Midsize law firms seem to be walking the balance between growing demand and sustaining staffing levels quite well, our analysis shows

Entering the second half of the year, many midsize law firms are well positioned to take advantage of busier times ahead, or so they hope. The recent 2022 Report on the State of the Midsize Legal Market from the Thomson Reuters Institute reflected on areas of strength in the midsize legal market such as demand growth, but it also addressed more nuanced areas like productivity where the market saw average hours per lawyer shrink by slightly less than five hours when compared to the same time last year.

Despite this contraction, however, it seems that midsize firm leaders have leveraged themselves to meet growing demand by choosing to sustain staffing levels. Evidence of this alignment can be seen when we look at demand leverage and full-time-equivalent (FTE) leverage.

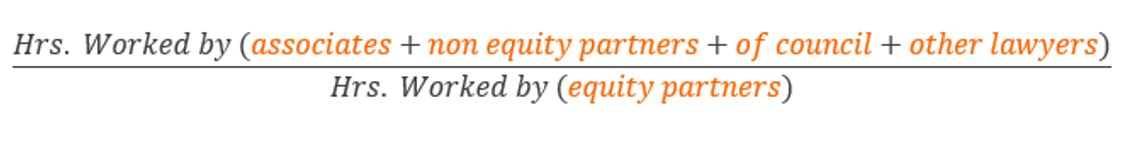

For the purposes of this blog, demand leverage is defined as the sum of hours worked by non-equity partners, associates, of counsel, and other lawyers divided by the sum of hours worked by equity partners. In other words, this formula tells us how many hours that all other lawyers (excluding equity partners) work for every one hour worked by an equity partner.

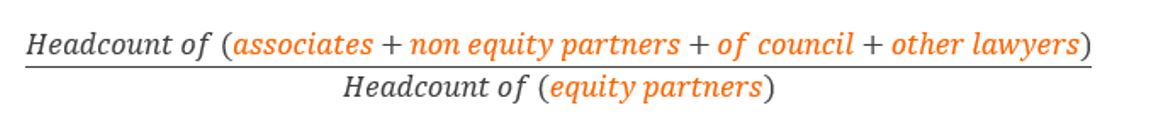

FTE leverage, on the other hand, analyzes headcount. It tells us how many lawyers (excluding equity partners) are employed for every one equity partner.

FTE leverage, on the other hand, analyzes headcount. It tells us how many lawyers (excluding equity partners) are employed for every one equity partner.

Ideally, demand leverage should be greater than FTE leverage. One reason for this is that equity partners’ additional responsibilities, like building client relationships and networking, are more likely to shift their focus away from billable hours, while lower-ranked attorneys can strive to be as productive as possible.

Ideally, demand leverage should be greater than FTE leverage. One reason for this is that equity partners’ additional responsibilities, like building client relationships and networking, are more likely to shift their focus away from billable hours, while lower-ranked attorneys can strive to be as productive as possible.

In theory, the more time equity partners devote to those additional responsibilities, the more demand a firm generates; meaning that a higher ratio suggests partners are putting time in drumming up new business and growing the firm, rather than simply billing hours at a higher rate. Beyond that, when demand is growing, the gap between these leverages becomes especially important because it correlates well with profit margins. By pushing work down to less expensive lawyers, demand leverage increases, and revenue grows relative to stable direct expenses. Essentially, when a firm’s lawyers bill more hours than their equity partners it means they are adding further revenue to the “profit-pie” in which equity partners partake at the end of the year.

Another reason why these types of leverage are so important is that they can give an indication of how well-prepared law firms are to meet future growth in demand. While in the short-run firms have incentives to cut excess capacity (i.e., underutilized lawyers), this can come back to bite firms later. Hiring lawyers is not a quick proposition; consequently, firms that cut headcount for short-term concerns risk finding themselves with a lack of capacity to meet client needs once demand returns.

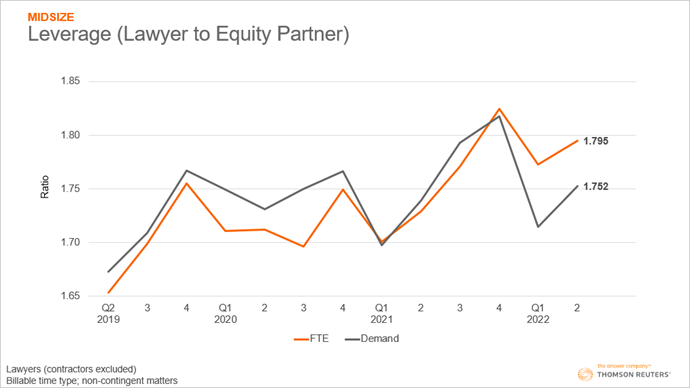

This battle of concerns has played out over the last few quarters with the balance between demand leverage and FTE leverage reversing recently in the midsize segment.

