In the new "2023 State of the Corporate Tax Department", published by the Thomson Reuters Institute and the Tax Executive Institute, we see a strong undercurrent of uncertainty running through many corporate tax departments

In the digital age, the acronym FOMO, or fear of missing out, describes the anxious feeling that occurs when you believe you are not in the know about the latest developments, innovations, or information and that you’re missing out on experiences and opportunities that could improve your life.

And while FOMO generally is associated with social media and the ever-present push to stay up to date, there may be a version of this phenomenon creeping into corporate tax departments.

In the 2023 State of the Corporate Tax Department survey report, published by the Thomson Reuters Institute in partnership with the Tax Executive Institute, we see that FOMO seems to flow as a strong undercurrent through many corporate tax departments.

Indeed, almost half of respondents (47%) said they feel their tax department is under-resourced, a term which carried an impactful weight throughout the rest of the survey. In just one critical example, under-resourced tax departments showed greatly increased risk for audits and penalties, often ones that were more costly and damaging than those incurred by better-resourced departments.

It appeared that under-resourced departments carried the FOMO shadow with them through the rest of the report. With technology and automation for example, while more than 75% of tax departments survey said they’ve automated half or less of their operations, among under-resourced departments, that portion climbed to 88%. In fact, whenever the overall population of corporate tax departments posted a disappointing statistic anywhere in the report — such as their level of automation — under-resourced departments would outpace that, often by 10 percentage points or more.

Further, more than two-thirds of corporate tax professionals surveyed said they expect their companies to undergo significant change within the next two years, whether a shift in product and service offerings, or a restructuring or merger. This level of uncertainty directly correlates to FOMO, especially among those tax departments that see themselves not keeping up with their peers, or with the expectations of their companies or of the tax industry itself.

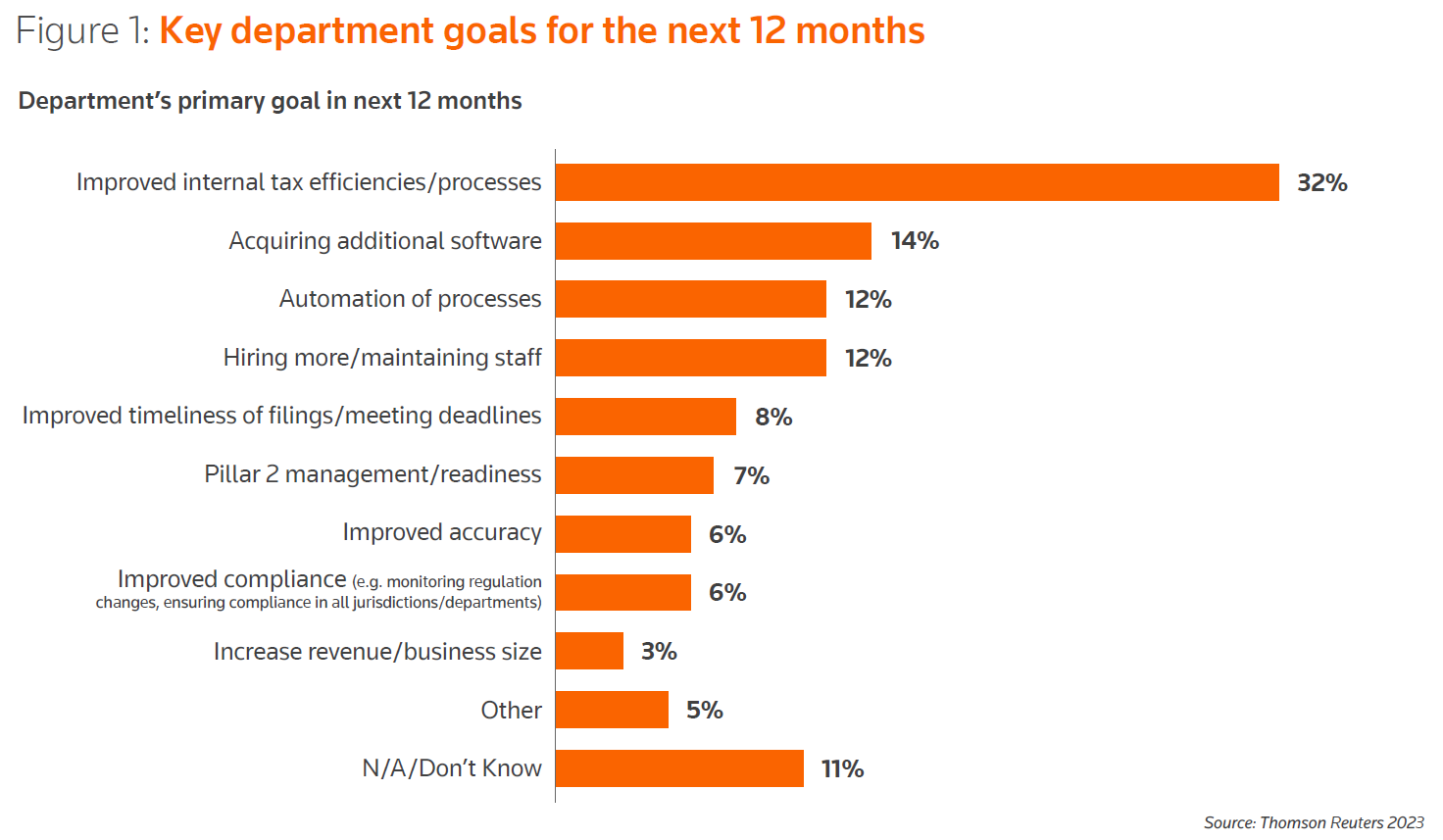

Not surprisingly, some of the key themes that respondents kept return to in the report include concerns over resourcing and under-resourcing, keeping up with the latest technology, and other critical priorities. And with close to half of businesses saying their tax department is under-resourced, this has greatly increased the risk of audits and penalties among other negative developments. Yet many respondents say their confidence in their ability to manage tax risk remains high, particularly those at more well-resourced businesses.

Under-resourced tax departments showed greatly increased risk for audits and penalties, often ones that were more costly and damaging than those incurred by better-resourced departments.

On the technology front, many respondents rated their businesses’ technological maturity as low to moderate. Further, 41% said their departments take a reactive approach to technology, particularly those departments that are under-resourced or from midsize organizations (companies with annual revenue of between $50 million to $6 billion). More distressing is that almost half (47%) said they feel their departments do not have sufficient resources to make needed technological improvements.

There are other critical insights noted in the report — such as tax department spending, use of performance measures and metrics, and how environmental, social & governance (ESG) issues are impacting tax departments — that will continue to be a challenge for department leaders going forward.

And while FOMO may not impact all corporate tax departments in the same way — after all, about 70% of survey respondents still cited aspects of operational improvement as their top priorities and noted positive results from past efforts at cost-savings and increased efficiency — the specter of FOMO seemed to glide through this year’s report.

And that should be a wake-up call to many companies in how they regard and more importantly how they fund their tax function. Because with such high percentages of respondents feeling their tax departments are under-resourced, weakly automated, technologically lagging, and unable to hire the type of talent they need, we may see a significant portion of departments and their companies falling further behind.

You can download a copy of the 2023 State of the Corporate Tax Department survey report here.