Our recent LDO Index showed that more corporate law departments are facing pressure to keep costs down, and they may have found a way — tiering their legal work

The new season for law firm rates is right around the corner. As the holidays and the end of the calendar year approach, both law firms and their clients are preparing for the inevitable increase in law firm rates. It’s not a question of whether rates will increase, but rather how much rates will increase.

The most recent Law Firm Financial Index from the Thomson Reuters Institute showed law firm worked rates growing at a remarkable 6.3% in the third quarter of this year. That is an incredibly strong performance. By comparison, 2022 was considered a strong rates year, and worked rates finished that year up by an average of 4.7%. We now sit more than one-and-a-half percentage points above that mark.

This is putting clients in a bind. They are under constant pressure to control costs — a difficult task when the largest portion of their budget — outside counsel costs — keeps getting more expensive every year. Many in-house legal professionals, both general counsel and legal operations teams, say that they would like to bring more work in-house as a means of controlling costs. However, as our recently published 2023 Legal Department Operations Index found, most law departments are facing increasing matter volumes with flat to declining budgets and headcount. This raises serious questions about their ability to absorb a greater share of an increasingly heavy legal workload.

If reducing reliance on outside counsel is unlikely to accomplish the goal and outside counsel costs keep increasing, what is a client to do? Many clients appear to have landed on an answer — tiering their legal work.

This is not a new strategy. We reported in the 2022 Legal Department Operations Index that, even as law firms continued to raise rates, many segments of in-house law departments had been able to find effective ways to save on higher rates. The theory to explain the change at the time was a shift in work from higher- to lower-cost law firms.

Evidence throughout 2023 has borne out that this, indeed appears to have been happening to an appreciable extent.

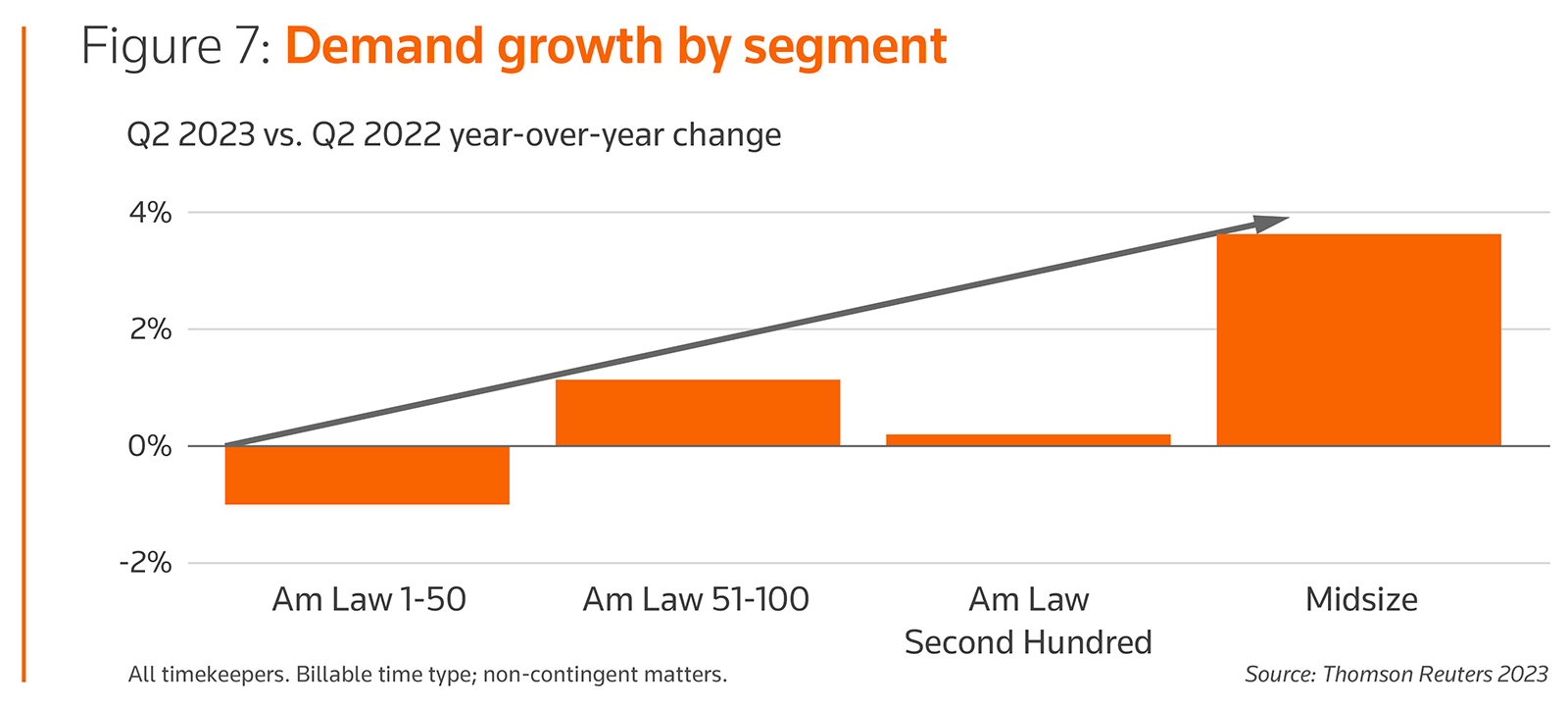

There has been a clear shift in demand for law firm services from larger law firms toward midsize firms — a trend that has been going on for more than a year. As a result, cost savings for clients have added up.

