The AI revolution in corporate tax could be coming sooner rather than later, says a recent report; however, many tax departments still need to answer data and process challenges to get the most out of their AI tools

The recent 2024 Corporate Tax Department Technology Report, conducted by the Thomson Reuters Institute and Tax Executives Institute, paints the picture of a corporate tax world that sees the potential for technological change but has not yet undertaken widespread digital transformation. Survey respondents from more than half of corporate tax departments, after all, categorized their organization’s technology maturity as chaotic or reactive, while 87% call their department’s tech competency as either somewhat competent or not competent.

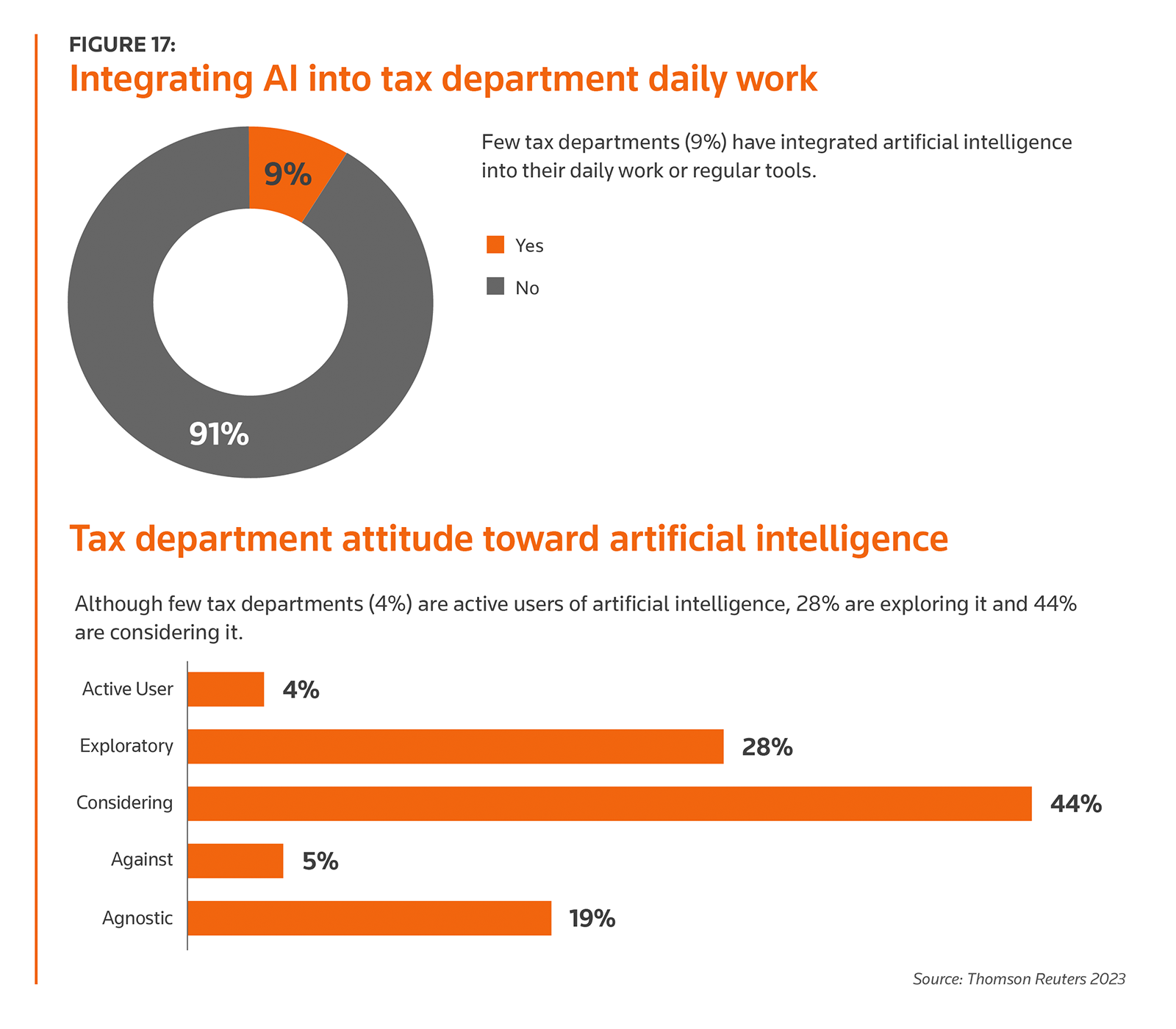

Those impressions filter down to corporate tax departments’ use — or lack of use — of artificial intelligence (AI). Just 9% of respondents said their departments integrate AI into their daily work, a number that decreases to just 5% of departments with three or fewer employees. Further, only 4% of corporate tax department respondents consider themselves active users of AI.

The AI opportunity

However, there is reason to believe these tech-doldrums won’t last forever. According to those surveyed, the AI revolution in corporate tax could be coming sooner rather than later.

While few consider themselves active users of AI, 28% of respondents said they are exploring the technology, and 44% are considering its use. Notably, just 5% of respondents said they are against AI, while the remainder are agnostic towards its use. It’s perhaps not surprising then, that 68% of report respondents called their sentiment towards the future of tax technology hopeful — particularly with the advent of generative AI applications (Gen AI), technology and its use cases, which now are advancing at a rapid pace.

When asked how technology will shape tax departments’ future, one respondent answered: “Artificial Intelligence will help our tax department be more efficient and possibly proactive in handling complex tax scenarios.” Another said they were “excited to see how artificial intelligence will shape our department and make us more efficient at our jobs.”

Indeed, many respondents said they expect efficiency to come quickly. More than three-quarters (78%) said they expect their tax departments’ tech capabilities to increase in the next 3 to 5 years. Some respondents believe this could result in changing current job roles to better adapt to the new technology (41%) or even see the creation of new job roles to handle technology changes (32%).

“It is going to become more and more necessary, as new laws and initiatives roll out,” said another respondent, citing the new Pillar Two tax regime as an example. “Businesses may not want to spend on new technology but will need to if they don’t want to outsource the work.”

Infrastructure needed

However, even if corporate tax departments want to adopt AI tools, do they have the current infrastructure to take advantage of the efficiencies these tools can bring? Some data from the report suggests that many departments may need to work on their internal tech processes and data governance before attempting to implement advanced AI tools.

