While our Law Firm Financial Index showed an incredibly strong performance on rates in the fourth quarter of 2023, delving deeper into the data reveals an even more remarkable story

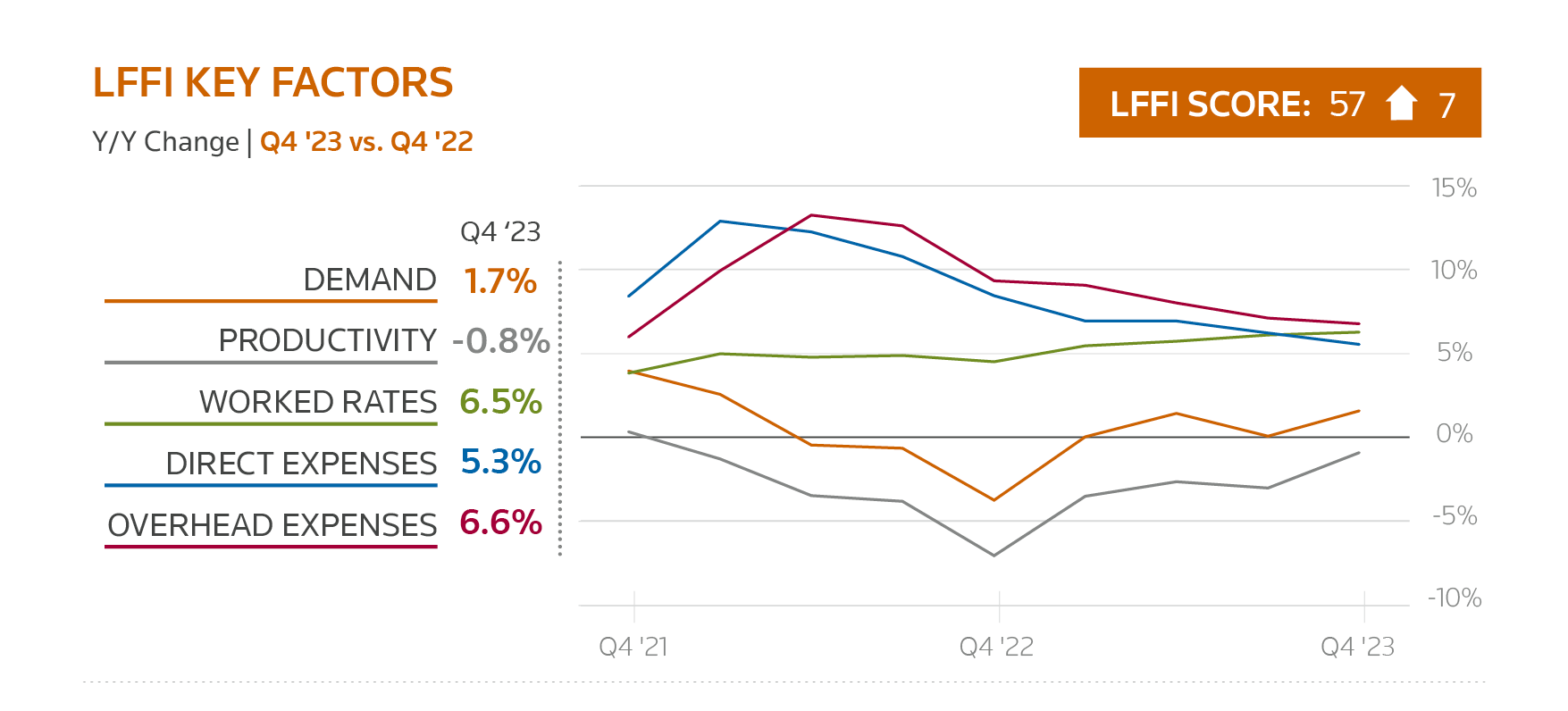

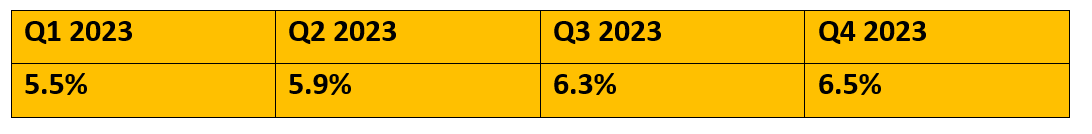

The Thomson Reuters Institute’s Law Firm Financial Index results for the fourth quarter of 2023 showed incredibly strong average rate performance across the legal market. Indeed, the final quarter of 2023 posted average worked (agreed) rate growth of 6.5% compared to Q4 2022, continuing a several-years-long trend of improving rate growth for law firms.

