The low hurdles set during the pandemic may be acting like a numerical fog and obscuring our ability to see true trends in today's legal environment, especially around expenses

In the second quarter of 2020, cost-cutting measures related to the global pandemic created low baselines which were reflected in the large law firm market’s dramatic increases in Q2 2021. Both legal demand and productivity surged north of 7%, despite the pandemic failing to abate. Similarly, the rapid growth in worked rates seen during 2020 appeared to begin to slow, also because of the pandemic-altered baseline.

These fluctuating baselines greatly influenced the year-over-year measurements that the Thomson Reuters Peer Monitor Index (PMI) relies upon, thus pressing the index up 22 points (a quarterly record) to a high of 84, an all-time record.

These low baselines have descended upon financial statistics like a numerical fog, obscuring the true trends beneath. In Q2 2020, industry demand fell by 5.9%, yet when shrouded in this mist, this decline takes on the guise of 7.3% growth in Q2 2021. To provide our audience with the necessary illumination to cut through the mire, we began using a “vs. 2019” comparison in our latest report, which eliminates the fluctuating baseline and shows our progression from a more “typical” year.

Within only a year after one of the worst quarters the legal market has seen since the Great Financial Crisis and ensuing Great Recession, the industry has rebounded to within ±1% of its previous levels in terms of productivity and demand, which is welcome news for many industry observers.

By contrast, the worst quarter of demand during the previous crisis was Q1 2009 with 8.2% average contraction — and a year later demand was still contracted below even that point. While we do try to tamp down the expectations associated with a mammoth 7.3% demand increase this quarter, the historical framework still gives us reason to be quite bullish and reflects an industry that was suppressed rather than in recession.

