In looking at Q2 data, we see that a shift in client workflow preferences had the effect of pushing up the average worked rate that law firms could demand

The second quarter of 2020 was marred by near unprecedented global uncertainty. The COVID-19 pandemic was still in its infancy, and no one at the time was sure exactly what was to come next. Many industries were deeply affected by the stay-at-home orders and broader economic shutdowns that were implemented, and the legal industry was no different. Not surprisingly, legal demand decreased by 5.9% in Q2, the largest quarterly decline since the great recession.

As a result, the Thomson Reuters Peer Monitor Economic Index (PMI) declined by six points to 51 in the second quarter of the year.

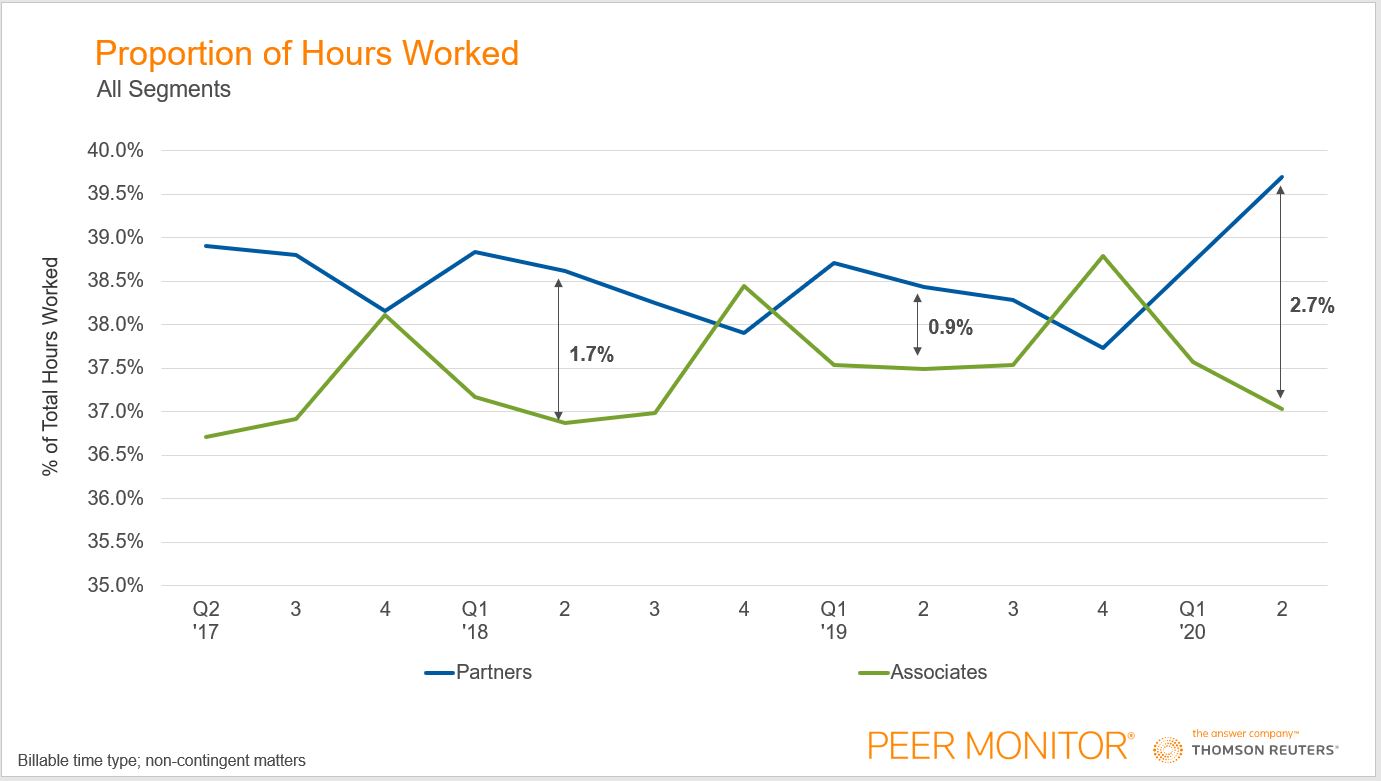

The lack of clarity for the future led to many rapid changes, and some surprising developments within the industry. Faced with such uncertainty, client demands dramatically shifted at the early onset of the pandemic. Clients increasingly demanded high-level advisory services that only could be completed by partner-level attorneys. This resulted in a shift in the proportions of work completed from associates to partners; and by the end of the second quarter, partners worked 39.7% of all billable hours as tracked by Thomson Reuters Peer Monitor, more than 2.7% more than associates over the same period.