However, the end of 2023 was remarkable for a couple of other reasons as well.

Law firms initially set their 2023 rate cards coming off a year marked by record inflation and an unprecedented inversion of inflation and agreed rate growth. That inversion provided the impetus for law firms to pursue aggressive rate postures at the outset of 2023, but the odd circumstances for rates did not stop there.

Looking at the LFFI Key Factors above there is a very clear trend line that begins in Q4 2022 and continues through the end of 2023. This stands as an interesting comparison to the trendline for rates shown in that same figure for 2022 in which worked rate growth held strong at around 5%, consistently throughout the year.

The trend of continually improving worked rate growth throughout 2023 marked an interesting departure from normal behavior for law firm rates. Some variation is expected, of course. For example, prior years have seen temporary spikes due to peculiar circumstances like currency value fluctuations from international offices of US-based law firms. And while notable, these changes in worked rate performance tend to be very short-lived.

What was odd about rate growth in 2023 was the consistent trajectory rather than temporary variation. In fact, by the end of 2023, the average law firm posted worked rate growth a full percentage point higher than the start of the year.

Is this an indicator that law firms were engaged in a new practice of mid-year rate changes? It’s possible, but unlikely.

Setting a new law firm rate card would require its own set of negotiation and agreement between law firm and client, a process typically only done once per year. A large number of lawyers are incredibly reticent to approach clients with rate changes at all, let alone asking for additional rate increases mid-year or perhaps several times in a year.

Changing the ways of negotiating

The more likely explanation lies in the nature of what constitutes worked rates — simply, they are a representation of an agreement between outside law firms and their corporate client on what the client will agree to pay for an hour of a lawyer’s time. Further, the pace of growth in rates can be influenced by either the buy-side or the sell-side without changing the underlying standard rate structure but rather by changing negotiation strategies. If a law firm offers, or a client asks for, a smaller discount, for example, it will positively impact the pace of worked rate growth.

Yet, that doesn’t necessarily mean that clients aren’t concerned about rate increases — they most definitely are. It may, however, mean that clients may have realized sufficient short-term cost savings as a result of moving work to lower-cost law firms, leaving them less concerned about pushing for additional discounts.

Let’s use an analogy to illustrate. If I buy a name-brand product at a grocery store, I may be aggressively clipping coupons to save money on that purchase. If I opt, instead, to switch to a different brand that already provides a significant cost savings, I may spend less time clipping coupons because I’m already realizing significant benefits from my switch.

Data from the Thomson Reuters Institute’s recent 2024 Report on the State of the US Legal Market shows that the pattern of demand mobility was still in full effect in 2023 as work migrated from larger law firms into the Midsize law firm segment. As clients realized greater cost savings from increasing the proportion of their work done by lower cost Midsize law firms, they may have felt less compelled to push for steeper discounts with their larger legal providers because clients had found another way to meet budgetary priorities.

The trend of continually improving worked rate growth throughout 2023 marked an interesting departure from normal behavior for law firm rates.

Of course, there can also be shifts on the law firm side to positively impact the pace of worked rate growth as a function of negotiation strategies. For example, many law firms have adopted policies allowing for a certain threshold discount that lawyers are allowed to offer before they are required to seek approval from firm management. In fact, many firms have adopted a 10% discount threshold. Yet, if the firm were to adjust that threshold amount — perhaps tweak it downward to 9.5% instead of 10% — or if a smaller proportion of the firm’s matters have the full discount applied, there will be a net positive impact on the firm’s average worked rate performance as well.

It is likely that all of these factors and more were in play in 2023, which certainly made it an odd year for law firm rate performance.

Now as we move fully into 2024, early indications are that many law firms will continue to be aggressive in pushing worked rate growth. Naturally, there are a few different fundamental factors that may impact whether the trend of continuous worked rate growth marches on or if it falls back. Notably, the inflationary environment that many firms relied on to support early-2023 rate increases has stabilized; therefore, clients may be less receptive to inflation-based arguments in 2024. Also, clients may have realized the immediate cost savings of adjusting their portfolio of work and then adjusted their budgets accordingly and will now return to discount-seeking behaviors as a means of further budget advantages.

That is not to suggest that worked rate growth in 2024 will move into negative territory such that law firms will charge less this year than last year. However, the pace of rate growth — and in particular, the trajectory of rate growth — while likely still strong, may be more tempered in 2024.