legal spend, whether that is a positive indicator for the legal industry, however, is a matter of debate

In the recent State of the Corporate Law Department report, we featured a series of metrics around what we have come to term net spend anticipation (NSA). This figure is one that’s worth a bit more attention and dissection.

First, while this is a metric we have reported for some time, the NSA nomenclature has only recently been standardized. Notably, the methodology behind its calculation hasn’t changed: it is calculated by asking a relatively simple question and then denoting the gap between positive and negative responses.

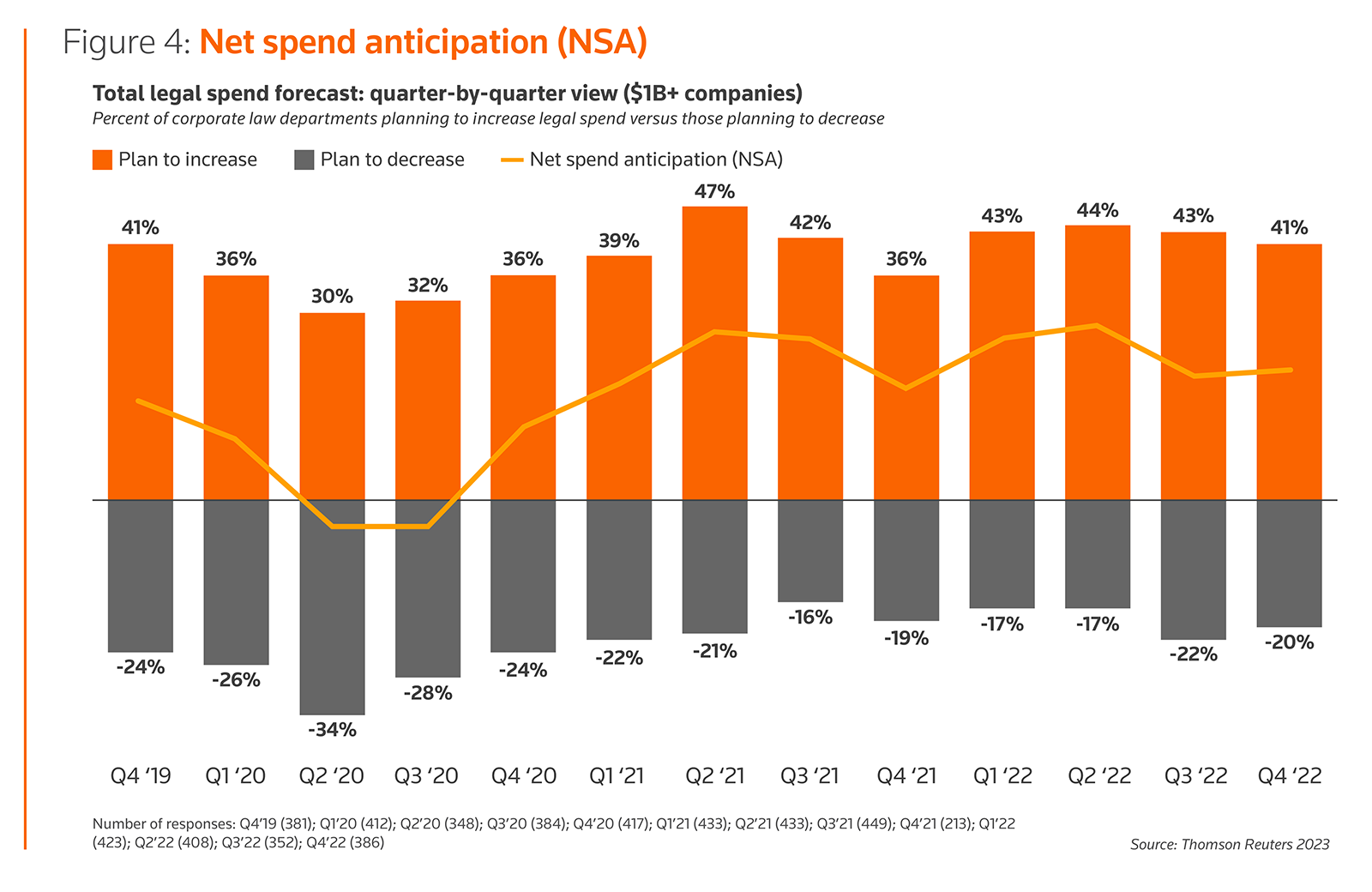

During interviews with corporate general counsel, we ask them whether, within the next 12 months, they expect their legal spending to increase, decrease, or stay the same. The NSA chart below shows the percentage of those who answered the question in the positive (41% anticipate their legal spend to increase over the next 12 months), and those who answered in the negative (20% anticipate spend would decrease). The actual NSA metric is then calculated by subtracting the anticipated decrease percentage from the anticipated increase percentage. For the most recent quarter, the responses give us an NSA figure of 21, up slightly from the prior quarter.

For much of the time we have been reporting this metric, we did so without a formal name for it. When we decided to formalize it, our first attempt was using the name net spend optimism, which seemed appropriate as the metric generally tends to show legal spend increasing over time — which often is unsurprising and can cause a general sense of optimism on the part of providers of legal services, as there will likely be an increasing amount of wallet to capture.

However, as we heard feedback from many general counsel, much of it fell along the lines of “I may be anticipating an increase, that doesn’t necessarily mean I’m optimistic about it” — a fair assessment.

As the State of the Corporate Law Department report highlights, cost control is among the top five strategic priority areas for GCs around the world — and it’s number one in the United States. Increasing legal spend potentially runs contrary to this strategic priority and may even invite greater levels of budgetary scrutiny for many GCs, something they would definitely prefer to mitigate.

So, we adopted their vernacular: they’re anticipating an increase in their legal spend.

Drivers of legal spending

In an era of growing cost pressures, what is driving the potential for increasing legal spend? There are likely several factors. First, as the report discusses at length, regulatory compliance is an increasing challenge for GCs, and each layer of regulatory complexity adds with it an increasing level of cost of compliance.