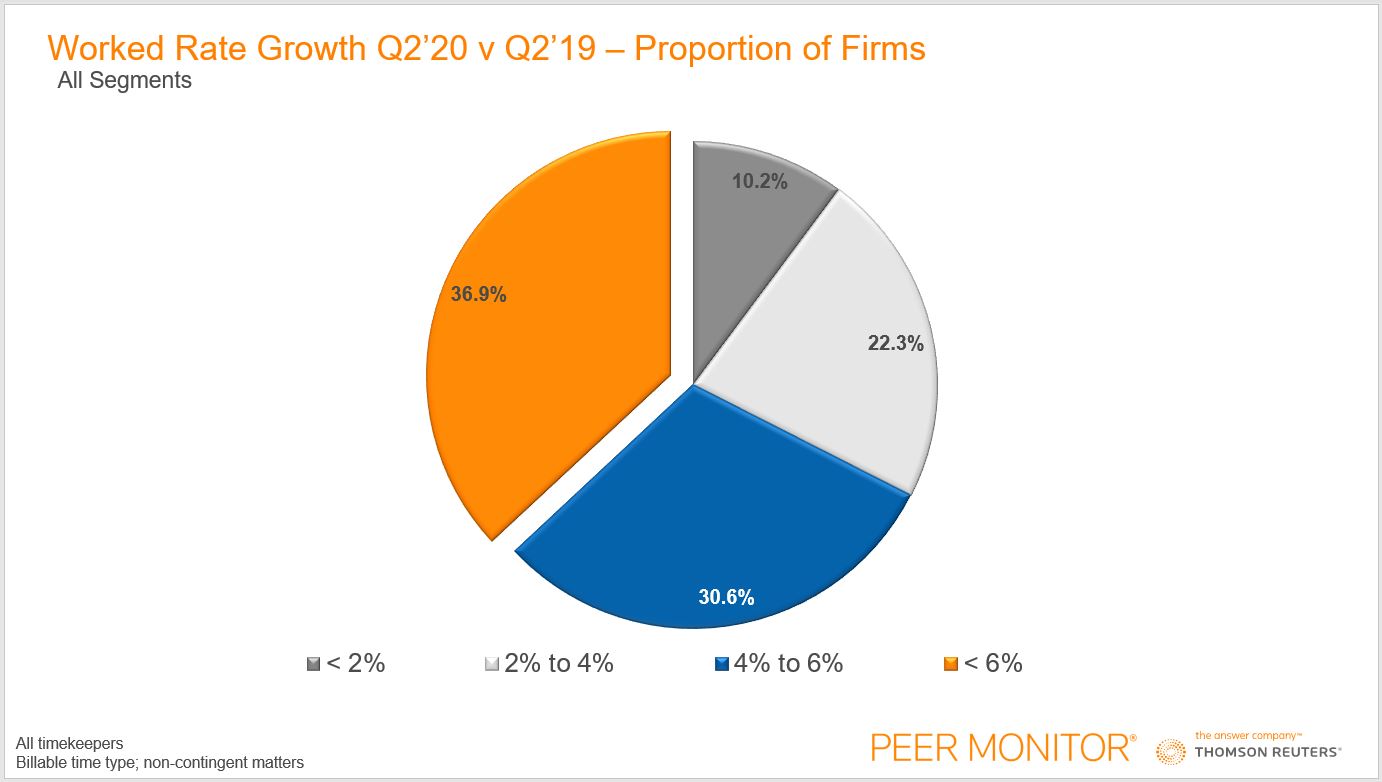

This shift in workflow dynamics had another interesting effect: the average worked rate in the market skyrocketed. In fact, worked rate growth in the second quarter finished at an all-time high of 5.2%, which was 1.4% higher than in the second quarter of the year prior. Further, 36.9% of tracked firms raised their average worked rate by more than 6%.

