How can corporate law department leaders best bring down their overall costs while demonstrating their department's value to company leadership?

In the 2023 State of the Corporate Law Department report, we noted an interesting finding. Controlling costs was an important priority for corporate general counsel in every region of the globe. But in the U.S., it was the top priority, making the U.S. somewhat of an outlier. That’s not to say that the ranking of cost control by U.S.-based GCs is problematic. Quite the contrary, it’s understandable. However, it does raise some questions.

Why the focus on costs in the US?

Why does controlling costs rank higher on the list of priorities for U.S. GCs? There are likely many possible explanations. The U.S. tends to be a more litigious society than many other places, which will naturally raise the cost of outside representation. Law firms in the U.S. typically have higher rates than some of their global counterparts, meaning the companies hiring those law firms may face higher fees.

It’s also notable that cost control makes the list of top 5 priorities in every region of the globe, supplanted in some cases by compliance concerns, another understandable finding given the proliferation of regulations around the world. The U.S. has yet to enact regulations similar to other global governments on topics such as environmental, social & governance (ESG) issues or data protection, meaning that advice on how to comply with these regulations for many U.S. companies is still theoretical given that regulations aren’t yet in place. The slightly higher ranking of cost control by U.S. GCs is likely a combination of these factors and more.

The next logical question is, however, what are U.S. GCs doing in their effort to rein in their departments’ budgets?

This, too, has a multifaceted answer.

What GCs plan to do about costs

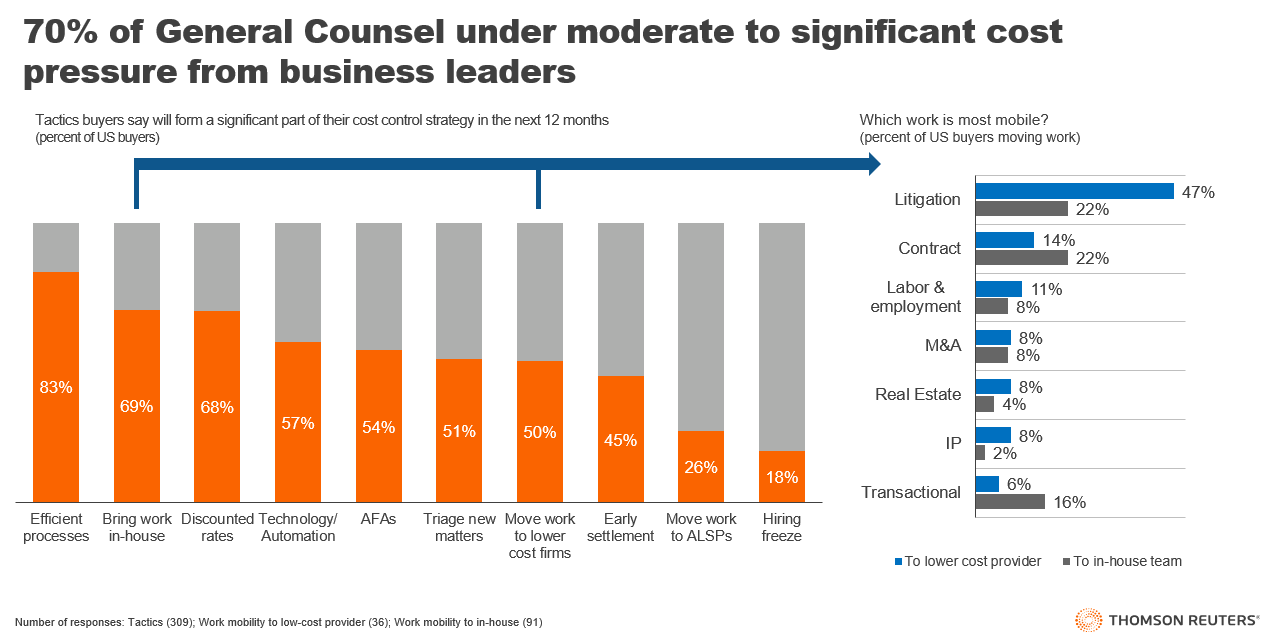

For the vast bulk of GCs, a key cost control strategy revolves around becoming more efficient. GCs face the same do more with less pressure as the broader businesses which they serve. For many corporate law departments, this means facing increasing matter volumes with flat budgets and staffing — in some cases even fewer staff and smaller budgets. As a result, department leaders have to find ways to get the most productive work out of each member of the team and that means looking for efficiencies.

This is especially important given the second most-frequently cited strategy, that of bringing more work in-house. If businesses are to successfully bring more work in-house, especially if staffing levels will not be increasing, the team within the law department has to be empowered to get the most out of their working hours.

GCs are also looking to heighten the expectations they have for their outside counsel. More than two-thirds of GCs (68%) report anticipating increasing the pressure they put on law firms for discounted hourly rates. This is unsurprising, and exactly what form such pressure will take remains to be seen. Recent data from the Thomson Reuters Institute shows that worked rates — the rates clients agree to pay to engage new matters — increased by an average of a sharp 5.9% in the second quarter this year, with the average Am Law 100 law firms growing worked rates in excess of 7% over the same time last year. Bear in mind, this does not refer to the rates the law firm is requesting, this reflects the rates to which clients are agreeing.

Some of the pushback may come, not at the point of matter engagement, but rather at the point the client is invoiced and has to pay the bill. Since the middle of last year, every law firm segment tracked by the Thomson Reuters Institute has seen a decline in the realization of their worked rates, with clients paying a decreasing percentage of the amount they initially agreed to pay. A good deal of this is due to behavior by the law firms themselves, but one cannot rule out the possibility that clients will look to greater billing enforcement and invoice-discounting as a way to bring their own costs down.

Clients are also looking to potentially increase pressure on law firms to offer alternative fee arrangements (AFAs). The term AFA means different things to different people and there is still disagreement in some circles as to whether discounted hourly rates constitute an AFA. In my opinion, they do not. And I would wager the survey respondents would agree, given that discounted hourly rates were covered under a separate response option.

Clients looking for options

The results indicate that clients will be looking for more options along the lines of capped or fixed fees, matter budgets, phase pricing, and possibly even subscription pricing models. The last major surge in AFA usage occurred following the financial crisis of 2007- ‘08. It would not be a surprise to see another uptick in interest during another period of economic upheaval, especially now that the industry has another decades’ worth of experience with AFAs and far more subject matter experts are now employed by many more law firms, which should hopefully instill greater confidence in the use of AFAs and create a greater range of new options.

We also cannot overlook the fact that 50% of respondents said that they plan to move work to lower cost law firms. It is hard to overstate the significance of this finding: Half of GCs surveyed specifically said they would be seeking out lower cost law firms.

For these lower-cost firms, there should now be an enhanced sense of urgency to create differentiation as a way of hopefully winning some of this new-to-me work. For higher-cost firms, this will likely serve as a call to redouble efforts to communicate the value their firm brings to their clients as a way of highlighting that there is more to the attorney-client relationship than just the fee structure.

We should also note that this does not mean that these clients will shift all or even most of their work to lower-cost law firms. Indeed, some of this shift has already started as was documented in this year’s State of the Corporate Law Department report. This is, however, an indication that the pace of demand mobility within the law firm segment may be about to intensify and will bear close watching for the next year and beyond.