A new Thomson Reuters Institute report discusses how tax & accounting firms are approaching the balance between offering clients value and pricing their services

In the fast-evolving landscape of today’s business world, tax & accounting firms are experiencing significant transformations. To delve deeper into that, the Thomson Reuters Institute has published a new report, Aligning Pricing with Value: Strategies for Success in Modern Tax Firm Operations in 2024, that provides a comprehensive exploration of these shifts.

Specifically, the tax & accounting industry is witnessing two major trends: i) a move towards a wider range of services to address the growing needs of clients; and ii) a notable departure from conventional pricing models.

The days when firms primarily helped clients with tax filings are dwindling, with today’s clients looking beyond the basics and focusing now on obtaining comprehensive advisory services from their outside firms. From business consulting to financial planning and decision-making support, the demand from corporate clients for holistic support is at an all-time high. Indeed, this change underscores the expanding role of CPAs in today’s business world.

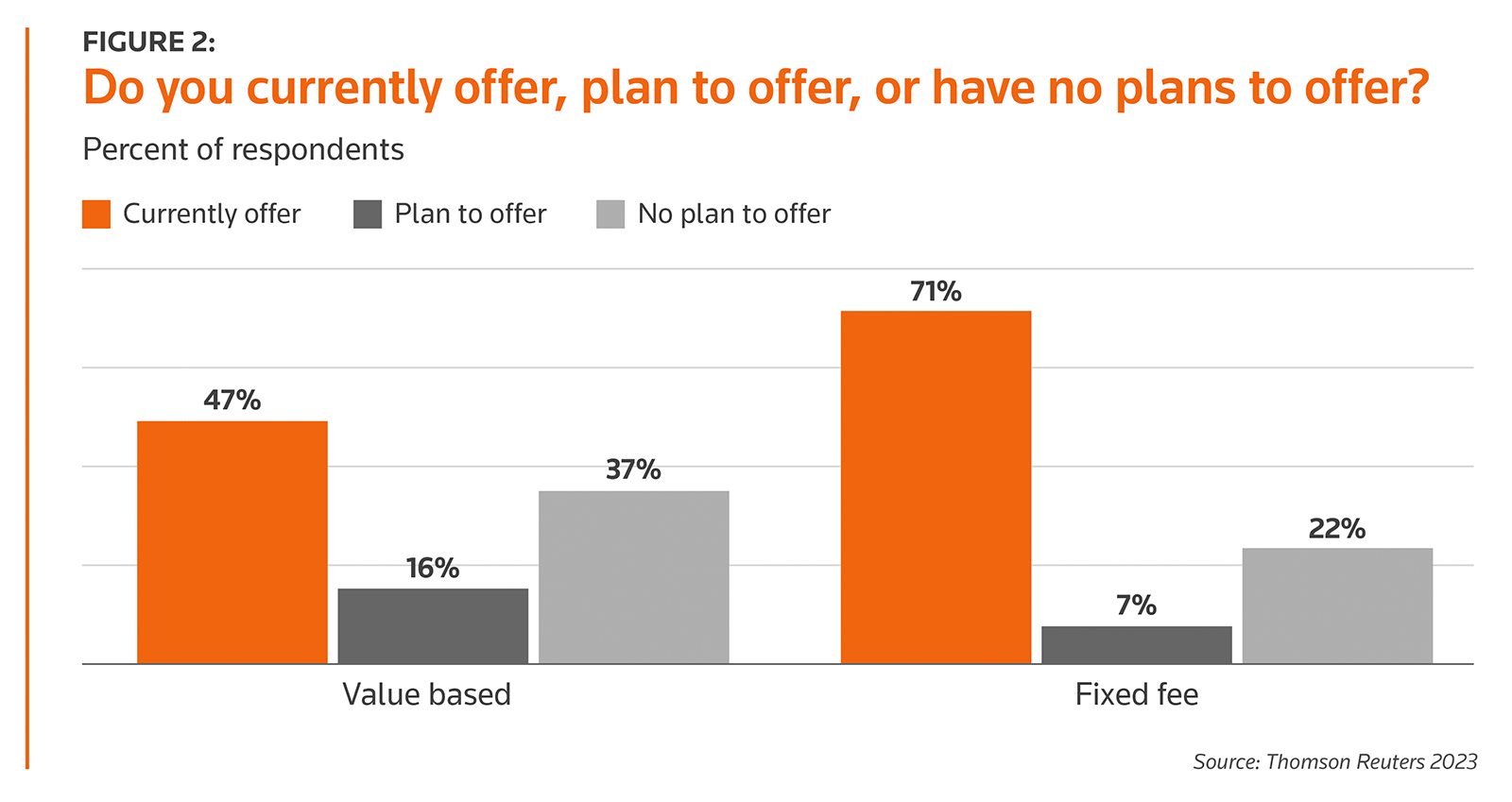

This transition in service delivery comes hand-in-hand with a growing preference for alternative pricing structures. The hourly billing model, which was once the gold standard, is seeing competition from alternative pricing models like value-based and fixed-fee systems. These models emphasize clear communication, tangible value, and stronger collaboration, which are all traits that modern businesses cherish.

Interestingly, while there is clear momentum towards these new pricing strategies, not all firms are jumping on board. A significant portion are yet to implement alternative pricing models, even though they are aware of changing client demands. This hesitation presents a golden opportunity for firms to capture a substantial competitive advantage in the market if they are agile and able to implement these alternative pricing solutions.

Shifting towards these innovative pricing models isn’t just about meeting client demands — it’s also a smart business move. By aligning their services with client expectations, firms stand a better chance at attracting new business and retaining existing clients. Beyond client satisfaction, these models can also boost a firm’s bottom line. With more predictable revenue streams and the potential for improved margins, the financial incentives are tangible.

The transformation we’re witnessing in the tax & accounting industry is not a fleeting phase. With client expectations and demands continuing to evolve, the shift away from traditional models — both in terms of services and pricing — is a strategic opportunity for many firms. And as firms pivot, they don’t just meet current market demands but also position themselves for long-term success going forward.

By recognizing and adapting to these shifts, today’s tax & accounting firms can ensure they remain relevant, competitive, and successful in an ever-changing business environment.