A new report shows that indirect tax professionals are challenged by the increasingly global and digital business environment — and more tech means they need more people with tech skills

In a world in which business operations are increasingly global and digital, the challenges surrounding indirect tax and compliance are becoming more complex. To learn more about how indirect tax professionals are dealing with the increasing complexity, the Thomson Reuters Institute surveyed more than 180 indirect tax professionals from the United States, Canada, and the United Kingdom.

The survey revealed that technology and automation were leading priorities among these professionals and — to no one’s surprise — keeping up with changing regulations was cited as a primary concern.

Concerns and solutions

The 2024 Challenges and Changes in Indirect Tax & Compliance report highlights some of the top challenges that indirect tax teams are faced with inside an organization. The report shows that at the core of these tax professionals’ jobs is being able to keep up with continually changing regulatory environments, with more than one-third (37%) of respondent saying that staying compliant amid rapidly changing tax laws throughout multiple jurisdictions remains a significant concern. Some of the more recent tax regime changes cited as the most impactful include Pillar Two, the Global Minimum Tax, and Research R&D Credits, to name just a few.

Among indirect tax department respondents, more than 40% also cited technology and automation as another challenge. As they understand it, the need to adopt the right technology and automation is critical in order to keep up with regulatory changes and to be an effective function within the organization. Respondents also cited resource constraints as a top concern, specifically not having enough workers or qualified staff to get the work done. Indeed, almost 4-out-of-10 respondents (39%) said their department already was feeling the effect of resource constraints

Almost 4-out-of-10 respondents (39%) said their department already was feeling the effect of resource constraints.

In response, many indirect tax department leaders already are thinking about how to strategically respond to these challenges, according to the report. Almost 70% of respondents said their departments are focused on training their existing staff; and more than 50% said their departments plan to enhance their technology solutions, including adopting more advanced tools driven by artificial intelligence (AI) to better automate work processes and reduce manual workload. Further, respondents also said their departments, when considering new hires, are seeking individuals with technology expertise (with 39% of respondents saying this), rather than simply those with over tax expertise (19%). This is a strong indication that tax departments are recognizing the necessity to shift towards tech-centric hires as it relates to streamlining the work and improving efficiency.

Measuring success in indirect tax functions

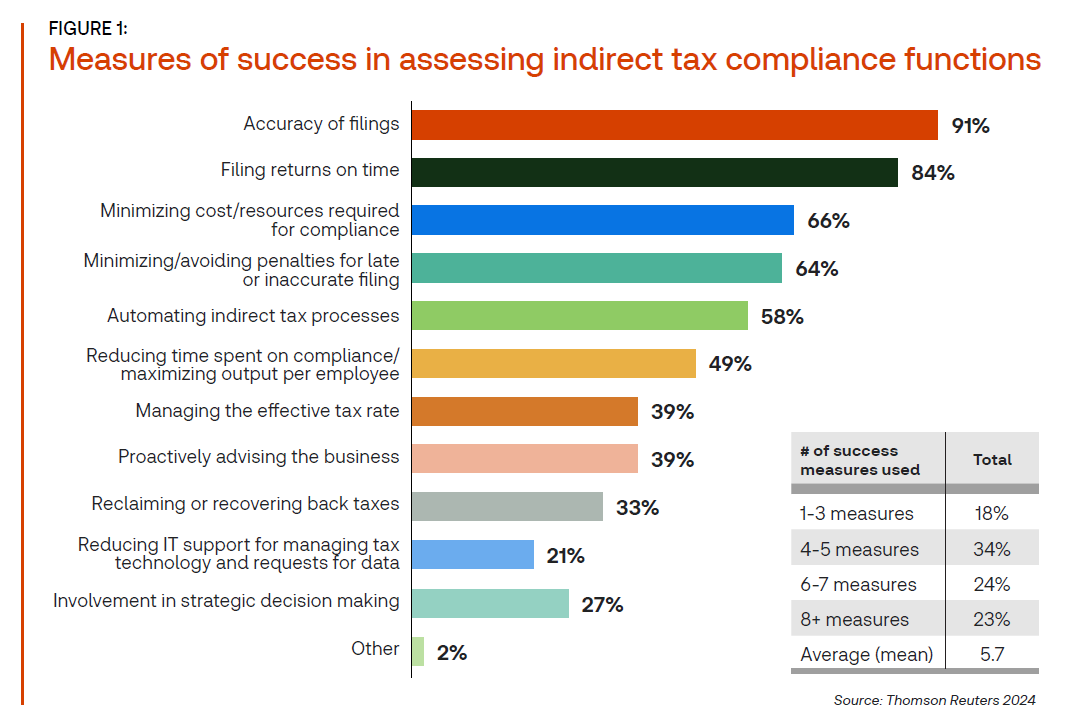

The old maxim that you can’t understand what you don’t measure is resonating strongly with indirect tax professionals, according to the report. When asked how success is measure for the indirect tax function, many respondents pointed to a long list of potential metrics. While the top measurements cited — accuracy and timeliness of filing — were the most obvious choices, with 91% and 84% of respondents citing these, respectively, other metrics for success included minimizing cost and avoiding penalties.

The evolving role of indirect tax professionals

The indirect tax function will continue to experience shifts and changes as the businesses navigates the increasing complexities in which these professionals work. Accuracy is paramount for indirect tax leaders, but increasingly the speed at which reporting takes place is becoming just as important, especially as many tax jurisdictions begin requiring more transparency and greater speed. Indirect tax professionals are poised to maintain this pace, but quick implementation of their strategic priorities is necessary for them to remain in compliance.

As the report suggests, indirect tax professionals will increasingly act as reviewers of tax filings rather than preparers, which aligns with the broader trend of automation in the industry. The report also highlights that businesses are increasingly relying on technology to manage compliance, reduce manual labor, and enhance the efficiency of tax processes.

And as technology takes over more routine tasks, the role of almost all tax professionals is expected to shift from preparers to strategic advisors as they focus more on value-added activities such as risk management, strategic planning, and corporate governance

You can download a full copy of the Thomson Reuters Institute’s 2024 Challenges and Changes in Indirect Tax & Compliance report here.