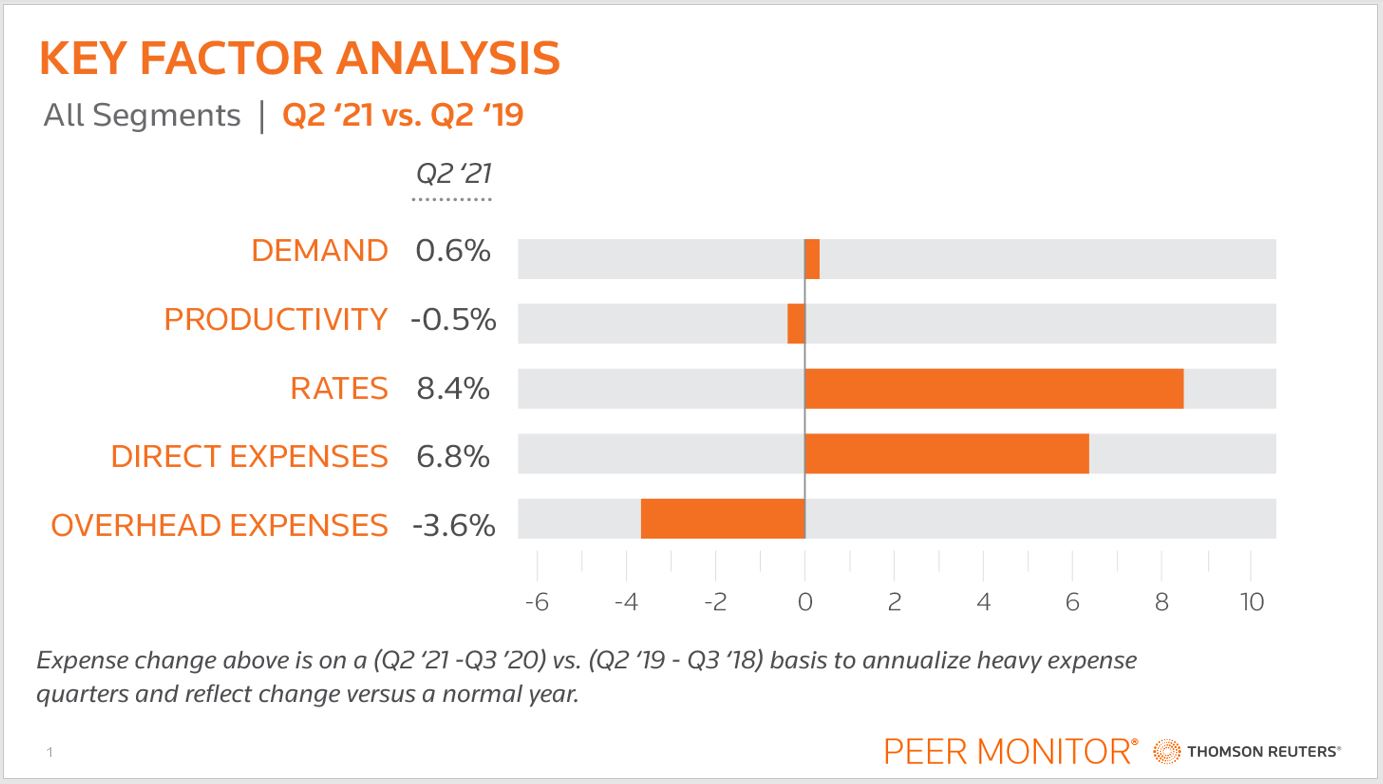

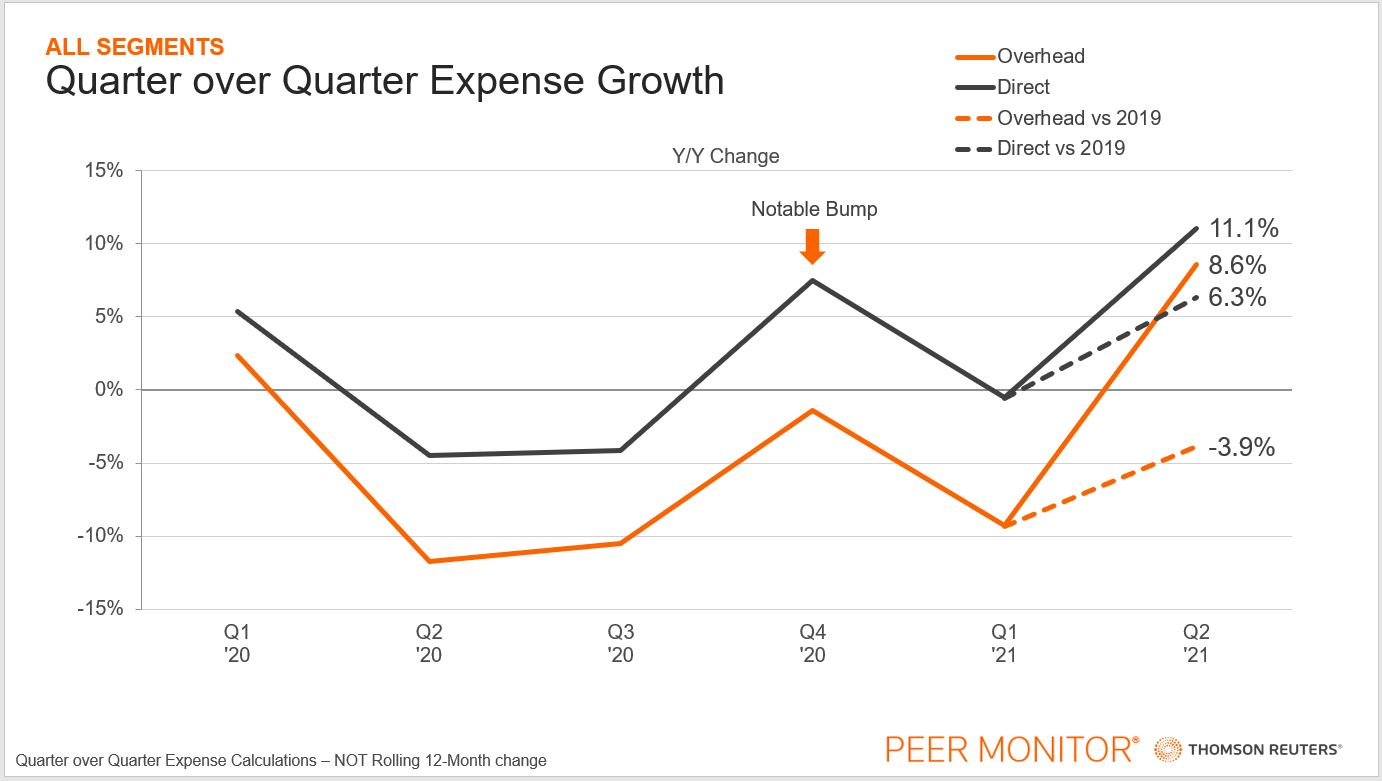

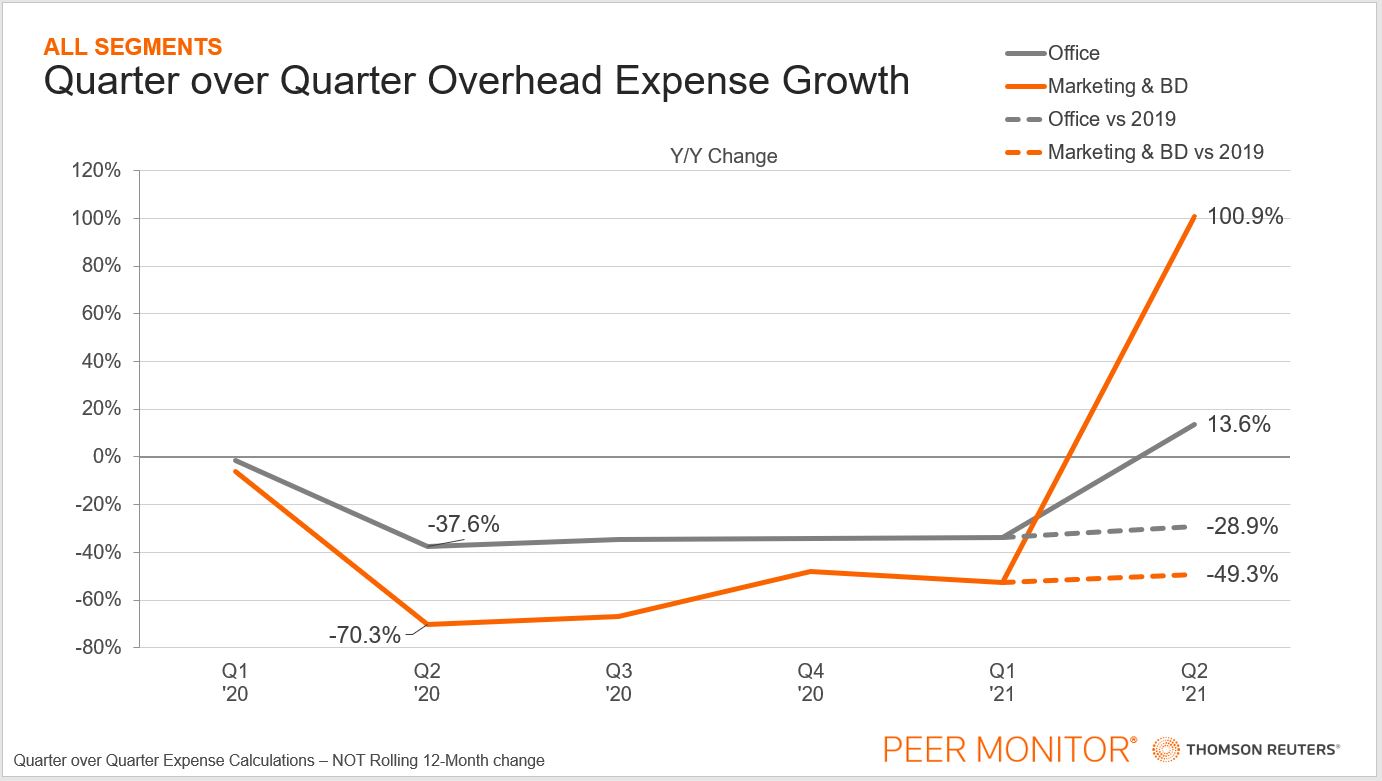

We believe law firms are agreeing with this sentiment once looked at through the right filters, as the market now increasing its investment even more so than high-level statistics may suggest. Our usual method of expense analysis is to utilize rolling 12-month averages, which gives us the ability to cut out noise. These rolling averages are great in stable environments, but the chaos of the pandemic caused extensive interference. The result was that the large reductions to expenditures in Q2 and Q3 of 2020 masked a relative bump in both direct and overhead expenses in Q4. These movements can be seen on just a quarter-over-quarter or Q4 2020 vs Q4 2019 (pre-pandemic) basis, a format typically more prone to noise but in this case being the clearer option.

Direct expense going from a 5% contraction in Q3 2020 to more than 5% growth in Q4 2020 is most likely tied to the large bonuses which resulted from the impressive profit growth by the end of the year. Overhead in that same Q4 still contracted compared to Q4 2019, but the relative shift from being down 10% to down only about 1% is promising. When we added dotted lines to represent how Q2 2021 faired against Q2 2019, we saw overhead’s year-over-year 8.6% growth morph into a metric still down 3.9% on the prior normal year. Direct expenditure shows “real” growth in the sense that the 2019 comparison is still up 6.3% mostly due to the salary increases seen across the marketplace.

