Diving deeper into our recent "Dynamic Law Firms Report", we see how this cohort of firms fared against the various law firm segments that comprise the Dynamic population.

In February, Thomson Reuters released its latest installment of the Dynamic Law Firms Report, which investigated the top quartile of law firms in the Financial Insights program with the highest average long-term growth to examine the aspects which made these firms more successful than their peers.

While the findings of the report were various, one topic we didn’t dive into was market segmentation, specifically how our populations of Dynamic and Static law firms performed against their peer firms among their respective segments. When we dived into the numbers, what we found is that Dynamic law firms not only outperform the average of all law firms, but they also outperform their respective segment averages, with some particularly stark differences in key areas.

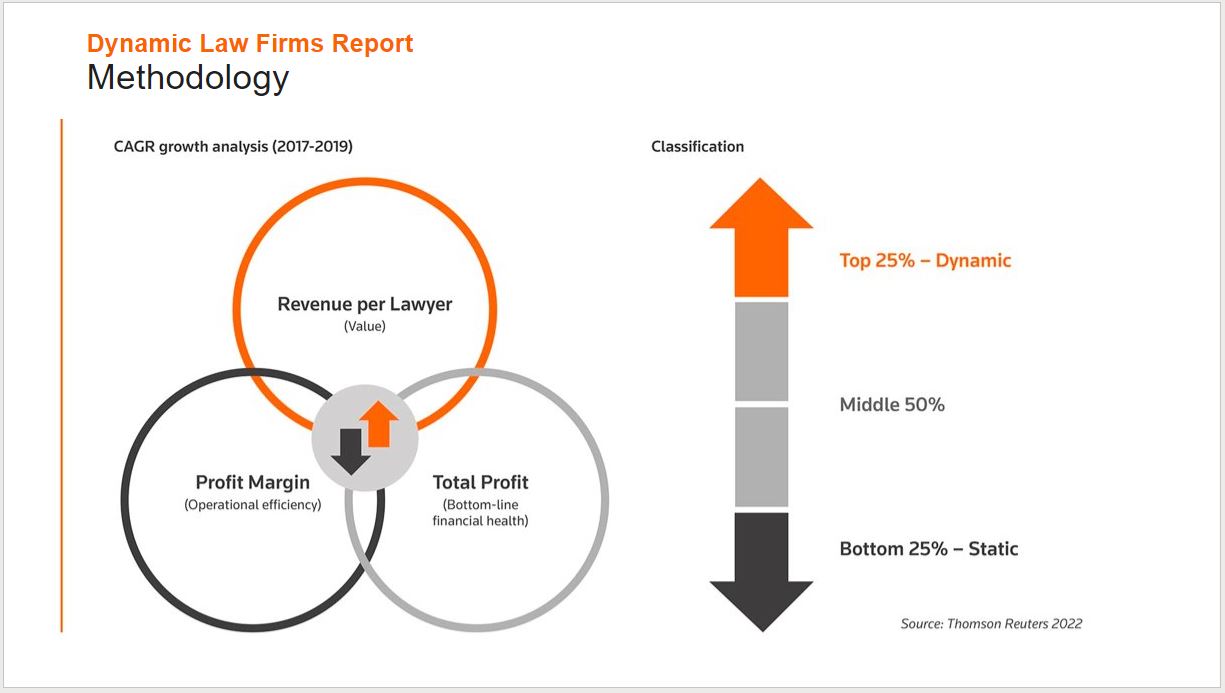

The Dynamic Law Firms Report ranks all of the law firms within the program according to a weighted index of three key growth statistics: revenue per lawyer, total profit, and profit margin. The top 25% of law firms on this list became the Dynamic subset. In contrast, the bottom quartile of firms are identified as Static firms. Typically, this report redraws the populations with every iteration, so the Dynamic firms we analyze in one year are not the same firms we analyze the next. With this report, however, we continued following the same firms from our previous report, identified at the end of 2019, analyzing how previous success impacted future performance during the pandemic crisis period.

