Looking at the data for Q4, we can chart how the growth of corporate and transactional work accelerated a decades-long industry trend away from litigation

In the final quarter of 2021, legal industry forces that had been building for multiple quarters collided. The legal practice demand for transactional matters had only quickened in pace on top of an already impressive Q4 2020, a time which looks to be the official start of the market-carrying surge in corporate work.

Simultaneously however, law firm expenses continued their upward acceleration, with compensation for associates growing by double digits. Without the beneficial low baselines of 2020 to empower the Thomson Reuters Peer Monitor index (PMI) in terms of demand or productivity, these expenses pulled the Index down 9 points, dropping the PMI for Q4 2021 to 58.

While the score may have dropped, it seems as though an exploration of legal industry’s impressive demand results could yield great insight, especially from a long-term perspective. The massive increase in corporate work in 2021 led law firms to new highs in the proportion of hours worked in these practice areas, a rise witnessed in all law firm segments. Proportional analysis, however, is a zero-sum game; and as with every such game, if one practice area gains share, then another practice area must lose share. In this case, it appears most of the relative losses over the last decade came from the litigation area.

The litigation legacy

Whether you’re fully immersed in the legal industry, or simply watching a TV drama about it, litigation has been effectively known as the Pangea of the U.S. legal market. For those who are unfamiliar, Pangea was a supercontinent that formed 300 million years ago and was comprised of all of Earth’s land masses together, effectively dominating the planet’s surface. After 100 million years, plate tectonics began to shift and break-up, with Pangea eventually becoming the seven continents and five oceans we know today. With its historic dominance, litigation could well be considered the supercontinent of the U.S. legal market.

And like Pangea, litigation continues to dominate the cultural perception of the legal industry, even as it appears that the continental break up is well underway on a more foundational level. The practice has lagged the industry overall through much of the 2010s and opened an opportunity for a significant rise in corporate and other transactional practices on a proportional basis.

During the mid-2010s, the legal industry witnessed an abundantly clear signal that the structure of dispute matters was changing. During this period, the average law firm saw 22 consecutive quarters of contraction in the litigation practice area. The economics that had emerged after the Global Financial Crisis (GFC) had given rise to growing corporate law departments and the alternative legal service provider market, both of which found fertile ground for change in litigation.

Corporate law departments immersed themselves in enhancing legal operations, working to gain efficiencies throughout their organizations, and, in turn, put pressure on their outside counsel to reduce costs as well. Alternative legal providers found their way into litigation matters in a wide array of functions, but all were centered around the tasks of litigation matters that didn’t require deep or specific expertise and were cost-inefficient. Once the remaining hours of a particular matter made their way out of that trimming process, outside counsel were left with a noticeably lighter load than they that to which they had become accustomed in prior years and decades. The lion’s share of litigation hours no longer went to large law firms.

