The fall in legal demand & the economic uncertainty in the second quarter has slowed lawyer headcount growth in Q2 as well, according to the recent PMI.

As the second quarter of this year ended, the large law firm market still was grappling with the effects of the COVID-19 global pandemic. Stay-at-home orders and court closures took lawyers out of their offices and courtrooms, challenging them to adapt to new ways of working in a very short period of time.

Not surprisingly, legal demand suffered, contracting nearly 6% compared to Q2 of 2019. As a result, the Thomson Reuters Peer Monitor Economic Index (PMI) fell 6 points to 51.

This demand contraction and economic uncertainty has slowed lawyer headcount growth in the second quarter as well. While full-time equivalent a(FTE) lawyer growth is not primarily highlighted in the PMI, changes in this metric can have influences in multiples of the key factors.

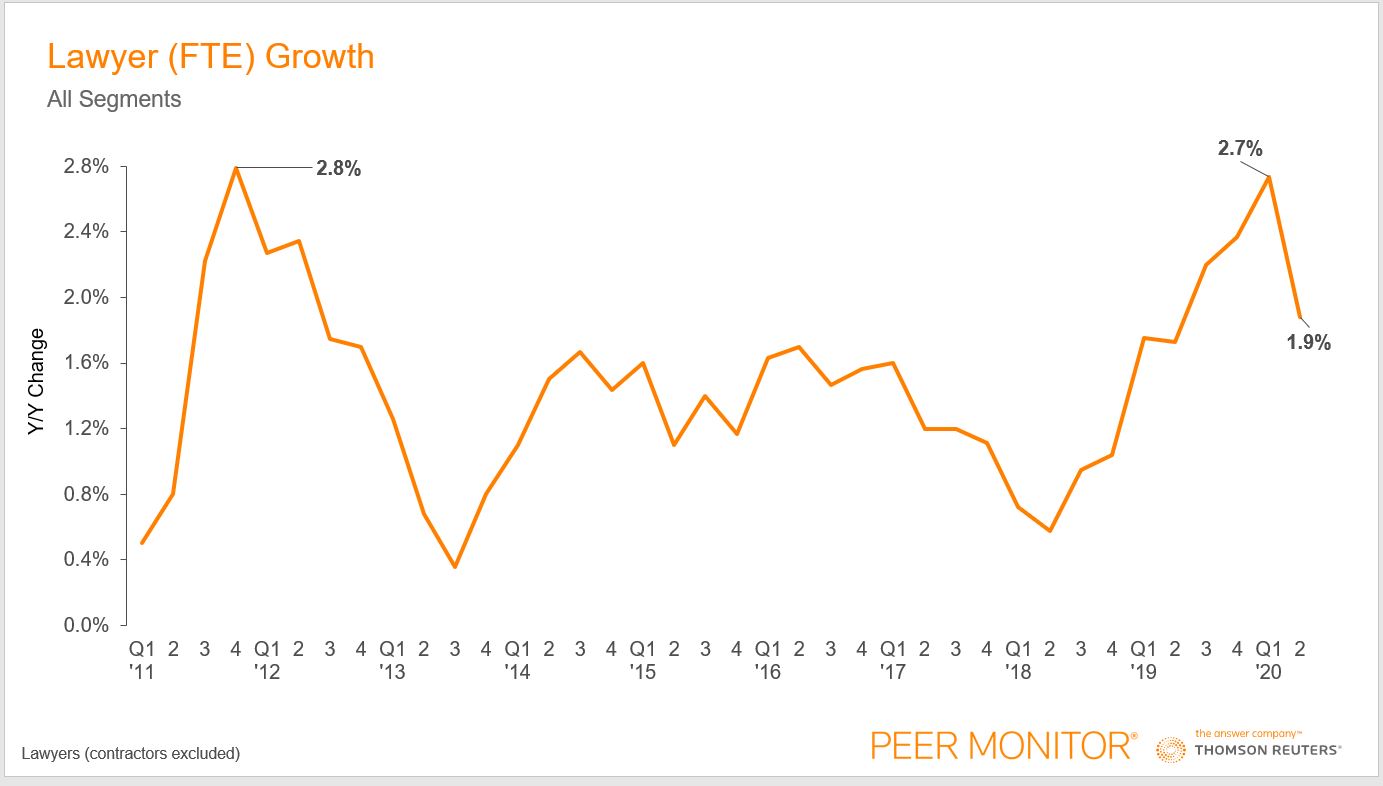

The impact on productivity, for example, is obvious because productivity measures the hours worked per timekeeper. In Q2, productivity saw a 7.2% decrease due to the 5.9% demand contraction coupled with 1.9% increase in lawyer headcount growth. This reduction in productivity could have potentially been much worse if law firms had not slowed their hiring, which was at nearly nine-year high in Q1 of 2020.

