Example 4b: Earned Income Tax (EIT)

Accounting CS compares the rates of the employer and employee EIT taxes and calculates based on the higher rate.

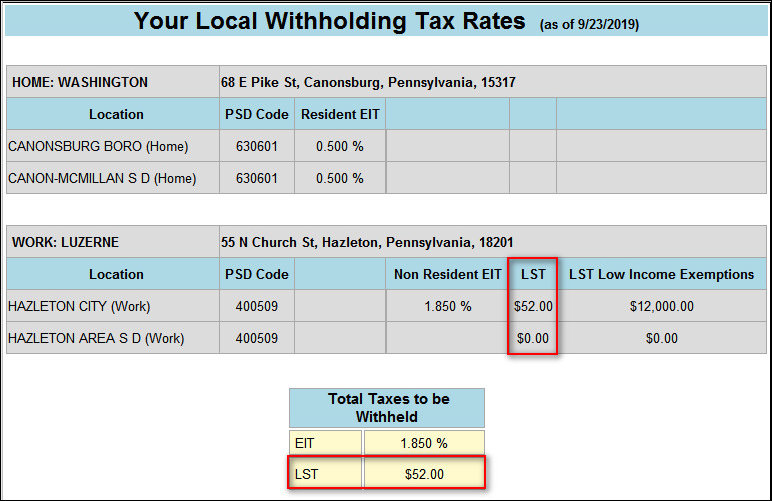

In this example, the employee's work location tax rate is 1.85% and their residence location tax rate is 1%, so Accounting CS calculates the higher 1.85% work location rate and assumes that the taxes will be remitted to Hazleton City.

Accounting CS uses the total of the municipality and school district rates to determine the total EIT rate. So, in this instance, the total EIT rate based on the home address is 1%. The work location municipality is Hazleton (1.85%), and the school district is also South Fayette Township (0%).

When the employee's home rate is the same as the work location rate, Accounting CS calculates the work location EIT (as specified under Act 32).