As law firms set their rates for the coming year after a period of strong rate growth, many are asking how high can they go before clients push back aggressively?

Law firm rate-setting season is just around the corner, and in fact, by the time you read this piece, many law firms will likely have set their rates for the coming year. Given this, it seems timely to take a closer look at how law firm rates have performed in 2023 and examine a few of the potential challenges that may lie in store.

At the outset, it’s important to state that 2023 saw the average law firm post remarkably strong growth in the rates they charge clients for work on legal matters. Even law firms that are typically more conservative with the pace of their rate growth seemed to find a yet-untapped pricing power.

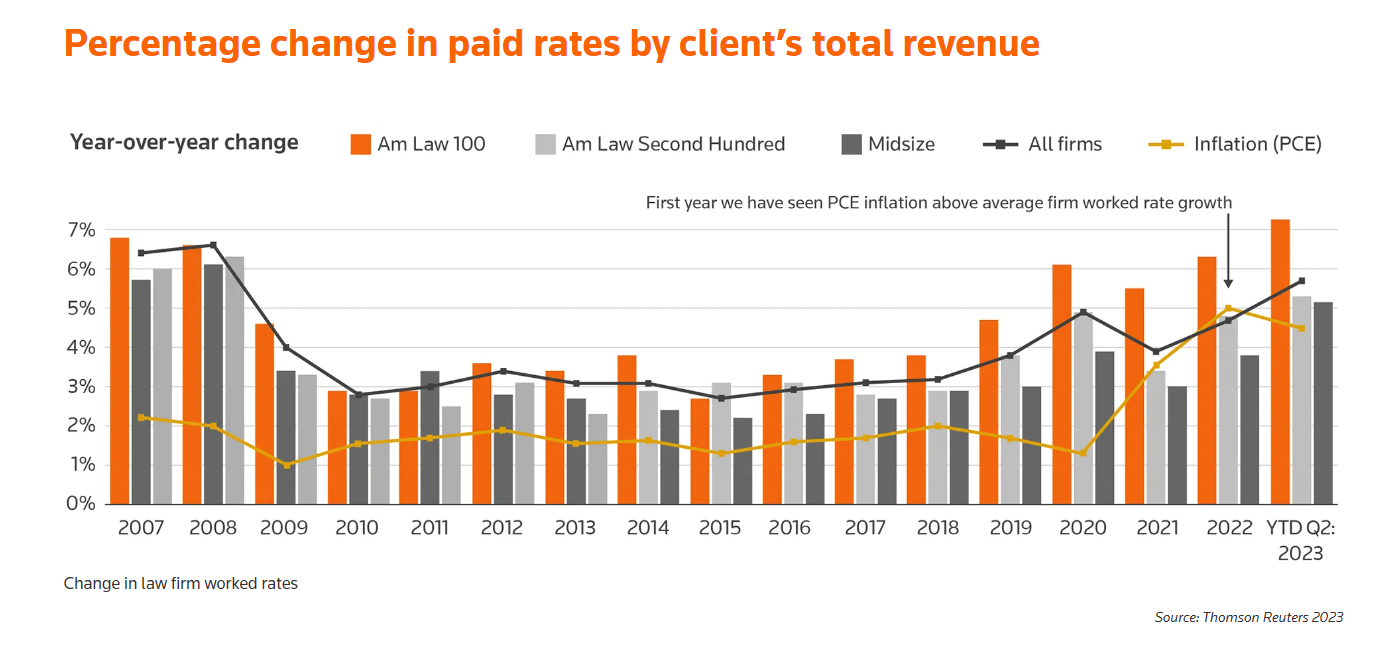

Through the midpoint of 2023, the average law firm grew their worked rates by 5.7% compared to the previous year, a pace not seen since before the Great Financial Crisis (GFC)-induced rate crash in 2008. On the high side of that mark, Am Law 100 law firms grew their worked rates by a startling average of 7.3%, a pace not matched even prior to the GFC. For their own part, Midsize law firms – typically far more reserved in pushing higher rates – grew their worked rates by 5.1% at the end of 2022, a full 1.3 percentage points higher than even six months prior.

The average law firm grew their worked rates by 5.7% compared to the previous year.

