A beacon of economic hope

The changing conditions in China have cast a hopeful new light on India in the emerging global marketplace.

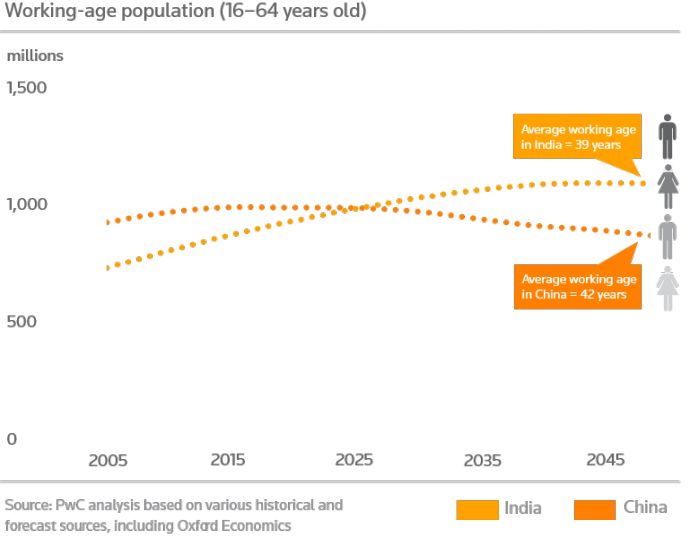

While many Asian countries are aging (Japan most notably), approximately half of India’s 1.2 billion people are under the age of 26, and by 2020, it is forecast to be the youngest country in the world, with a median age of 29. That means a growing pool of buyers for goods and services, and a growing middle class.

China, which came into economic prominence on the heels of a similarly youth-heavy population, is forecast to have a median age of 37 by then.

Demographic trends in India

A growing workforce helps the entire Indian economy, giving businesses access to people that are young, educated and physically fit; it also drives down labor costs.

Already, Chinese manufacturing labor costs nearly four times as much, at an average of US$3.52 an hour, as it does in India, at 92 cents an hour, according to an analysis by Boston Consulting Group.

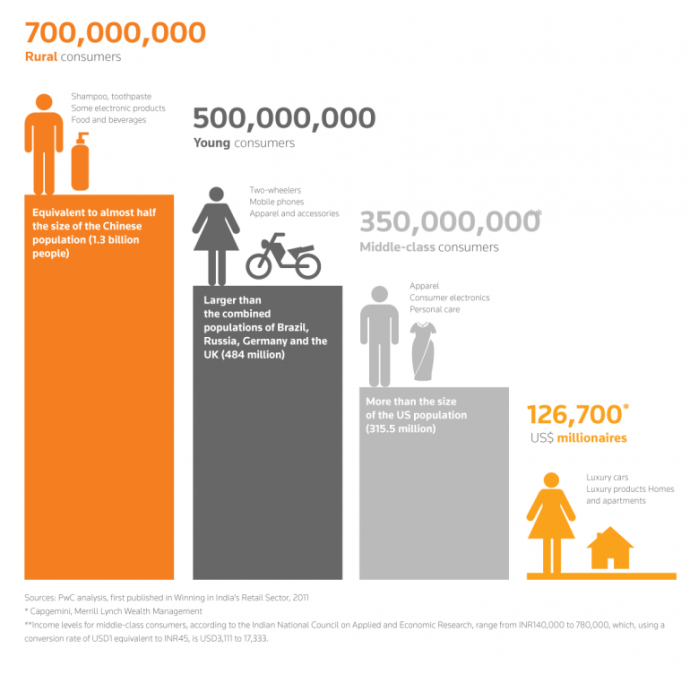

The demographics feeding consumption

The potential for businesses to more fully incorporate India into their global manufacturing strategies is also driven by the boom in Indian consumer spending.

Between 2006 and 2011, consumer spending in the country almost doubled, from US$549 billion to US$1.06 trillion. In a recent CNBC article, Sunil Devmurari, country manager for India at Euromonitor, said this is just the beginning.

“250 million people are set to join India’s workforce by 2030. As a big chunk of the population shifts into the working age group, the offshoot of that is an increase in disposable incomes and conspicuous consumption. This is the most exciting aspect of India’s demographic dividend,” Devmurari said.

Stubborn challenges remain

India’s rank of 142 is near the bottom of the World Bank’s Ease of Doing Business list, and the country continues to lag behind other Asian economies in the share of GDP attributable to manufacturing. India also has well-documented issues with infrastructure as well as bureaucracy and intractable regulatory requirements.

‘Made in India’

Prime Minister Narendra Modi was elected with the mandate of confronting these challenges and stimulating economic development. His goal: to increase India’s share of the world’s exports from 2 % to 3.5 % by 2020.

In fact, the India of the near future is expected to be manufacturing-centric.

General Motors Co (GM), for example, recently announced a new US$1 billion investment to ramp up production capacity in the Talegaon region of India.

More broadly, companies in the Biotechnology, Pharmaceutical, Electronic Systems, Renewable Energy, Oil and Gas, and Textiles sectors are also poised to become more dependent on India from both manufacturing and retail perspectives.

Learn more

Thrive Globally. The rebalancing of global markets brings new possibilities, new ways of finding customers, and new sources of growth. But how do you identify where the right opportunities are for your business? Thomson Reuters has created an in-depth resource providing a clear path forward, illuminated by trusted answers that can help you not just survive, but thrive in the new global reality.

Thomson Reuters in India and South Asia brings together a full suite of tools, tools and expertise to help you gain a broad view and deeper understanding of India and all it offers.