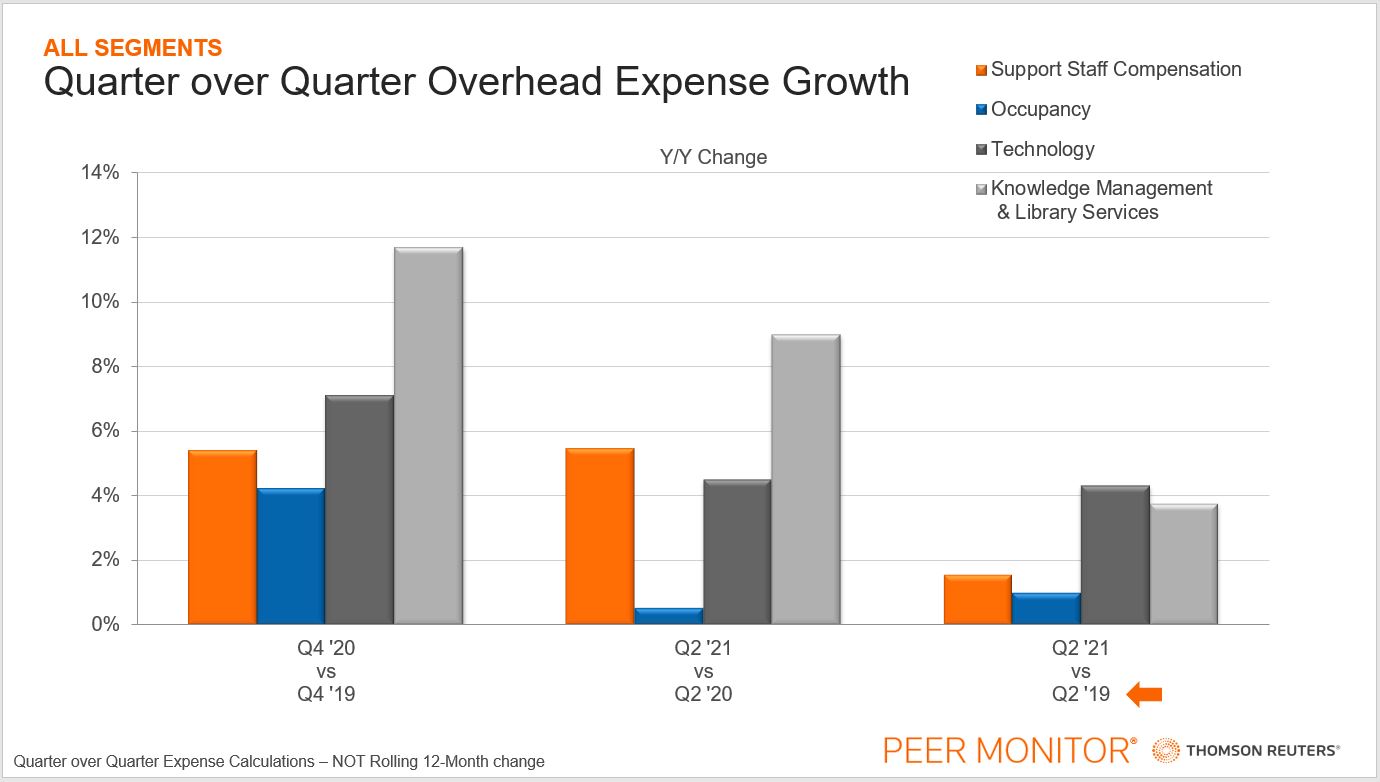

You probably are now asking, why do you think that law firms are investing if overhead is still contracting? The answer is that overhead expenditure is a bucket with various differing expense items, and while as a whole they are contracting, when you dive deeper into these buckets the investment only becomes clearer.

Support staff compensation (34%), occupancy (25%), technology (11%), and knowledge management & library services (5%) made up 75% of all overhead expenses in 2020. These four categories were primary drivers of cost increases that led to the relative rise in Q4 2020, with growth rates among these categories ranging from 4% to 12%. In the figure above, the middle timeframe compares against the pandemic low, and we see similar trends that remain even when comparing against pre-pandemic Q2 of 2019.

What is holding back overhead expenses is not surprising. Marketing & business development as well as office expenditure haven’t been able to rebound because the lingering effects of the pandemic have continued to suppress opportunities for these activities despite there still being an appetite for them among firms. These categories account for 10% of total overhead expenditure; and with their weight, the hefty cuts in these categories have had a meaningful impact.

The figure above provides a spectacular and almost exaggerated example of how impactful using proper baselines can be for benchmarking and analysis. The apparent doubling of business development spending may give the impression that firms are wining & dining once again, but in reality, this doubling of a nearly 70% contraction still nets us a 50% contraction compared to a normal year. Office expenditure tells the same story, demonstrating how these categories smother an otherwise investment-heavy end to 2020 and mask an effort by law firms to achieve true and meaningful development in their talent, infrastructure, and technological tools.

With the fog of the baseline removed we can now see a clearer picture. The pandemic suppressed economic activity, leading to a short-term loss. Firms reacted quickly to ensure survival and as soon as they could see the light at the end of the tunnel, they reinvested those unneeded cash reserves into the future.

With a hopefully waning pandemic, those categories which are still contracting will rise again; and when this happens, we will be watching closely to see if the fog has any more hidden surprises in store.

You can download a copy of the PMI report for the second quarter of 2021 here.