That law firms were able to push through these kinds of increases is indicative of a couple of realities: First, law firms have gotten more aggressive in seeking rate increases in the post-pandemic era; second, clients appear to be more willing to agree to rate increases. The first conclusion is evident from the chart – if law firms weren’t pushing for the increases, clients wouldn’t be agreeing to them. The second conclusion can be inferred from the very nature of the increases. The rates reflected in the above chart are what are known as worked rates – the rates clients agree to pay to engage a law firm on a new legal matter. In order for worked rates to be growing at the pace they have been, clients necessarily would have needed to agree to such increases.

With new high-water marks set, it seems likely the legal industry is potentially set for a period of sustained higher rate growth, if not continuously accelerating rate growth. After all, if law firms were successful in pushing through notably higher rates in 2023 compared to 2022, what factors in the market would lead to a conclusion that firms would not be similarly successful pushing rate increases going forward?

To answer that question, we must examine a few realities from the clients’ perspective.

According to the “2023 Legal Department Operations (LDO) Index,” 70% of corporate law departments report higher matter volumes than a year ago. At the same time, 66% of clients report their internal law departments have flat or decreasing budgets, and 65% report their in-house attorney head count is similarly flat or declining. While 43% of clients said they expect to bring more work in-house in the coming year, it is evident corporate law departments are facing capacity challenges. The constant push to do more with less has put these law departments in a bind. Perhaps as a reflection of this reality, some 47% of corporate general counsel reported they expect their spending on outside legal counsel to increase in the coming year.

The pricing conundrum

All of this would seem to be pointing to a potential future boom for law firms. Yet, it’s possible that at least some firms will find themselves in a bit of a conundrum.

Hiring a law firm is an expensive proposition. Given the current pace of rate increases, it is likely to become an even more expensive proposition very quickly. And while increasing the rates they charge is a vital component for law firms looking to boost profitability, it is not without risk.

One component of the risk that law firms run is the reality of what economists call price-demand elasticity. At a basic level, price-demand elasticity can be explained as the idea that the more expensive something gets, the less of it people will want to buy. The legal profession seemed to be largely immune from the effects of this economic rule for most of the 2010s. Am Law 100 law firms were the most expensive, then got even more expensive faster than any other segment of law firms. Yet demand for their services grew faster than any other segment from 2016 through 2021.

It seems likely the legal industry is potentially set for a period of sustained higher rate growth.

That immunity may be waning, however. Recent data from the Thomson Reuters Institute shows a distinct and prolonged trend of demand mobility. In essence, Am Law 100 law firms have been losing market share – as reflected by contracting demand – while Midsize law firms have been growing their demand. Through the middle of 2023, Am Law 100 law firms’ demand contracted by an average of 0.6%, while Midsize law firms’ demand grew by an average of 2.8%. Indeed, this pattern has persisted for more than 18 months at this point.