The continuing drift

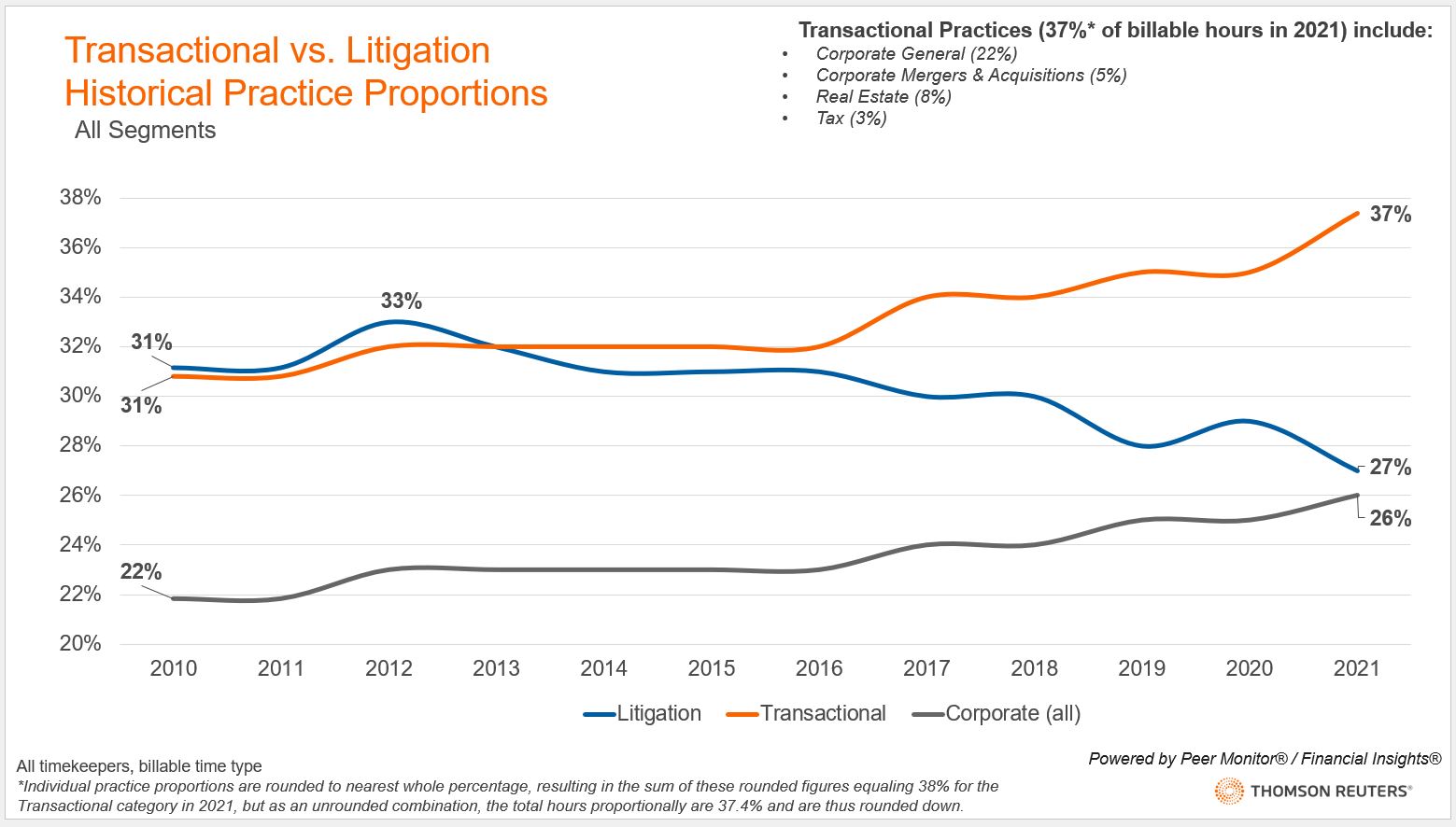

Dating back to the first post-GFC years, litigation enjoyed a high of 33% proportional share among practice areas, compared to 22% for corporate and 31% for all transactional practices. However, in the 12 years since, those numbers have changed significantly. In the beginning of 2022, litigation sits at 27% (down 6 percentage points, losing roughly one-fifth of its previous position), corporate work is at 26% (up 4 percentage points), and all transactional practices are at 37% (up 6 points). Further, it’s important to keep in mind that these shifts over a decade represents hundreds of firms and the proportion shifts themselves represent millions of hours worked (or in this case, not worked) across that decade.

