Tax & accounting firms see technology as a crucial part of their future strategy, according to a recent report; however, without investment in the people to run and train on technology, any investment could be quickly wasted

The future of tax & accounting firms is going to be increasingly technology centric. This statement may come as a surprise, particularly for those tax professionals at smaller firms who may be accustomed to manual processes and not having the time to keep up with the latest technological innovations. However, leaders across various firms and geographies have been forceful that they see technology as a crucial part of their future.

In fact, 88% of tax & accounting professionals said they deem technology to be a significant or integral part of their firm’s strategy moving forward, according to the recently released 2024 Tax Firm Technology Report from the Thomson Reuters Institute. This is true across the board — respondents from small tax firms (between 1 and 3 employees) found this to be true at an 85% rate, not far off that of their larger firm (30-plus employees) counterparts. As such, it may not be surprising that 80% of survey respondents overall said they expect their firms’ technology budget to increase within the next 3 to 5 years.

Listen to any technology expert, however, and they will tell you that spending money to buy software is far from the only necessity for a true technology strategy. The regular maxim is that organizations need all three factors — people, process and technology — in order for the tech to properly function. If one of those three legs of the tripod are shaky, the entire structure risks falling down.

This could be a problem in tax — particularly the people part of the equation. According to another Thomson Reuters Institute survey, 2024 State of Tax Professionals Report, almost two-thirds of respondents (64%) said that recruitment of new employees with necessary skills & experience is either highly or somewhat challenging. And more than half (58%), meanwhile, said the same about training & development of existing employees.

As a result, a hard decision could be coming for many tax & accounting firms. It’s not enough to simply raise tech budgets in order satisfy firm initiatives. Proper technology usage requires people to manage and train on technology — and that means more strategic focus must be paid to tech than ever before.

Technology on an island

Although many tax & accounting firms are increasingly focusing on technology, their personnel plans towards technology are largely static, according to the 2024 Tax Firm Technology Report. Many survey respondents said their firms do not have full insight into how their technology is governed and instituted throughout the firm.

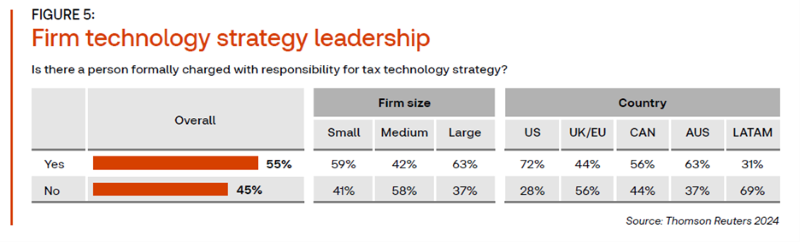

Take, for instance, ownership of technology within the firm. Despite so many firm leaders citing technology as a crucial part of their firms’ overall strategy, only 55% of respondents actually reported having an individual who is formally charged with the responsibility for tax technology strategy. For respondents in the United Kingdom and European Union, and in Latin America, this figure was less than half of respondents.

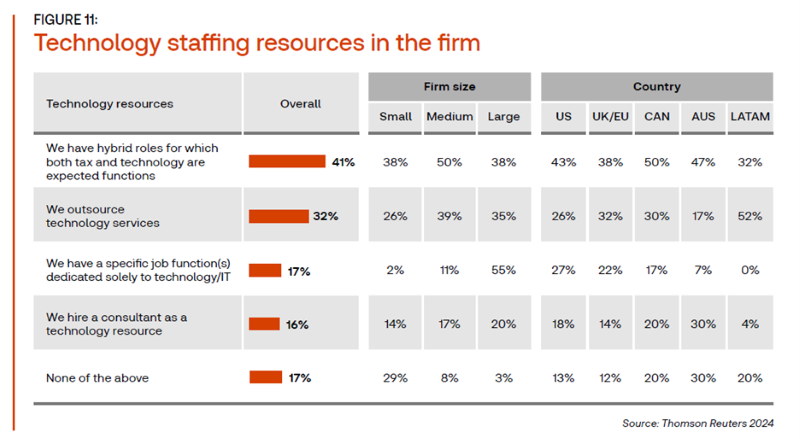

In regard to those individuals who are charged with spearheading technology strategy, the most common description was a person who also has a number of other responsibilities within the firm — an owner (23%) or director (12%) being the most common. This is perhaps no surprise because dual tax/technology personnel is the most common way that most firms are staffing their technology matters, the report shows.

