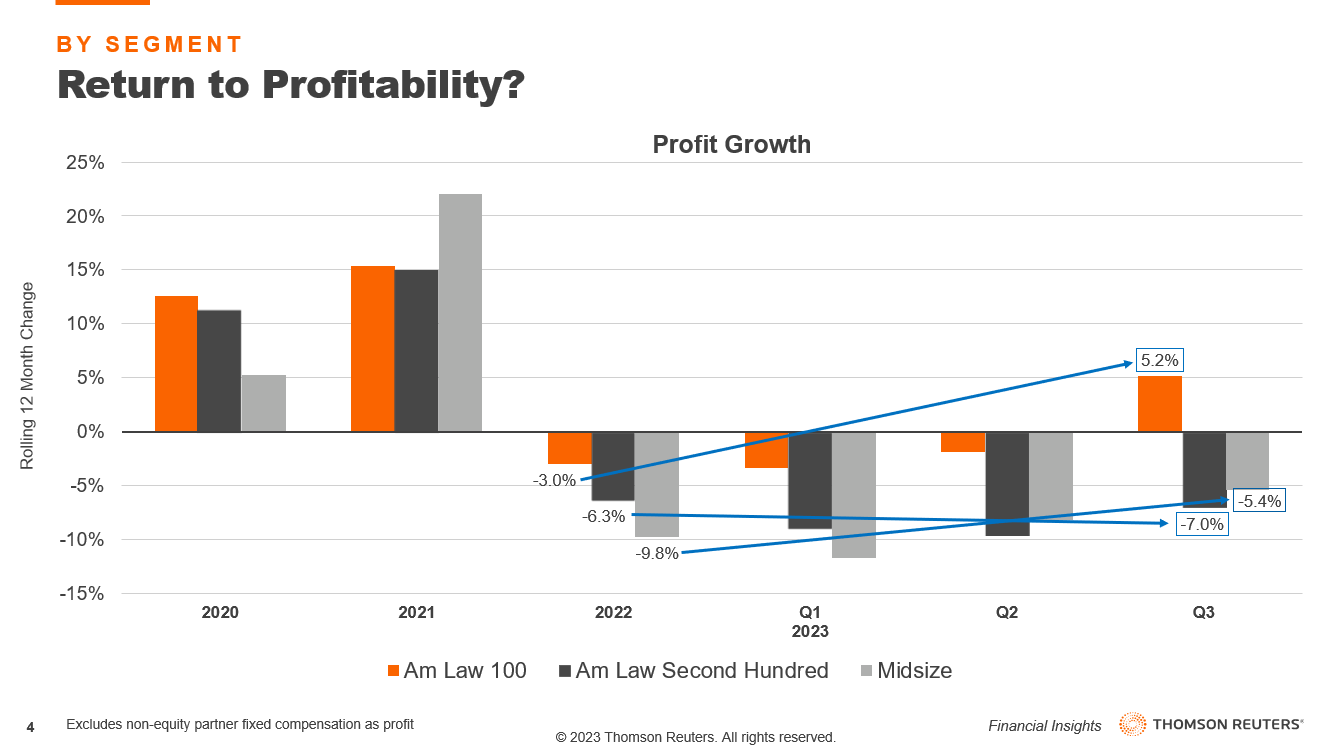

In the recent LFFI report, we see how the largest law firms that make up the Am Law 100 are leading the way as the legal industry tries to return to strong profit growth

In the third quarter of 2023, firms within the Am Law 100 were the first group to return to profit growth since Q2 2022 and played a significant role in the Thomson Reuters Institute’s Law Firm Financial Index (LFFI) remaining at its current six-quarter highwater mark of 50 points.

In fact, by the end of September, firms in the Am Law 100 saw their profits increase by 5.2% on a rolling 12-month basis, up from a 1.9% contraction at the end of June. This rapid improvement was driven by a multitude of factors including historically high-rate growth and greater cost controls from both an aggregate and per-lawyer basis. The combination of these positive metrics demonstrates that, despite uncertain macroeconomic conditions remaining an ever-present threat, the outlook for law firms in this segment will be generally positive going into 2024.