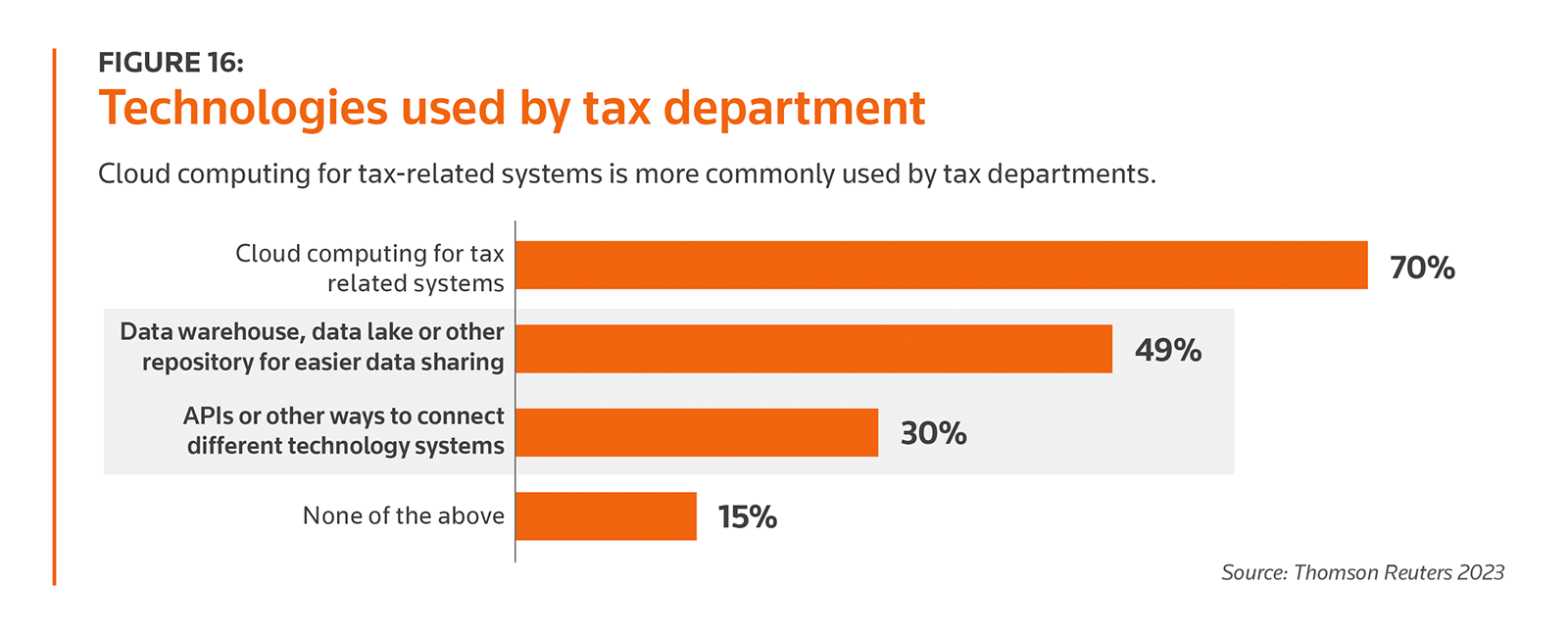

For instance, the report found that while 70% of corporate tax departments utilize cloud computing for tax-related systems, less than half use a data warehouse, data lake, or other repository for easier data sharing. Moreover, less than one-third utilize API solutions or other ways to connect different technology systems.

The oft-repeated mantra of garbage in, garbage out is perhaps truer than ever before with a new generation of AI tools on the horizon. Although next-generation AI tools provide more promising use cases than ever before, the fact remains that they are still a tool — the AI can only provide an answer by accessing the data it has on hand. With less data to work with due to unconnected systems, or with unclean data due to uneven data collection, AI tools’ utility drops dramatically.

“I think views towards tax tech are frequently overly optimistic,” explained one survey respondent. “Tax first needs quality data from accounting records. Generating that data in a systemic, tax-optimized, form is the first step.”

Another respondent noted that while tax departments are aware of this issue, actually solving it takes time. “There is a need to address the underlying accounting data and systems within the company before tax data and systems capabilities can ever be improved,” the respondent said. “That process is on-going currently, but no set timetable exists for completion.”

