Delivering the next level of client accounting advisory services (CAS) doesn't start with the latest widget, it starts by simply listening to the needs of clients

Over the last decade, tax & accounting professionals have been discussing client accounting advisory services (CAS) and what they entail. Initially, practitioners opined that CAS was moving bookkeeping to the Cloud. However, this definition downplays the value CAS delivers to clients.

Although technology plays an essential role in delivering scalable, high-margin accounting advisory services, clients want knowledge from their tax & accounting professionals even more than an improved process. The effects of the pandemic further increased the demand for the advisory components of CAS. This emphasis on delivering more advisory services over business process outsourcing is called CAS 2.0.

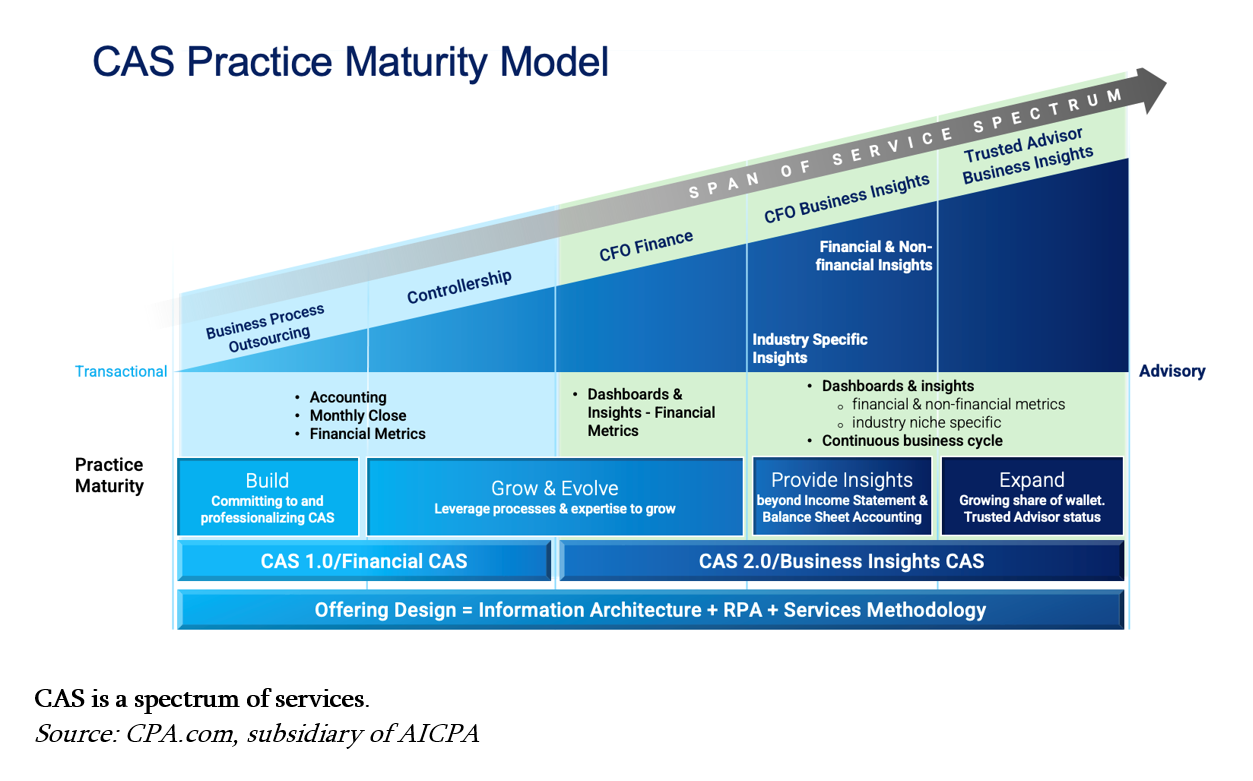

As referenced by the above CAS Practice Maturity Model, most practitioners start their CAS practice on the left side of the spectrum because they need accurate, quality data to fulfill their role as a trusted business advisor. CPA.com has defined this as CAS 1.0:

As referenced by the above CAS Practice Maturity Model, most practitioners start their CAS practice on the left side of the spectrum because they need accurate, quality data to fulfill their role as a trusted business advisor. CPA.com has defined this as CAS 1.0:

“Cloud-based financial services, providing monthly financial statement preparation and normal accounting services with controller level oversight; ideally delivered through a standardized dashboard of financial information.”