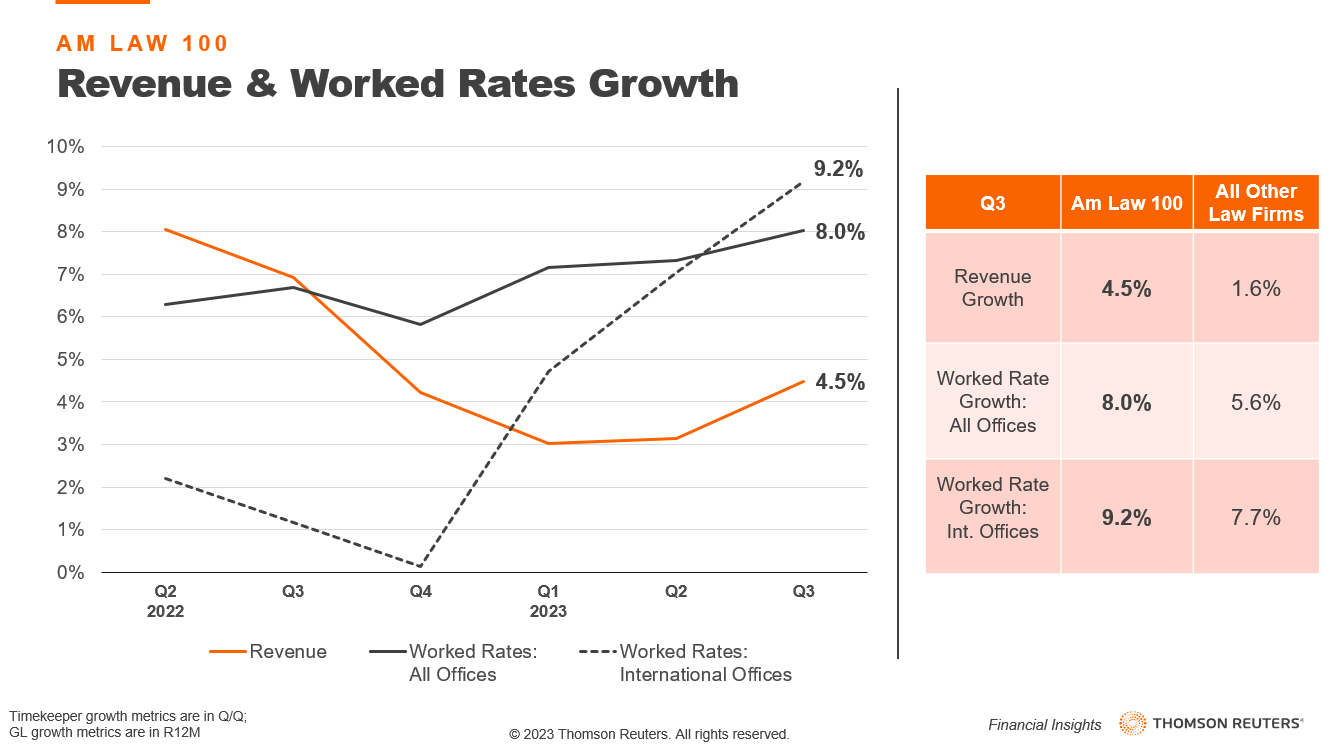

A key reason for this positivity comes from the segment’s incredible 8.0% worked rate growth in Q3 which helped increase the segment’s revenues by 4.5%. Indeed, both figures lead all large law firm segments.

The greater international presence of these firms compared to other firm segments also has proven to be beneficial as a result of favorable currency conversions, with an average worked rate growth of 9.2% in Q3 compared to a 7.8% growth in just their United States offices. Overall, however, the unstable geopolitical and economic environment within which Am Law 100 clients are currently operating may have led to a heightened willingness to pay more for the decreased risk exposure these rarified law firms offer.

Due to this, as law firms make their price decisions for 2024, many may decide that they actually left money on the table, per billable hour, despite the elevated rate hikes they implemented and held onto from the start of the year.

