A new report from the Thomson Reuters Institute reveals that while tax & accounting firms view technology as a central part of firm strategy, gaps remain in their workflows and personnel plans

As technology has become more commonplace in the business world, the need to become tech-savvy has taken increased importance among tax & accounting firms. Leadership at all sizes of firms has pinpointed technology as a significant or central part of the overall firm strategy, and next-generation technologies such as generative artificial intelligence (GenAI) are firmly on firms’ radars.

At the same time, however, leadership focus on GenAI has not translated into practical applications, according to a new report from the Thomson Reuters Institute. The 2024 Tax Firm Technology Report has found many tax & accounting firms still have a way to go in making sure technology actually works in the best interest of the firm. Even if firms are increasingly purchasing software solutions, few firms have the personnel, workflows, and leadership strategies to make sure they are getting the most out of their technology usage, the report shows.

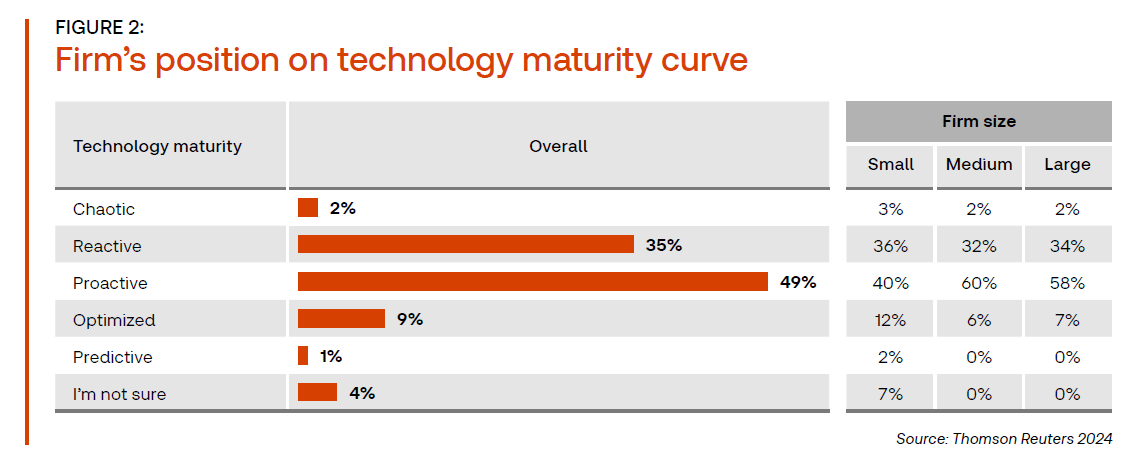

Overall, those firm leaders surveyed said they feel they are relatively mature in their technology usage compared to peers. More than half of survey respondents rated the tech competency of their firm personnel at a 7 or 8 out of 10, indicating that while there was some room for improvement, they felt generally positive about how technology was being used. Similarly, when asked about their firm’s overall position on the technology maturity curve, nearly half called themselves proactive — not to the level of optimized or predictive — but still generally positive.

However, these positive beliefs may not hold up to close scrutiny at many firms. For one, there is a lack of personnel within these firms whose role it is to actually guide broader technology decision-making — just more than half of respondents (55%) said their firms had a person formally charged with tax technology strategy. And outside the United States, that proportion dropped to less than half.

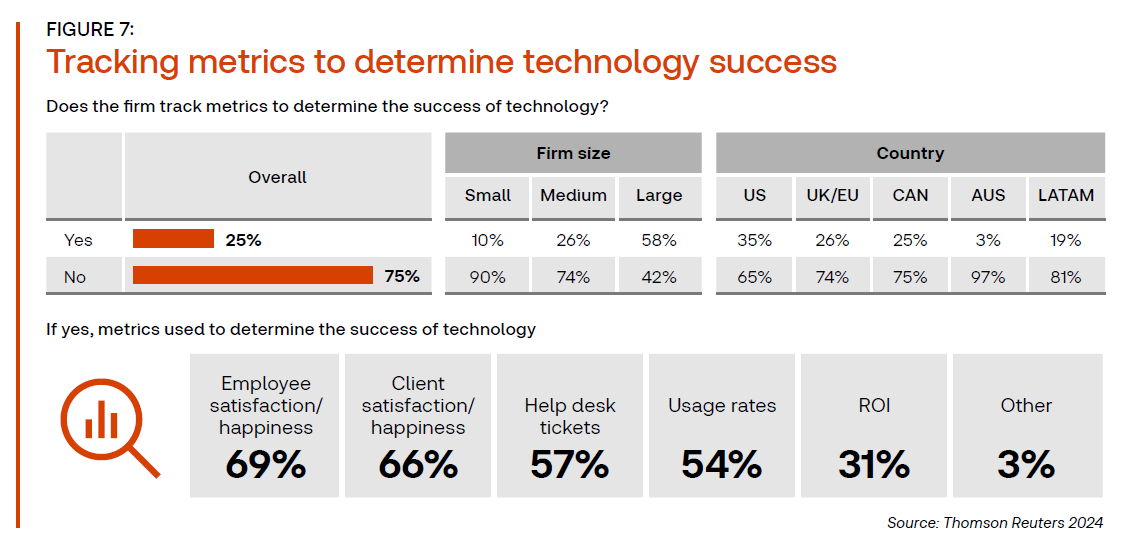

Further, few tax & accounting firms are actually measuring their technology. Only one-quarter of respondents said their firms were using metrics to track technology success, and at small firms that percentage dropped to just 10% of respondents. And even among those utilizing success metrics, the most common metrics were more qualitative — employee and client satisfaction, for example — rather than more quantitative metrics like return-on-investment or usage rates.

Perhaps most revealing when it comes to their approaches to technology, there are stark differences between the haves and have nots in the tax & accounting world. It’s perhaps unsurprising that large firms have more monetary resources and personnel to address technological needs, but those differences are placed in sharp relief when we see that the average large firm’s technology budget is about thirty-times the average small firm’s technology budget. This puts into question how small firms will keep up at all, particularly as clients come to expect technology usage that’s more sophisticated and more fully embedded into work processes.

“I don’t know what I don’t know,” said one small firm owner from the US. “And working on my own, I’m only implementing changes that I hear about and approve.”

Of course, as the tax & accounting profession moves into the future with GenAI and other technologies, there is a lot subject to change. Perhaps nowhere is this more evident than in Latin America, where survey respondents said they expect massive growth — not only in technology usage, but in the budgets and personnel required to support that usage.

Throughout the world, however, there is still a sense that tax & accounting professionals are poised to move into a new technology-sound age. Now, firms just need the infrastructure to get themselves there.

You can download a full copy of the “2024 Tax Firm Technology Report” from the Thomson Reuters Institute by filling out the form below: