The recent “Future of Professionals Report” found that corporate C-Suites are using AI to start work tasks at a higher rate than legal or tax professionals, and as C-Suites forge ahead with AI use, their outside legal and tax firms may need to adjust their AI approach to match their clients

At this point, it’s clear that artificial intelligence (AI) and its subset technology generative AI (GenAI) will have a sizable impact on companies and firms in the future. In the recently released 2024 Thomson Reuters Future of Professionals Report, 42% of the more than 2,000 professional services respondents surveyed said they believe AI and GenAI will have a transformational impact on their professions. An additional 36% said they believe it will have a high impact. Already, professionals among the legal and the tax & accounting industries are already planning for a GenAI-enabled future.

At the same time, however, many are not actually using AI and GenAI right now. While tech experts urge caution when using AI and GenAI as a starting point for professional work rather than fully automating the process, the Future of Professionals Report finds that many legal and tax & accounting professionals have not yet begun to take that step, instead eschewing AI as a starting point due to accuracy concerns, security reasons, or simply that they may not know where else to start.

The legal and tax & accounting industries are known for moving slowly into new technologies. In this particular case however, that could be a problem. And that’s because their ultimate clients — corporate C-Suites — are moving into the GenAI world regardless, potentially leaving legal and tax behind.

Different starting points

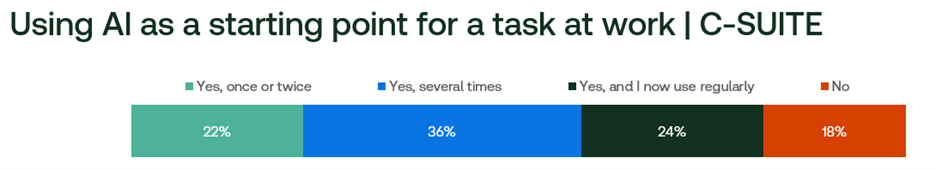

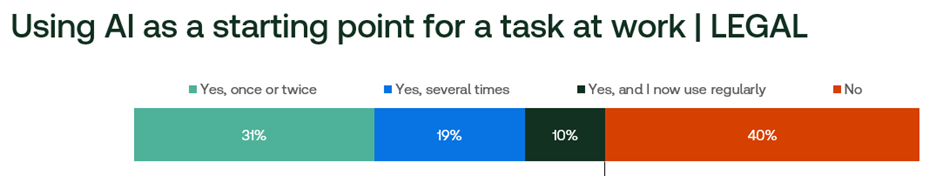

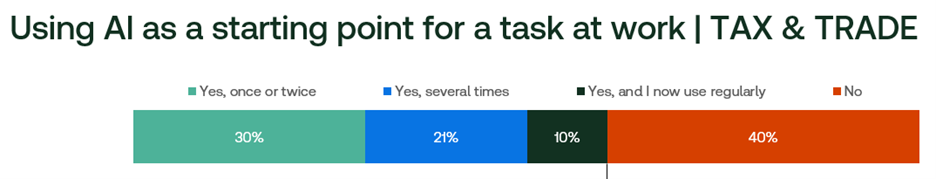

As a whole, the professional world has begun to engage AI early in the work generation process. But as the report illustrates, corporate C-Suite respondents are approaching AI in a completely different way from their legal and tax & accounting counterparts.

According to the report, a whopping 82% of C-Suite respondents said they have used AI to start work at least once. Further, 60% have used AI to start work tasks several times, and 24% are using AI to start their work product regularly.

Comparing these figures to responses from legal and tax professionals, it’s clear that the two sides are viewing AI in completely different ways. The portion of professionals who said they have used AI to start any task in both legal and tax sits at 60% — more than 20 percentage points lower than their C-Suite counterparts. Meanwhile, the portion who say they regularly use AI to start tasks is just 10% in each of legal and tax — less than half the portion of C-Suite respondents.

Legal and tax professionals do differ in their reasoning for why they aren’t regularly starting tasks using AI. For legal professionals, it’s largely a matter of risk aversion. Almost half of legal industry respondents who said they aren’t using AI to start tasks expressed concern around the accuracy of the tools. More than one-third also cited data security or concern around the ethics of AI use.

Meanwhile, tax & accounting professionals who said they aren’t using AI as a starting point said they do not have the time or capability to explore those tools in the first place. While many shared similar concerns to their legal counterparts around accuracy and data security, tied with that as the top reason to not use AI (at 36% of respondents) is simply tax respondents’ uncertainty about what type of work for which the technology can be used. And one-third of respondents also indicated that they intend to use the technology at some point, they just have not had a chance yet.

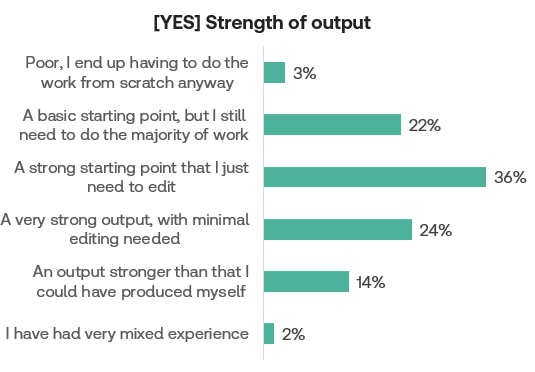

This could be a problem for many within the legal and tax & accounting professions, because it’s clear C-Suites have had success with AI tools and intend to keep on using them in some form. According to the report, of those respondents within C-Suites who said they have used AI as a starting point at least once, 74% called it at least a strong starting point, if not better. And 14% of C-Suite respondents, meanwhile, said AI produced “an output stronger than I could have produced myself.”

Time to change priorities?

This isn’t the first time C-Suite members are not on the same page as legal and tax professionals. Just last fall, a Thomson Reuters Institute survey of C-Suites found that corporate executives thought their in-house legal and tax departments shared their approach to AI development and risks, but the truth revealed widely varying priorities.

According to that research, C-Suites by and large focused their efforts on customers and talent, followed by operations and financial growth, with safeguarding the business bringing up the rear. Legal, by contrast, was much more focused on safeguarding and less on customers and talent. Tax & accounting, meanwhile, is also more focused on operations, while similarly being less focused on customers and talent.

Those differing values are reflected here. While legal professionals are largely worried about the risks that come from inaccuracies and security issues, corporate C-Suites are more focused on how the output of tools will impact their customers and the overall business.

Similarly, tax professionals are heads-down focusing on current operations rather than taking the time to experiment with AI, perhaps an unsurprising development given the current tax talent crunch and how the industry is increasingly looking to do more with less. But C-Suites are taking a much more expansive view — less focused on day-to-day operations and more experimental in how they’re approaching AI to potentially grow their companies in the future.

While legal professionals are largely worried about the risks that come from inaccuracies and security issues, corporate C-Suites are more focused on how the output of tools will impact their customers and the overall business.

The goal of legal and tax professionals — both those in-house and at outside firms — should be to serve the best interest of their client. The methods by which the client is best served will vary, of course, but the priorities and ultimate goals of the client are more static and should ultimately serve as a guiding North Star. It’s clear in the recent research, in public statements, and in overall investment dollars that an increasing number of corporate C-Suites view artificial intelligence as successful and the way of the future.

So now, it falls to legal and tax professionals to find a way to approach AI technologies in a way that squares with their professional responsibilities. Naturally, legal and tax professionals should continue to be vigilant for risk and focused on efficient operations; but at the same time, as corporate C-Suites are moving towards further integration, it is becoming necessary to for legal and tax professionals to learn how to embrace these technologies rather than ignoring them.

You can download the full Future of Professionals report here.