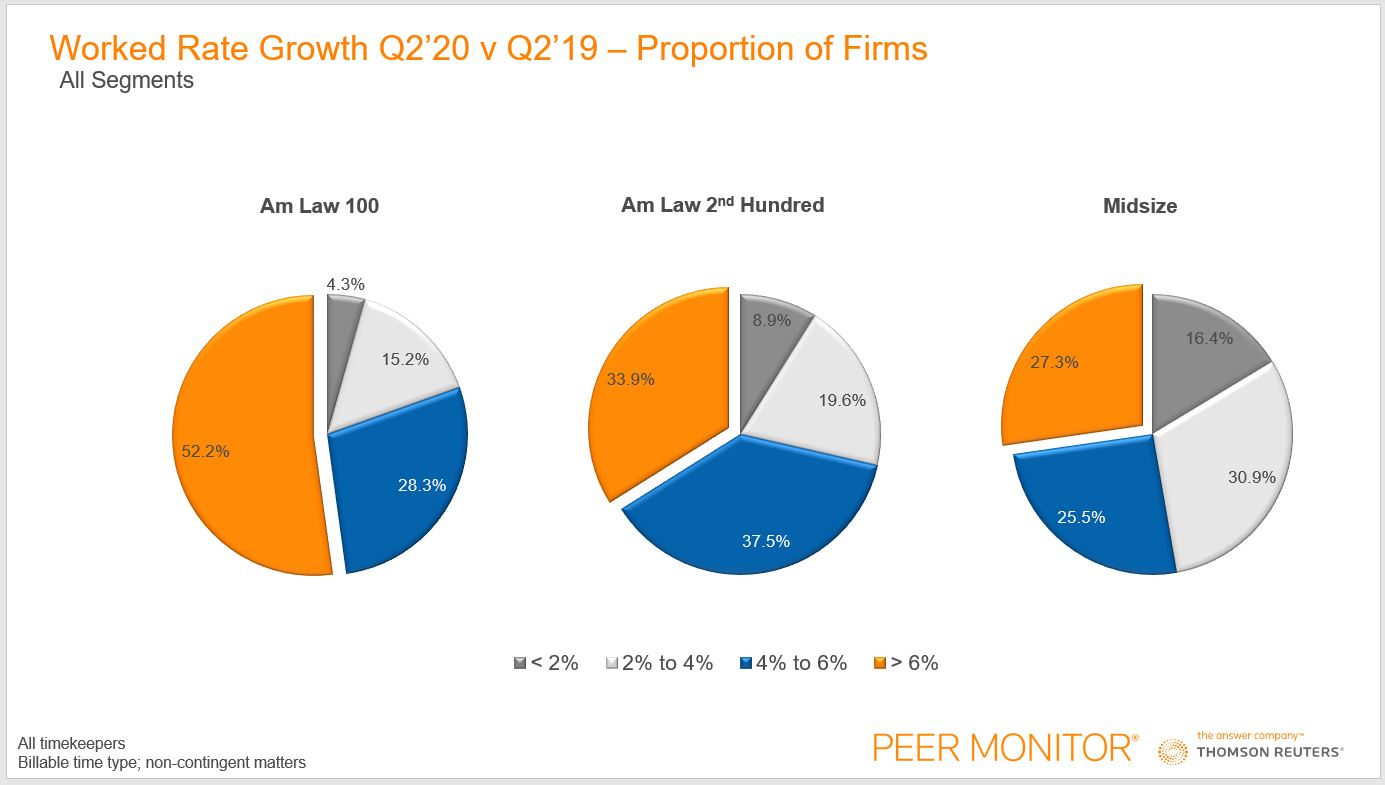

While worked rate growth was higher across the board in every segment, the highest levels of growth were consolidated to those law firms at the top of the market. In fact, while more than one-third of firms surpassed 6.0% worked rate growth overall, more than half of firms in the Am Law 100 accomplished this feat. How strong were the headwinds that firms further down market faced when imposing higher worked rates on their clients during such uncertain times? While 80.5% of firms in the Am Law 100 had worked rate growth of 4.0% or higher in the second quarter, only 71.4% accomplished this feat in the Am Law Second Hundred, and just slightly more than half of midsize law firms were able to do so as well.

Faced with waning levels of legal demand and a pandemic that could persist for a yet undetermined amount of time, rate growth is now a more important lever than ever before for firms to utilize in order to maintain profitability growth.

Whether or not clients push back on these rate hikes in the second half of the year is yet to be determined, but what is clear is that firms who are able to increase the amount charged for their work have a slightly thicker shield against demand downturns than those that cannot.