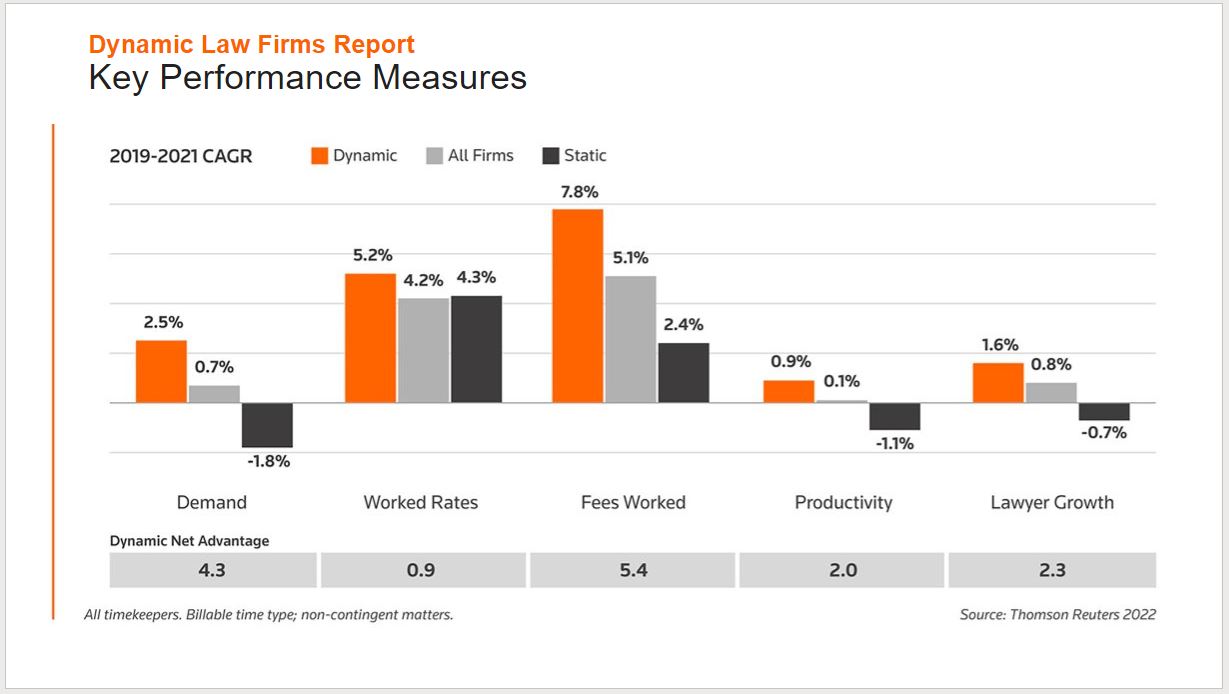

The results we found were promising. Dynamic law firms, those who achieved the highest positive growth between 2017 and 2019, continued to expand, while the Static firms (those on the lowest quartile of growth in that period) saw more mixed results.