Firms’ direct expenses tie closely to headcount, as that expenditure pays the bills of all lawyer hires, while overhead expenses support that headcount and expect it to be as profitable as possible. Indeed, the slowing of lawyer growth only accelerated the cutbacks firms have been making to direct and overhead expenses, as both have fallen to multi-year lows.

One of our more positive looking indicators from the Q2 PMI results, have been the shocking rise in worked rates, which also can be tied to staffing. The average worked rate charged across the market was 5.2% higher than at the same point last year, and a full percentage point higher than growth levels recorded in the first quarter of 2020. The main reason for this has been that law firm partners are shouldering a higher proportion of work by volume.

Now why have partners been doing this? There are a couple explanations. Partners are feeling pressure to achieve their own billable hour goals; and in addition, law firm clients are needing legal advice during this time, which often cannot be replicated by less-experienced lawyers. Also, in terms of staffing, law firms have been trimming headcount of non-partner fee earners much faster than partners.

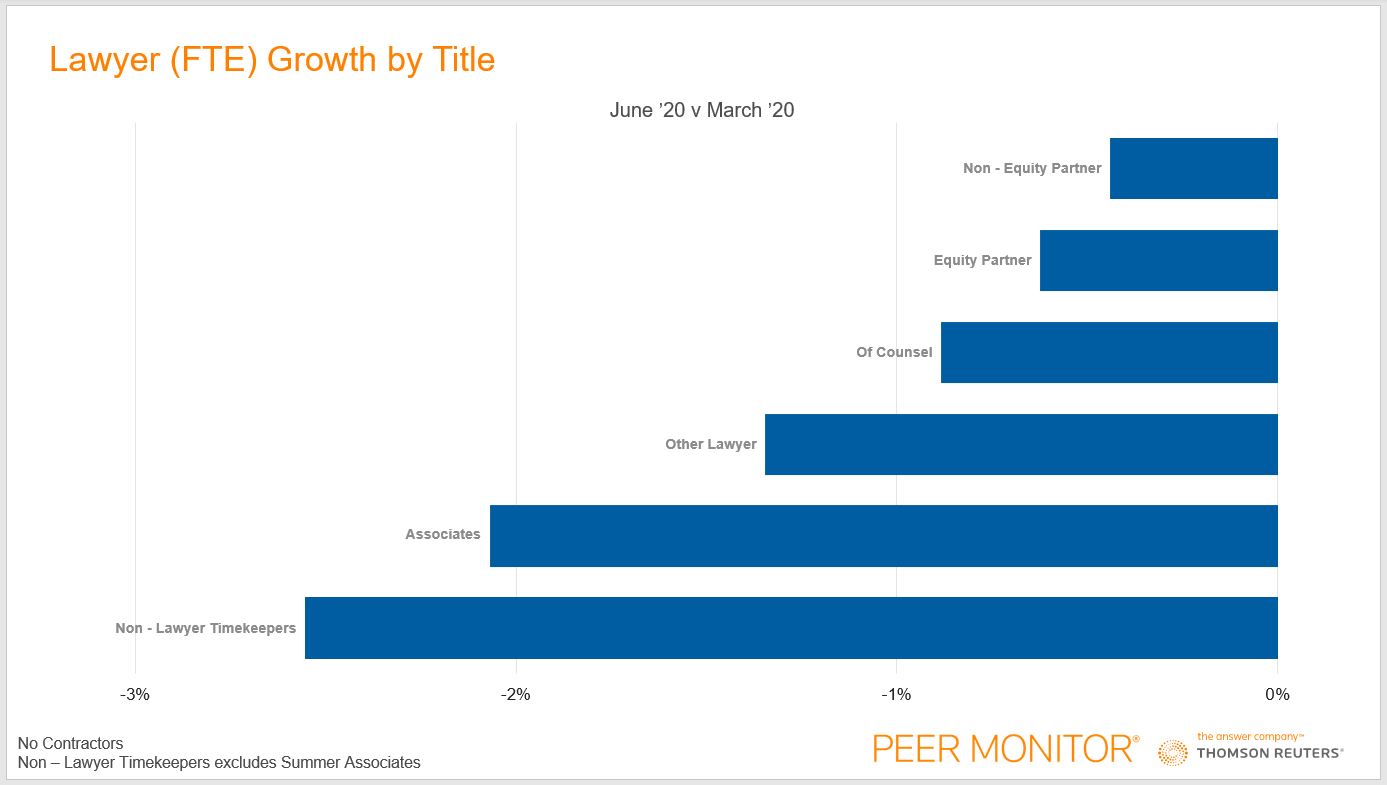

On the first chart, lawyer growth was calculated on a year-over-year basis, which showed that firms have increased headcount on average by 1.9% in Q2 of 2020 compared to last year’s second quarter. This graph above is instead looking at how firms’ staff level stood at the end of March 2020 (pre-pandemic staffing levels) and compares that figure to staff levels today. This can give us more insight into how law firms have changed over the course of the pandemic.