Given the effort, time, and investment it takes to build a CAS 1.0 practice, many firms stall in their progression toward trusted business advisory services. It is as though they are climbing a mountain and reach the CAS 1.0 base camp and then lose the energy to keep going to the peak. Many firms also report that they are so busy with business process outsourcing (BPO) and controllership-level work that they can’t offer more services to their clients.

However, not adding advisory services puts firms at a distinct disadvantage, especially as there are third-party competitors now entering the CAS 1.0 space. Tax & accounting professionals demonstrate their competitive advantage the more they deliver services on the right side of this CAS spectrum of services.

“CAS 2.0 is additive to CAS 1.0,” explains Kalil Merhib, Vice President of Growth and Professional Services at CPA.com. CAS 2.0 is a “differentiated advisory service that augments normal financial reporting created by CAS 1.0 with additional financial & business insights generated through financial & non-financial information delivered through industry-specific KPIs [key performance indicators],” as CPA.com defines it.

CPA.com also has “established the next generation CAS Advisory Council comprised of progressive leaders from top CAS practices. The council is committed to providing a high level of transparency around successful practice strategies and providing feedback, experience, and ideas on how to continue to evolve the future category of CAS.”

Growth in demand

Pre-pandemic, advisory services were some of the fastest-growing offerings in the profession, and the demand has only increased in the past few years. The interaction between businesses and their tax & accounting professionals during the pandemic made clients realize how much more they could get from a relationship with these professionals, says Merhib. While pandemic services like the Payment Protection Program, the Employee Retention Credit, and the like have declined, CAS is reaching new levels of growth across the profession.

In fact, “client accounting services/business process outsourcing is the most commonly reported area of expansion over the last year for the 83 responding T100 Firms,” according to Accounting Today; and the median growth rate for all CAS practices was 20% in 2020, CPA.com’s CAS 2021 Benchmark survey found.

Scaling up CAS 2.0

It has really become a quest in the tax & accounting profession to make practices scalable — fortunately, scaling CAS 2.0 services doesn’t have to be complicated. When developing CAS 2.0 services, the perception is that practitioners need to design very customized, hands-on services that they only have time to provide for a few clients. This is where the innovation that was leveraged to design CAS 1.0 needs to be reignited.

To make CAS 2.0 scalable, the service needs to be “standardized, repeatable, productized, and leveraged,” says Merhib. The operations of advisory services can be systematized like BPO — that way, the client’s feelings of personalization originate from the tax & accounting professional, who talks with clients about their goals and provides financial insights to help clients reach them.

The CAS Practice Maturity Model has three levels of advisory services: CFO Finance, CFO Business Insights, and Trusted Business Advisor. By having clearly defined services, processes can be more easily created. And as the CAS team grows, more responsibilities can be pushed down to lower levels. When team members are operating at their highest and best use, advisors have more capacity to advise, increasing profit margins.

Maximizing the use of technology is also critical to making advisory services scalable. Technology that supports forecasting, budgeting, financial planning, dashboards, etc., has been advancing in the marketplace. Merhib suggests assigning someone to look into “all capabilities available of the technology the firm uses” and explore what else may be possible. Automating repeatable tasks saves time and creates an opportunity for further digital transformation.

Another important caveat to consider: The traditional accounting firm model is not optimal for a CAS practice. Successful CAS practice leaders are taking new approaches to talent upskilling, pricing, measuring a practice’s performance, and better integrating CAS into the firm’s client service approach.

The client demand exists for CAS 2.0. Now is the time for tax & accounting firms to get intentional about developing a strategy for a CAS 2.0 practice.