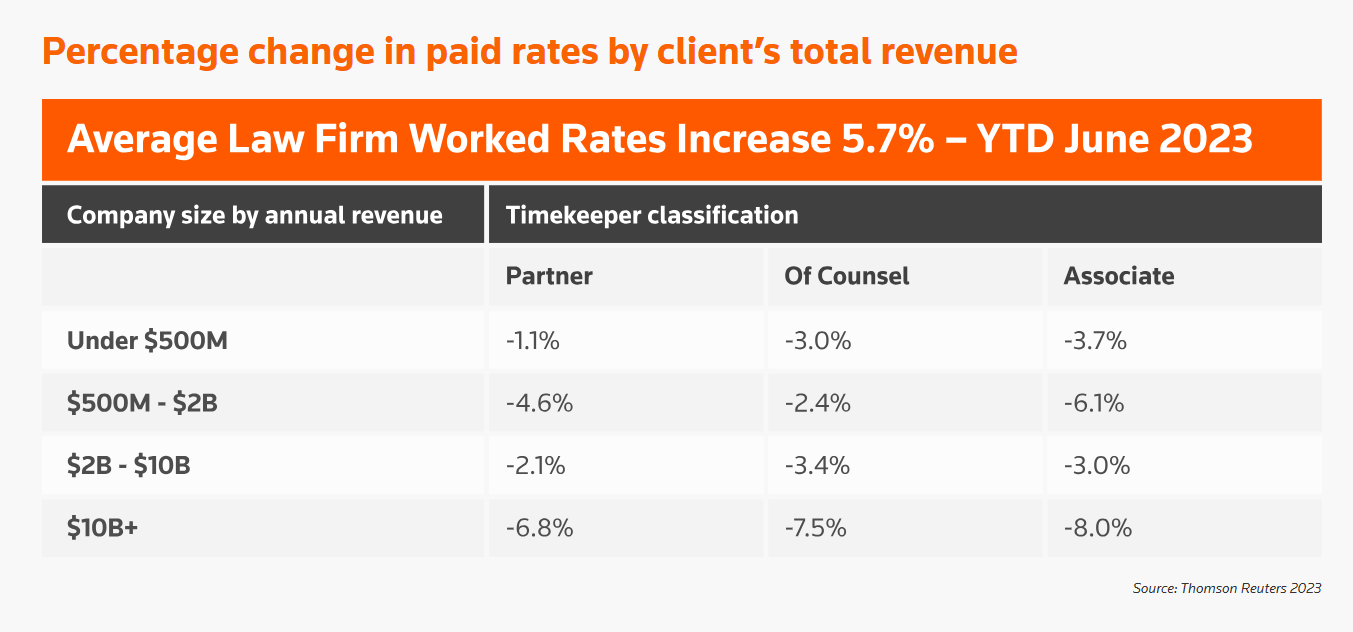

And it’s also paying dividends for clients. While the average law firm’s worked rates have grown by 5.7%, the average client has actually seen their effective average rates decrease.

Despite strong rate growth on the part of law firms, clients (regardless of their size) have managed to shrink the rates they pay across all timekeeper types by shifting, or tiering work to lower-cost providers. In fact, according to the “LDO Index,” some 50% of corporate general counsel report that moving work to lower-cost law firms will form a significant part of their cost-control strategy in the coming 12 months.

Notably, lower cost is not synonymous with cheap – a law firm can be comparatively lower cost than a competitor firm while still commanding impressive rates. However, such a message should cause some discomfort among law firm leaders.

What can law firms do?

This highlights another portion of the law firm pricing conundrum – specifically, what can law firms realistically do about it? It seems unlikely that law firms will voluntarily slow the pace of rate growth. It has proven to be successful, and speaking to many law firm leaders, few firms have experienced an outflow of demand mobility to a degree that it makes them feel as though something needs to change. By contrast, a firm that is seen as less aggressive than its peers in growing rates may face potentially devastating reputational damage if such a strategy is not carefully managed and messaged.

And yet the reality remains that clients are voicing a desire for greater cost-effectiveness. So, what is a law firm to do?

First, law firms and their pricing teams must work hard to ensure that the money conversation focuses not on price, but rather on the value delivered. When asked about increasing rates, clients typically respond that for all but a few firms, rates definitely make a difference in whether or not that firm is hired. However, every client has a few select firms with which money seems to be no object due to the overall value delivered. This can be a factor of the timeliness or quality of outcome, the particular lawyers staffing matters, ancillary benefits the client receives in the form of legal technology consulting, or a host of other options that vary widely by client. It is incumbent on those law firms wishing to achieve the status of a valued partner to ask which of those factors the client most values and then deliver on those.

Hiring a law firm is an expensive proposition. Given the current pace of rate increases, it is likely to become an even more expensive proposition very quickly. And while increasing the rates they charge is a vital component for law firms looking to boost profitability, it is not without risk.

Second, law firms should be closely monitoring their position in the market relative to their peers. Law firms do not want to find themselves in a position where they are grossly overpriced for their market, nor do they want to fall too far behind, such that they later feel a massive push is needed to correct for years of underperforming rates.

Finally, law firms must be diligent and strategic in their messaging to clients. We’ve already discussed the need to focus on value, but firms should confront head-on the reality of clients seeking lower-cost options.

For those firms that already enjoy a price advantage from offering lower rates, it is important to highlight not only the lower price, but the fact that the client will not experience any dilution in quality for making the switch.

For higher-priced law firms, the messaging is trickier. However, lower cost does not necessarily mean cheap. And there are additional costs involved with switching law firms, working with firms with slower cycle times, and losing the opportunity to work with experienced legal operations teams – all of which could be borne by a client switching firms for the sake of lower rates.

Whatever the added costs may be, law firms that cannot compete solely on price still have the ability to compete on cost if they can stake out ground in which they have the advantage.