At the same time, certain legal practice areas such as litigation are incessantly more expensive. Given that litigation lawyers cost more, and the high costs associated with eDiscovery are almost unavoidable, the resulting increased costs of litigation undoubtedly factor into the anticipation of higher legal spend. And last but not least, as reported in last year’s Legal Department Operations Index, 65% of corporate law departments are experiencing an increase in their overall matter volume. With all this in mind, it’s unsurprising that many GCs anticipate their spend to increase.

That raises the question, however, whether these anticipated spend increases a good thing or not? While, to a great extent, they are likely unavoidable, as businesses of all sorts face continued economic uncertainty, it is quite understandable that GCs would be apprehensive. So, what can be done?

For some time, law firms have been reporting rising pressure from their clients around rates and fees. Yet, we see a continuing pattern of ever-higher rate increases.

For many GCs, turning to technology to help automate workflows and increase efficiencies in their operations has become a primary way to increase departmental productivity. Some 71% of legal operations professionals see using technology to simplify workflows as a high priority. And they are also looking for help from the outside.

For some time, law firms have been reporting rising pressure from their clients around rates and fees. Yet, we see a continuing pattern of ever-higher rate increases. For those law firms looking to maximize the likelihood of a client agreeing to a rate increase, capturing a greater share of a client’s spend, increasing the firm’s market share, or minimizing the amount of business potentially under threat as clients look to optimize their outside counsel panels, the focus needs to be on how value is delivered to the client and how that value is communicated.

At a recent event I attended with a large number of GCs, the discussion inevitably turned to law firm rates. Surprisingly, many of those in attendance said that they actually paid little attention to the top-line rate the firm charged, but instead were much more attuned to what the business received in exchange for that rate.

For example, one GC shared that she paid nearly double the hourly rate to one firm for the private equity work she needed, but she was more than happy with that firm — which she named specifically to a room full of GCs — because they consistently delivered expert, timely advice that met the goals of her business, doing it in one-half to one-third of the time it took other firms. What a great testimonial for that firm. The factors the GC valued — quality, timeliness, commercial soundness — were all things this law firm delivered routinely. As a result, she agreed to their rate increases, she paid the firm’s bills quickly (and fully), and she was actively promoting them to other GCs who might be in need of similar services.

In an era where GCs know they will likely have to spend more money and don’t necessarily love the idea, law firms would be well advised to follow such a model for the benefits it can deliver to both their clients and the firm itself.