As the chart demonstrates, FTE leverage surpassed demand leverage in Q4 2021, with a wide gap remaining throughout the year thus far. Admittedly, part of this widening can be attributed to seasonal trends. Equity partners often join firms in the first quarter, and other lawyers often leave firms at the same time. However, this seasonal trend does not account for the scale of this year’s disconnect. Potentially, the main reason for this imbalance was fear of heightened associate attrition and the risk of repeating the post-2008 under-capacity blunder in which the average law firm cut associates by 10% during the Global Financial Crisis. Then, when demand returned, firms found themselves unable to hire attorneys back quickly enough to keep pace.

Fear of repeating that past mistake and having to pay the increased salaries required to lure back experienced associates likely contributed to the decision of today’s firms to hold onto their lawyers. Indeed, many seem to have opted to weather slowing demand with an eye towards brighter times ahead.

Data from the second quarter seems to vindicate this decision. The difference between demand leverage and FTE leverage within midsize firms started trending towards a more normal state as demand leverage grew, equity partner attrition resumed, and newly hired associates began contributing in a more productive way.

Yet despite midsize firms experiencing a negative difference — in fact, the largest gap of all the segments we tracked — they still ended the first half of the year with the smallest YTD productivity contraction compared to their Am Law peers. Productivity shrank by only 1.8% at midsize firms compared to an all-firm average of 2.3%. Although this figure may be explained by midsize firms’ FTE growth being the slowest of all the segments, the gap between FTE and demand leverage suggests that lawyers still have plenty of room to grow and midsize firms will probably contract slower than their larger competitors. If this trend continues, demand leverage is likely to overtake FTE leverage and provide that extra layer of profit discussed earlier.

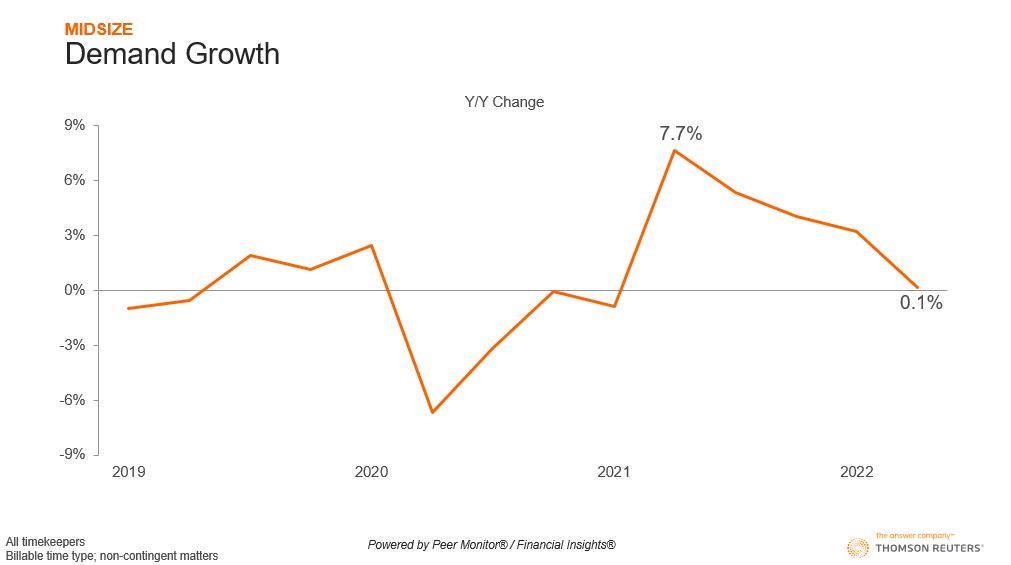

The sticky part of this strategy is that it rests on the assumption, or hope, that demand growth materializes. While on a YTD basis midsize firms did outperform their Am Law 100 competitors in demand growth, the second quarter continued a decelerating slide of four consecutive quarters, ending with a mere 0.1% growth. A reasonable explanation for this unimpressive figure is last year’s growth. At 7.7% year-over-year growth, Q2 of 2021 was one of the largest demand growth rates ever recorded for the midsize segment. And that means the rest of this year has to contend with elevated baselines, which will make it increasingly difficult to justify current FTE levels as demand and productivity continue to struggle.Firms may be looking towards a more demand-rich future as they resist making cuts to their ranks, but they must also understand that this could be a long haul. For now, the gap between demand and FTE leverage looks to be heading towards a more profitable direction, but it should be noted that even if the leverages realign themselves, it doesn’t necessarily mean that the firm will increase profit margins.

Rather, it means if firms grow demand at a healthy rate, they will add additional revenue to the pool from which partners pull at the end of the year. The success of the second half of the year hinges on that “if”, and on whether midsize firms have leveraged themselves properly for the future.