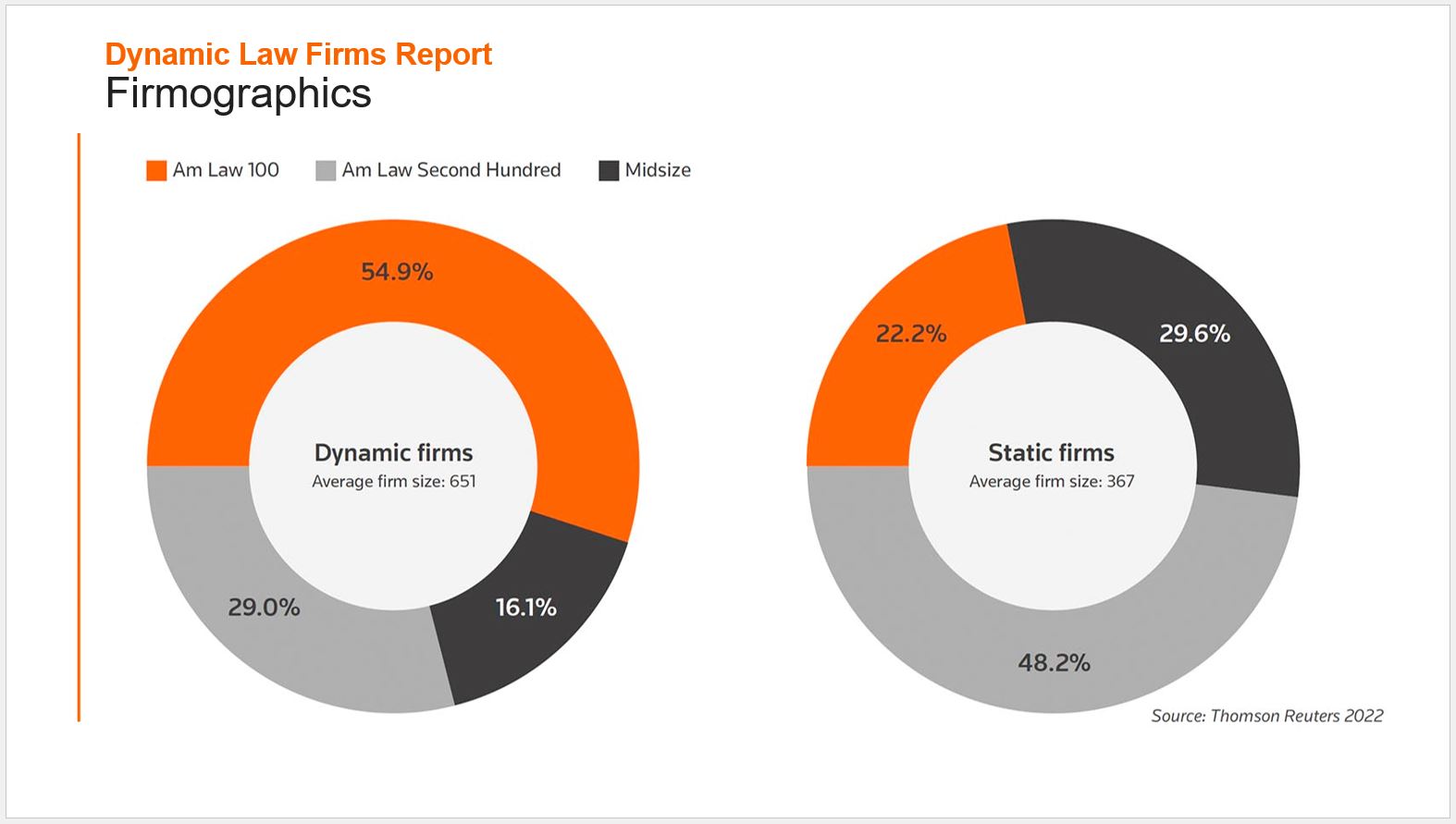

While the report went into detail about the way these firms were organized, the investments they were making, and more, there was one aspect the report only mentioned in passing. The firm populations were not necessarily equal. One of the regular findings of the Dynamic Law Firms Report is that scale matters.

Large law firms, able to leverage economies of scale, are often able to keep pace or exceed the growth of smaller law firms despite requiring larger absolute gains for the same percentile growth. The result is that the Dynamic and Static populations are comprised of different components. In our latest report, for example, Am Law 100 firms made up 54.9% of the Dynamic firms’ population, and just 22.2% of the Static firms’ population.