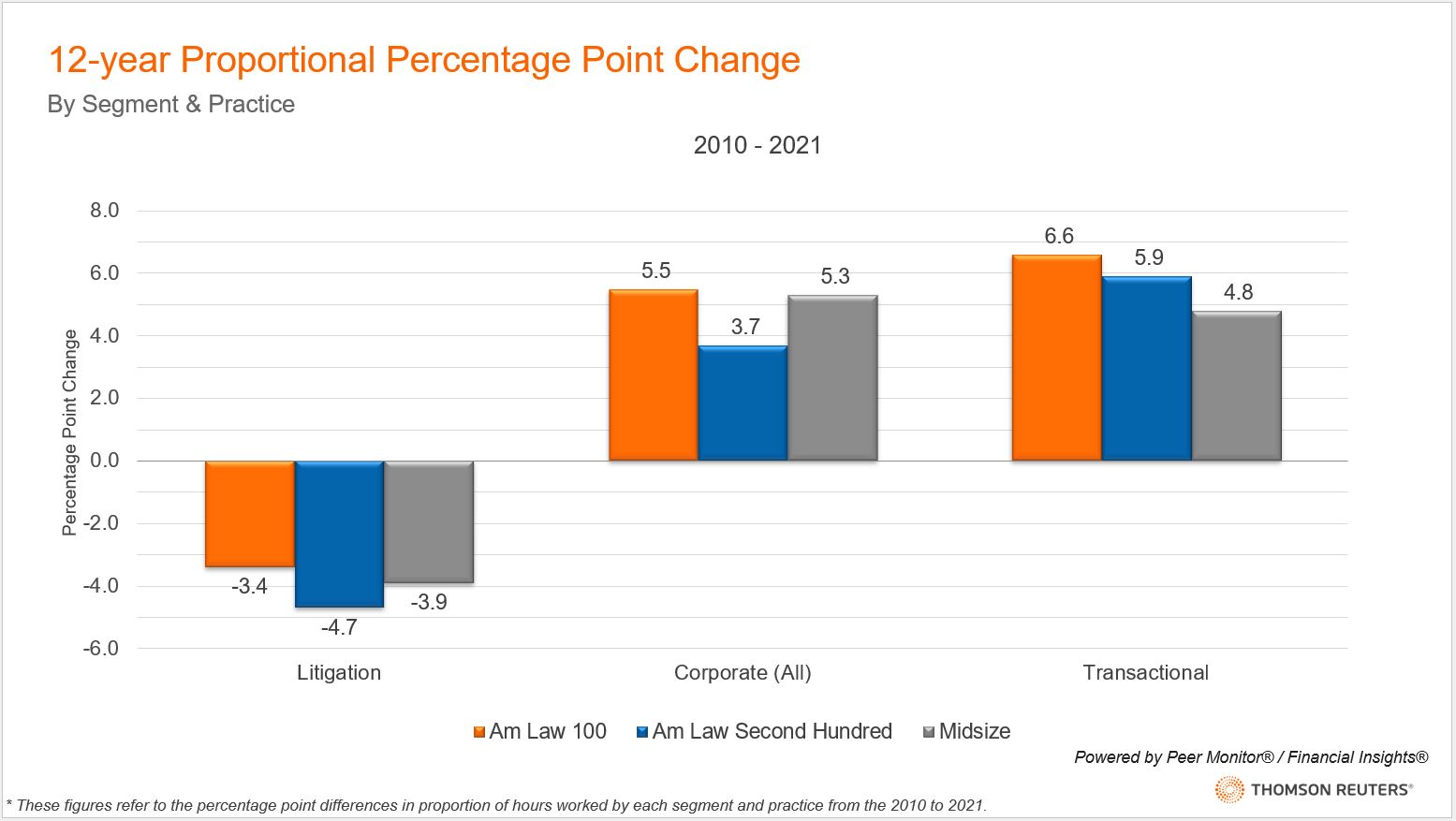

Interestingly, this continental drift has been spread almost equally across the market. All firms saw their litigation practices shrink by at least 3.4 percentage points, while the Am Law Second Hundred saw the largest reduction at 4.7 percentage points. Over the same period, transactional practices in the Am Law 100 grew by a whopping 6.6 percentage points, with the Am Law Second Hundred increased their proportion by 5.9 points, and Midsize firms saw a near 5-point shift as well. As you can see in the middle portion of the below graphic, corporate general work as well as mergers & acquisitions work — the two components of the corporate (all) category — are driving most of the transactional shift.

Another facet of this issue which firms are currently facing in 2022 is how to grapple with inflation. The most obvious answer would be to raise rates to a level that will either match or exceed the extraordinary inflation levels we’re facing; however, not all practices will be able to command such heavy increases. Worked rates for the litigation practice area grew at 3.7%, while the average firm raised their rates in transactional practices by 4.9%.

Of course, the litigation practice still does, and probably always will, carry significant weight in the U.S. market and in most law firms’ offering portfolios. Yet the U.S. legal market already is looking a lot less like the legal market of 30 years ago, when about 40% of of an average firm’s billable hours came from the action within court rooms. In actuality, the market seems to be moving more toward a transactional practice-led market that competes with other global legal markets that share the same goals.

This evolution has taken us to a legal market that’s more fractured, its disparate parts coming into contact and collision, becoming a continental legal industry, rather than a Pangeaic one.