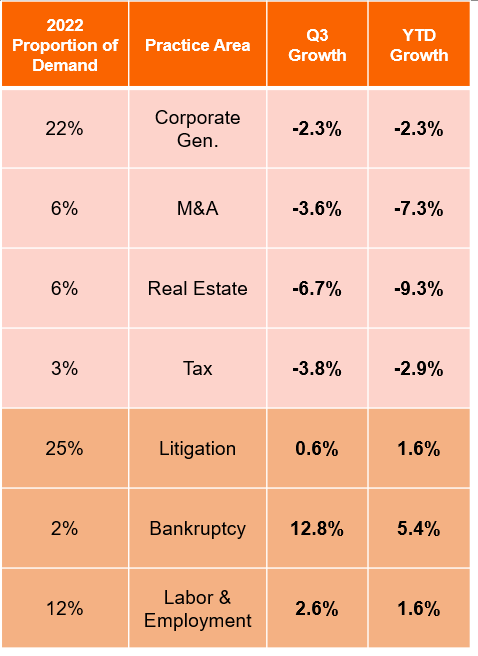

Working somewhat against these aggressive rate hikes has been cooler demand in 2023, especially in transactional practice areas where Am Law 100 firms saw a 3.2% decline (firms in the top 50 saw an even worse 5.2% decline) compared to Q3 2022. Although elevated interest rates have, so far, not led to the broader business cycle contraction many predicted at the start of the year, there has been a general pulling back of deals at the top end of the market as liquidity dries up.

Higher costs for borrowing have led to declines in legal demand in several practice areas, including a drop of 2.3% for corporate (general), 3.6% for M&A, 6.7% for real estate and 3.8% for tax work in Q3 2023. With Am Law 100 firms much more weighted towards these more interest rate sensitive practice areas, the threat of the Federal Reserve leaving its target interest rate “higher for longer” poses a significant obstacle for, at a minimum, the first quarter of 2024.

Fortunately, demand for transactional work has improved between Q1 and Q3, suggesting that demand in this area may have bottomed out already. Additionally, demand for counter-cyclical work, like bankruptcy and labor & employment, has boosted law firms’ overall demand figure and has been enough to support the much-improved growth in revenue mentioned above.