As we see, associates and non-lawyer timekeepers (including specialists, paralegals, litigation support staff, and other timekeepers) have experienced the most reduction in headcount thus far during the pandemic, with the average firm reducing their ranks 2.1%, and 2.6%, respectively. While the levels of equity partners and non-equity partners have only been reduced by 0.6% and 0.4%, respectively.

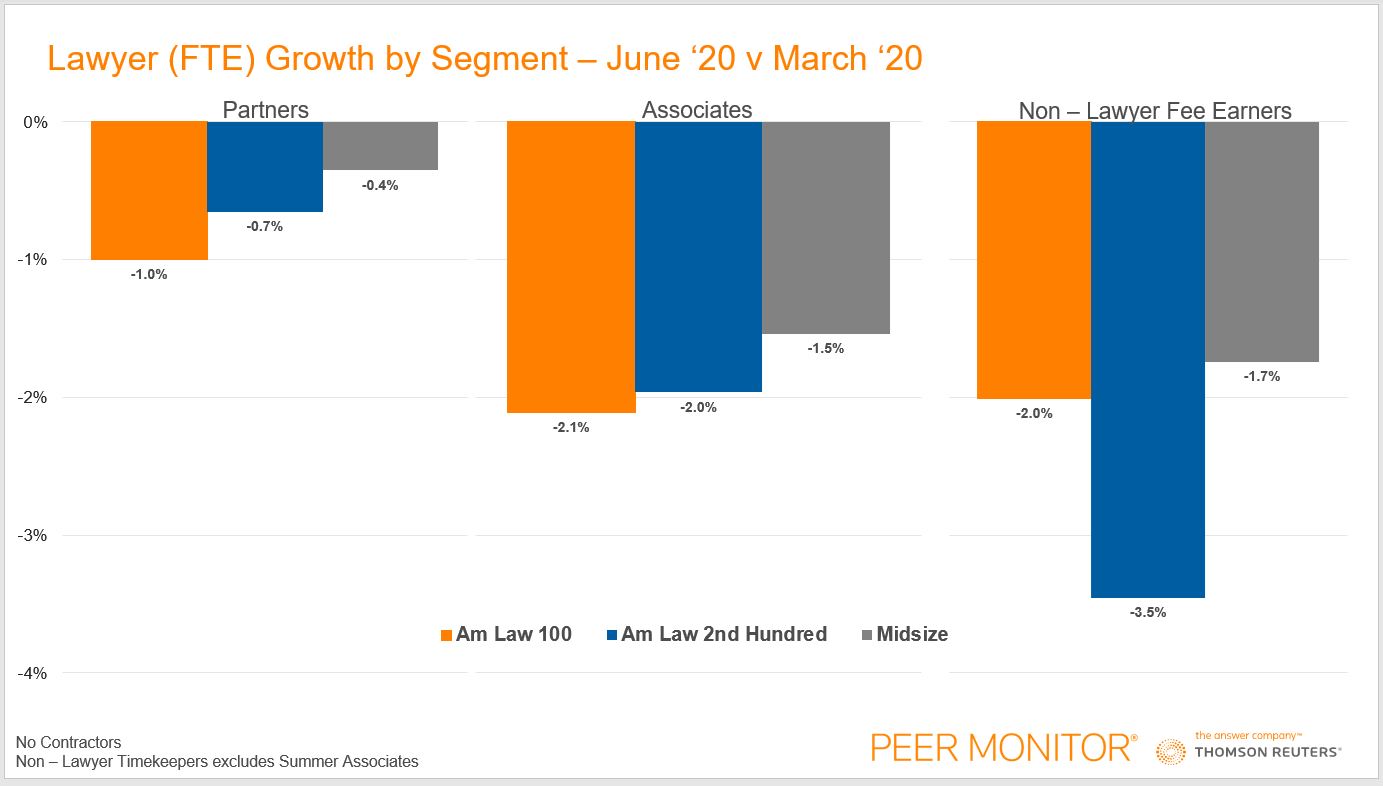

Looking on this same time period from a segment perspective shows the same trend to differing degrees. Am Law 100 firms have been most aggressive with cuts to their partner and associate ranks. This may be trimming off a high base as this segment grew their lawyer count the most in 2019 to the tune of 2.3%. Midsize law firms have been least likely to cut any staff, while the Am Law Second Hundred has seen mostly average contraction for partners and associates, but their non-lawyers were pared back at the fastest rate.

While large-scale layoffs have not been prevalent in legal thus far, this small amount of trimming of staff can be quite healthy — and it can be seen in all segments of the market. Indeed, now is a time where reflection and planning for post-pandemic way of doing business is paramount.

This restructuring of support staff (especially those that are more valuable in an office rather than at home), along with reducing low-fee generating lawyers, and cutting less-profitable practice groups is starting to reflect what the large law firm market may consider to be its new normal.