Across all firms, 41% of respondents said their firm has hybrid roles for which both tax and technology are expected functions. About one-third (32%), meanwhile, said their firms were outsourcing technology services. Just 17% said they have specific job functions for technology or IT within the firm, but that number shrinks to just 11% of Midsize firms and 2% of small firms. And an additional 17% reported that their firm had no technology personnel at all.

Particularly for personnel-strapped smaller tax firms, there is nothing wrong with outsourcing or having dual technology/tax roles; indeed, for many organizations, it’s the only way that technology work will ever be able to get done. However, an overall lack of resources creates a problem for something even as simple as technology training.

Moreover, firms were split directly down the middle as to whether they provided any sort of technology training at all (49% of respondents said their firms did offer training, and 49% said their firms did not, and 2% did not know). This disparity was particularly acute at smaller firms, where only 32% of respondents said their firms provided technology training. Yet even those firms that did provide training may not be keeping up with the latest trends in a rapidly-moving technology paradigm — less than one-third of respondents from firms that provided training said their firms did so every few months or more frequently.

Doing more with less

It’s perhaps interesting that the 2024 State of Tax Professionals Report found that the number one way that firms of all sizes are looking to fill the skills gap is through technology, with 49% of respondents citing increased automation as a primary strategy to make up for deficiencies in personnel.

Unfortunately, this creates a chicken-or-the-egg scenario for many of today’s firms. They want to use tech to fill crucial people gaps within the firm, but they can’t properly implement automation without having those people in place, training on the technology and conducting ongoing reviews to make sure it’s working properly.

So, what are firms to do? The answer comes with fully baking technology into strategy through process and people, rather than treating technology as an add-on capability to the firm.

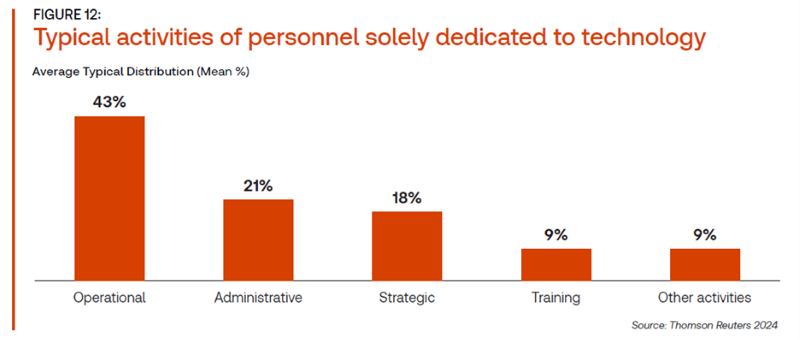

For example, take the firms that have a standalone technology or IT person — typically a larger tax firm with resources and a budget to match (large firms reported an average yearly tech budget above $300,000). Respondents at these firms also generally reported having technology as a significant or crucial part of their firm’s overall strategy. However, when asked about the typical type of work that their technology/IT personnel do, respondents reported operational and administrative work as much more common than strategic work.

In the tax firm of the future, this proportion will likely need to change. Even among dual tax/technology personnel, there will be a need not only to focus on technology as an enabler of day-to-day operations, but one that actually drives business. This requires not only knowledge of technology itself, but a deeper understanding of how technology fits into the overall goals of client service.

With new technologies such as artificial intelligence (AI) and generative AI becoming much more commonplace, this understanding becomes more crucial than ever. “I expect we’ll be able to use technology, including AI, to leverage our existing workforce to get more done,” said one director of a large US tax firm. “The challenge will be competing with off-the-shelf products that are developed that can potentially undercut on less complex services.”

Yet, keeping up with the competition will require more training, deeper investment, and repeated conversations about how technology fits into the firm’s larger strategic goals.

Even for firms without many resources, however, this could be a mission-critical decision. The owner of one small Australian firm that also does contract work for a larger firm noted: “My concern is that technology, while useful, could make for a generation of lazy accountants who don’t get the in-depth experience they need to really understand what is going on with tax work, so they can identify issues and useful queries or see when the AI has wrongly flagged something or missed something. Technology is only as good as it is programmed.”

The numbers don’t lie: Technology will be a crucial part of tax & accounting firms’ future. It’s important to remember, however, that planning for that eventuality means not only mapping out the technology itself, but how firms will apply their personnel resources to make sure their technology usage is effective.

You can download a full copy of the Thomson Reuters Institute’s recently released 2024 Tax Firm Technology Report here.