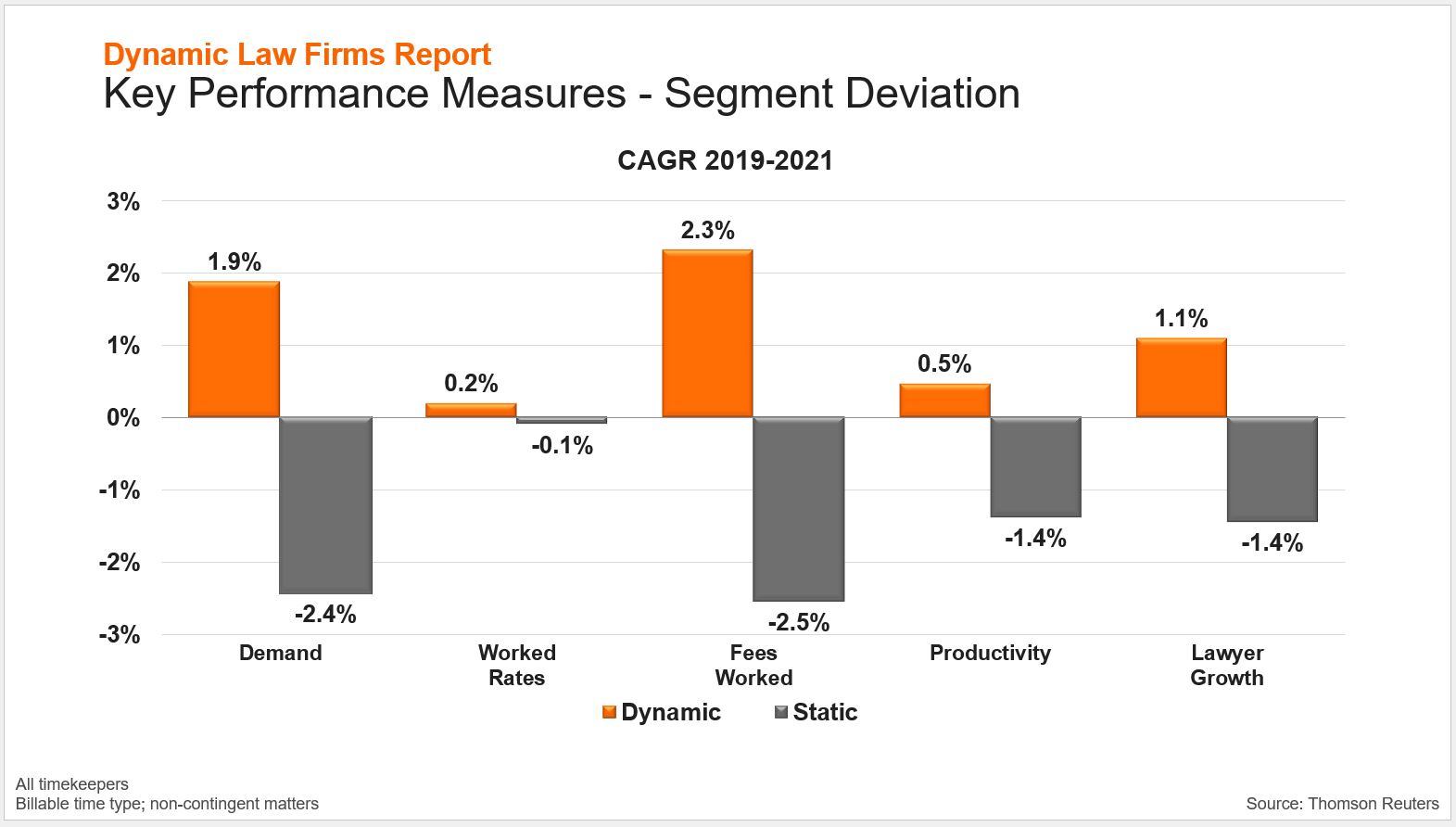

To control for possible segmentation impacts, we compared every firm’s compound annual growth rate (CAGR) from 2019-2021 to the average growth of their segment. Then, we calculated the difference between those numbers on a percentage point basis. We refer to this metric as the Segment Deviation, where a positive deviation indicates that the firm grew more than their segment average while a negative value indicates lower growth than the segment average. (For example, a Segment Deviation of 1.2 would indicate that the group grew 1.2 percentage points more than their segment average.)

When applying this metric to the Dynamic Law Firms Report, the results were stark. First of all, we found that Dynamic firms exceeded their respective segment averages in every Key Performance Measure. In some cases, the advantage was as small as 0.2 percentage points but in others it was as high as 1.9 percentage points. Conversely, Static law firms on average underperformed relative to their segments. While worked rate growth for both Dynamic and Static law firms tracked closely with their segments, there was a notable gap between the two populations in terms of overall legal demand. Dynamic law firms achieved demand growth far in excess of their segment averages.

Another important finding relates to growth in the number of lawyers within a firm. Unlike many aspects of large law firms, lawyer growth is one of the few metrics where the benefits of scale are small or even non-existent. In-fact, our data indicates that the largest law firms are having greater difficulty growing their talent recently, with the Am Law 100 averaging lower lawyer growth than the all-firm average in every quarter of 2021.

Dynamic firms’ Segment Deviation of 1.1 percentage points shows just how well these firms are navigating the talent wars. In the report itself, we spent a considerable time analyzing how Dynamic law firms were positioning themselves as a destination for talent given their approach to innovation, cooperation, and growth opportunities. These lawyer growth figures seem to indicate that the strategy is paying dividends.

In summation, when segmentation is taken into account, Dynamic law firms managed to exceed their segmentation by an impressive amount, especially in terms of demand growth, thus backing up our earlier findings that these firms are seeing true growth. Static firms, in contrast, underperformed not just the market average, but even the average law firm within their respective segments, further highlighting that their success in growing profit per equity partner is due to strategies which focus on factors other than improvement and investment.