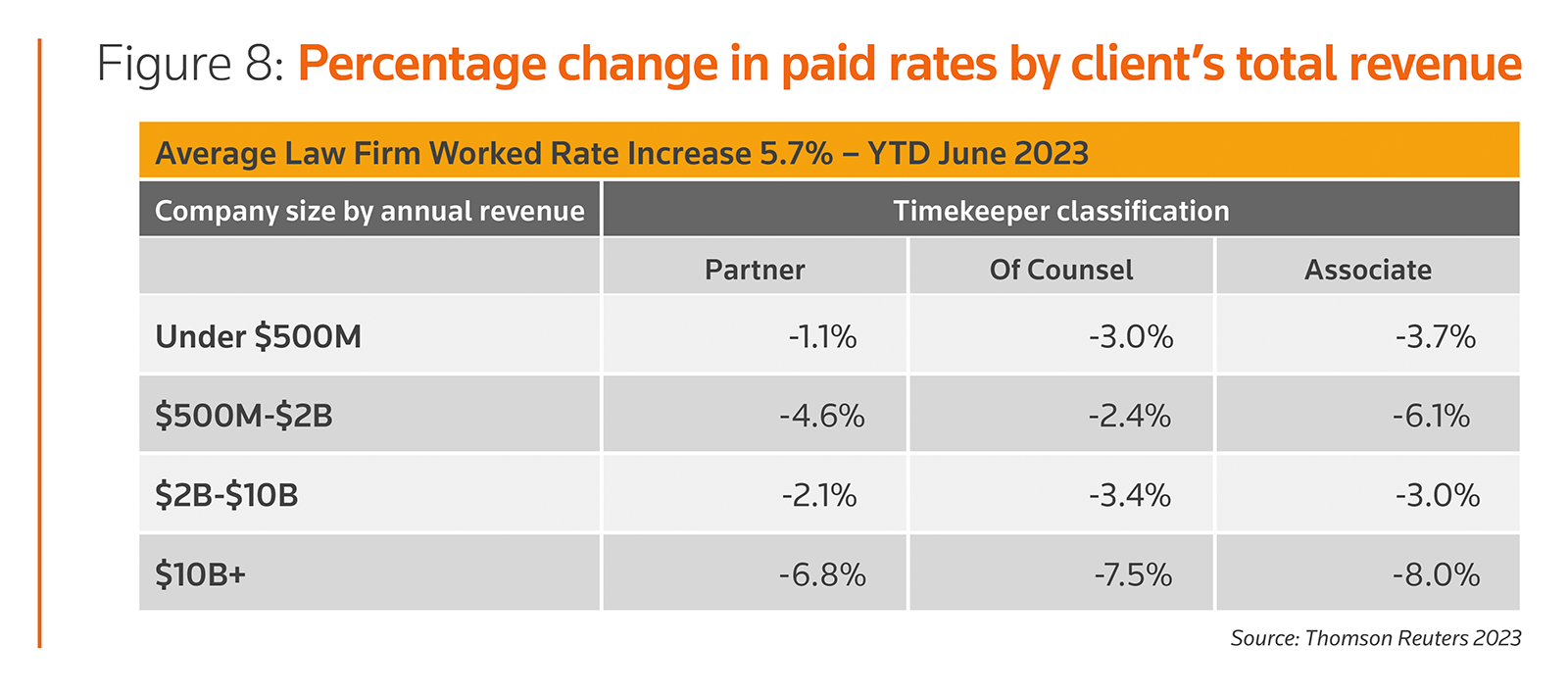

As of June 2023, average law firm worked rates had grown by 5.7%, a pace since eclipsed in the most recent quarter. Yet even as law firm rates grew, the effective rates paid by clients actually contracted. In fact, every size-segment of corporations paid effectively lower rates across all timekeeper classes. These two results seem diametrically opposed and yet the data are clear — both are happening. But how can this be?

It may be easiest to explain by analogy. Assume a family owns two cars. One takes only premium gas while the other runs on regular. The cost of both types of gas can go up, and the industry can rightly report on the increasing cost per gallon of gas. Our hypothetical family, however, can realize savings-per-gallon by simply driving the premium-only car less. Every gallon of regular gas substituted for a gallon of premium is a net savings to the family. The increase in the cost of the gallon of regular gas is less material because to the family, it’s still cheaper than what they had been paying. The family can continue to realize and even increase their cost savings in this way up to the point they stop driving the premium-only car altogether or the cost of regular gas catches up to premium — both unlikely events.

The same holds true for corporate law departments. They can continue to realize cost savings via tiering work out to more cost-effective law firms. Note carefully, cost-effective is not synonymous with cheap. There is certainly crossover between those terms, but even a relatively expensive law firm can be cost-effective in comparison to its peers, based on the quality of work product, the general favorability of outcome, the speed of matter resolution, or the many value-added benefits it brings to a client relationship.

It seems likely that 2024 will bring with it continued high law firm rate growth. At the same time, clients show no signs of easing up on their cost consciousness. Law firms that fail to convey the value they deliver risk appearing expensive, increasing the likelihood they’ll be on the downside of a tiering trend in legal work that clients seem poised to continue.

And for clients, the benefits of tiering are clear, and it seems likely they’ve only scratched the surface of just how they can leverage it to their advantage.