The large law firm market recovered some ground in recent months amid crosscurrents of low demand, high rates & reduced expenses, according to the Q3's PMI

The large law firm market recovered some ground in the third quarter amid cross-currents of low demand, high rates, and reduced expenses.

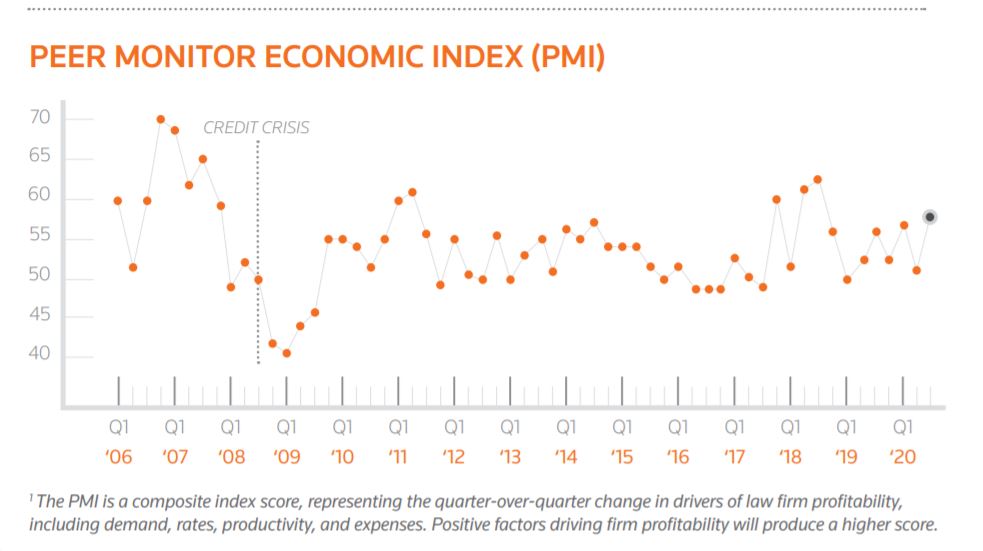

These competing and conflicting factors were the driving forces that pushed a 7-point rise in the Q3 Peer Monitor Economic Index (PMI), which climbed to 58 for the quarter.

Despite the PMI’s somewhat sunny outlook, the news within the legal market was decidedly mixed. Demand for law firm services fell 2.4% for the third quarter, but that was a much a smaller amount than in the second quarter, which saw a 5.9% drop. Although total hours billed remained down, firm profitability is being supported by a combination of two key behaviors among large law firms — they’re charging higher average rates and cutting costs, including making a slight reduction in headcount.

Indeed, the lawyers who remain after these cuts are still seeing reduced workloads, but ones that are now “more comparable to ‘normal’ times,” according to the report.

You can download a copy of the Q3 2020 PMI report here.

Higher rates helped cushion some of the impact from the overall weak demand, and average worked rates rose 5% in the quarter, a near-record pace. Shifts in workflows among timekeeper levels are accounting for much of the increase, as a higher proportion of worked hours can be attributed to partners than in past quarters.

At the same time, firms are cutting expenses. After growing lawyer headcount consistently over the past decade, the average firm reduced its lawyer headcount in the third quarter. The resulting decrease in lawyer compensation contributed to a slowing of direct expense growth.

“Law firms have acted swiftly to deal with the challenging business environment brought on by the COVID-19 pandemic,” said Mike Abbott, vice president of Market Insights and Thought Leadership at Thomson Reuters. “In addition to moving their workforces to work from home, firms are adjusting their business models to adapt to shifts in practice demand, benefitting from strong average worked rates, and reducing costs to boost profitability.”

The PMI, produced by Thomson Reuters, is a composite index of law firm market performance using real-time data drawn from major law firms in the United States and key international markets.

You can find more information on Peer Monitor here.