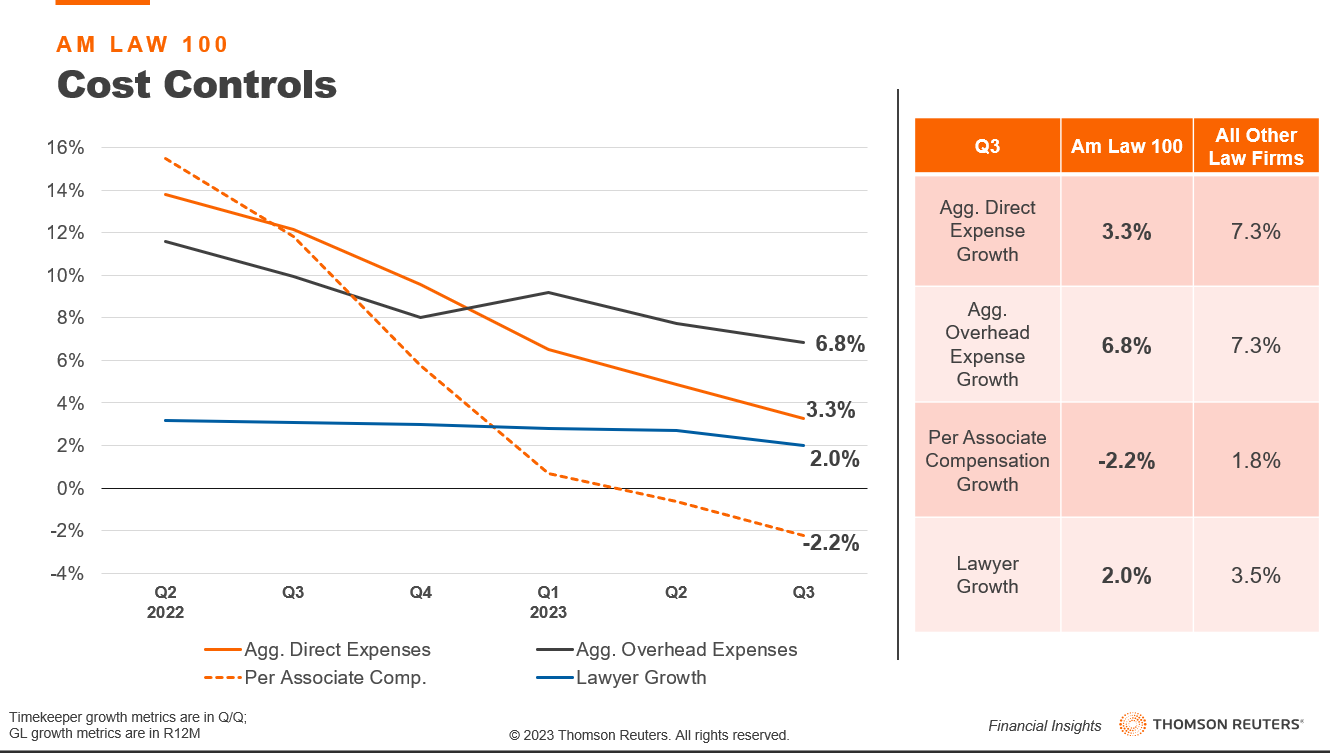

From a cost perspective, Am Law 100 firms have made a substantial effort to control their aggregate expenses by slowing their hiring, along with targeted layoffs. In September, when firms usually begin hiring a new class of first-year associates, we saw that firms in the Am Law 100 decreased their average first-year associate class size by 16.5% compared to their class average of 2022 and 2021.

This reluctance to take on a large new class during a more demand-tightened environment led to a muted 2.0% growth in overall attorney headcount in Q3. Over the course of 2023 we have also seen firms, specifically those within the top 50 of the Am Law 100, gradually shrink their headcount from January’s peak. From the start of the year, in fact, the average firm in this group has shrunk its overall associate ranks by 1.3%. Compare this to Am Law Second Hundred and Midsize firms that have grown their associate headcount by 3.7% and 8.2%, respectively, over the same time frame.

In tandem with controlled hiring has been a push to keep attorney salaries more stable, which have only increased by 0.4% over the last 12 months. As a result, aggregate direct expense growth in Q3 fell to 3.3%, a massive improvement from the 12.1% growth firms in the Am Law 100 were experiencing at the same time last year. The main reason for this rapid improvement has been the segment’s control on associate compensation. Through the first three quarters of 2023, per associate compensation fell 2.2% from the same time last year, meaning that that the largest portion of direct expenses is shrinking from both headcount and per-head cost perspective. Both of these metrics are positive, at least from a balance sheet perspective, but there remains at least one more month in the legal industry’s traditional hiring season which could push aggregate direct expenses higher, and, of course, we have yet to see the level of bonuses which are to be distributed.

Contrasting the improvements seen in direct expenses, however, have been much more sticky overhead expenses which have, on an aggregate basis, increased by 6.8% on a rolling 12-month basis. Although this was an improvement from the 7.7% overhead growth seen in Q2, multiple factors may continue to hold these expenses at an elevated level. One of those factors will be inflationary pressures on core overhead expenses — such as support staff compensation, benefits, occupancy, technology, and knowledge management costs. These expenses make up roughly 70% of Am Law 100 firm’s total overhead spend, are much more stable categories of expenses, and are currently accelerating in growth. Another major factor that may hold overhead higher will be return-to-office expenses — such as office expenses, marketing & business development, and recruiting — which in total were growing at 14.0% as of September.

As mentioned earlier, the combination of these metrics has resulted in firms in the Am Law 100 segment growing their profits by 5.2% in the third quarter. So far, these firms’ cost-conscious focus and decisions on headcount have positioned themselves strongly for the end of 2023 and the beginning of 2024. Looking at just the fourth quarter, this segment’s performance will hinge on hiring decisions in October, how those decisions affect direct expenses, how substantial bonuses will be, how inflation and return-to-office strategies impact overhead costs, and how demand adjusts to a higher interest rate environment.

If trends continue, it seems entirely possible that Am Law 100 firms are positioned for end-of-year profit growth results somewhere in the range of 7.0% to 9.0%. Although firms in Am Law 100 have been the first to return to profit growth and will likely lead the way in performance 2023 as a whole, we can’t say for certain if this strategy will result in better results in 2024 or in the long-term growth that all firms desire.

Only time will bring clarity to the evaluation of such strategies.