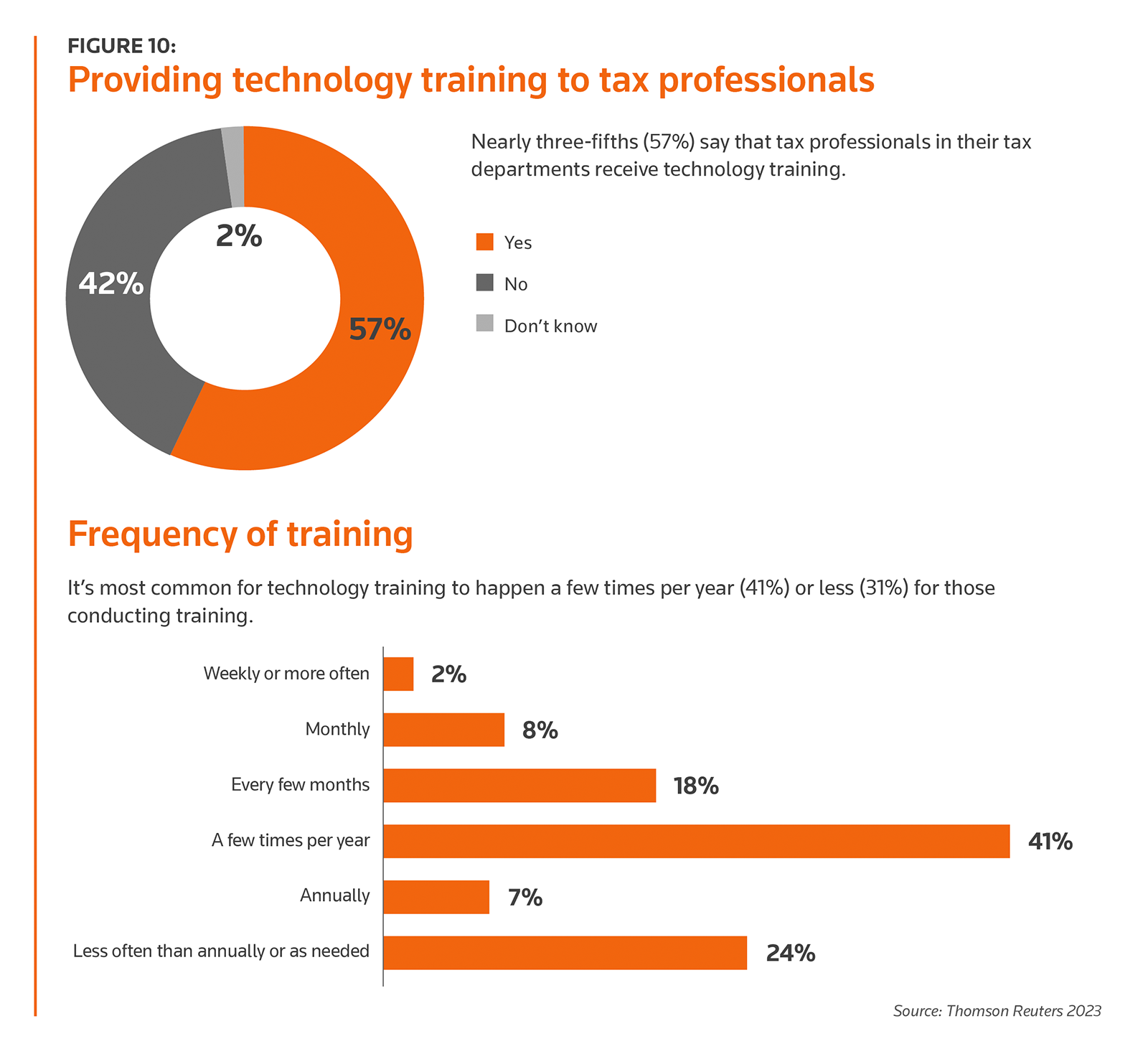

Similarly, for tax departments to maximize their AI usage, employees actually need to know how to use the tools. However, just 57% of corporate tax departments report providing technology training to their employees, a number that drops to less than half (47%) of departments with three or fewer employees, according to the survey. And even among those that provide training, 31% provide that training annually or even less frequently.

Particularly in an era in which Gen AI technology advancements are moving more and more quickly — ChatGPT was publicly released just one year ago, after all — corporate tax departments may quickly run into a situation in which employees don’t know how to extract value from the tools their departments have paid to adopt. “I am hoping that new technology would enable people to do more value-added work instead of tying people down and spending more time to deal with technology itself and be enslaved by it,” a survey respondent noted.

As a result, some departments may lean towards not adopting technology at all rather than address these challenges, at least until they see a clear benefit to the cost. “I am open to any type of technology that can give us real and significant improvement,” answered one respondent. “I’m skeptical of a lot of the solutions brought to us that would only provide minimal improvements but would require the team to learn a whole new software and process.”

At some point, however, the potential for improvement will be too great to ignore. While many corporate tax departments are still in the consideration and exploration phase of actual AI technologies themselves, they would also be well-served to solve data and process challenges now in order to extract the most value from their AI solutions when the switch occurs.

“It is hard to say how it will impact [corporate tax], but it will undoubtedly be impacted in some way,” a respondent said. “We feel the same about tax technology as we do about generative AI generally: We know things will change, but we’re not sure exactly how. One this is sure though; we cannot fall behind with this movement.”